Answered step by step

Verified Expert Solution

Question

1 Approved Answer

NOTE: THIS PROBLEM MUST BE SOLVED IN EXCEL, with NO ROUNDING of INTERMEDIATE RESULTS Consider a bond that has irregular cash flow promises before it

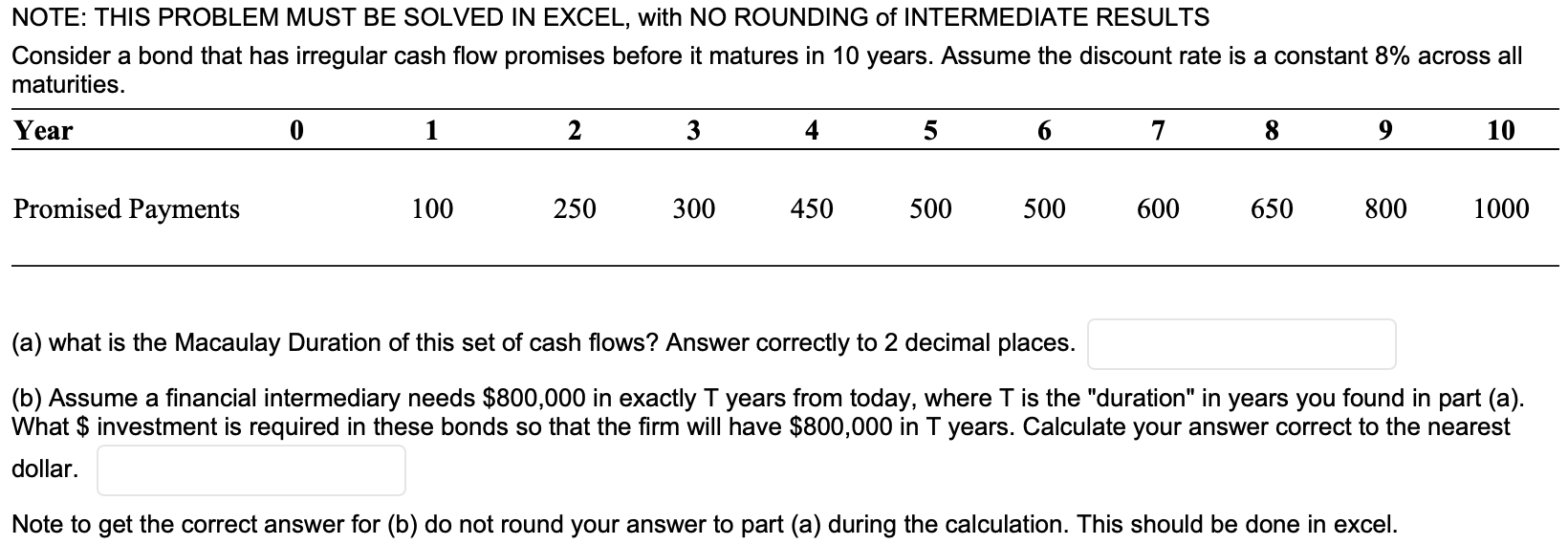

NOTE: THIS PROBLEM MUST BE SOLVED IN EXCEL, with NO ROUNDING of INTERMEDIATE RESULTS Consider a bond that has irregular cash flow promises before it matures in 10 years. Assume the discount rate is a constant 8% across all maturities. (a) what is the Macaulay Duration of this set of cash flows? Answer correctly to 2 decimal places. (b) Assume a financial intermediary needs $800,000 in exactly T years from today, where T is the "duration" in years you found in part (a). What $ investment is required in these bonds so that the firm will have $800,000 in T years. Calculate your answer correct to the nearest dollar. Note to get the correct answer for (b) do not round your answer to part (a) during the calculation. This should be done in excel

NOTE: THIS PROBLEM MUST BE SOLVED IN EXCEL, with NO ROUNDING of INTERMEDIATE RESULTS Consider a bond that has irregular cash flow promises before it matures in 10 years. Assume the discount rate is a constant 8% across all maturities. (a) what is the Macaulay Duration of this set of cash flows? Answer correctly to 2 decimal places. (b) Assume a financial intermediary needs $800,000 in exactly T years from today, where T is the "duration" in years you found in part (a). What $ investment is required in these bonds so that the firm will have $800,000 in T years. Calculate your answer correct to the nearest dollar. Note to get the correct answer for (b) do not round your answer to part (a) during the calculation. This should be done in excel Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started