Answered step by step

Verified Expert Solution

Question

1 Approved Answer

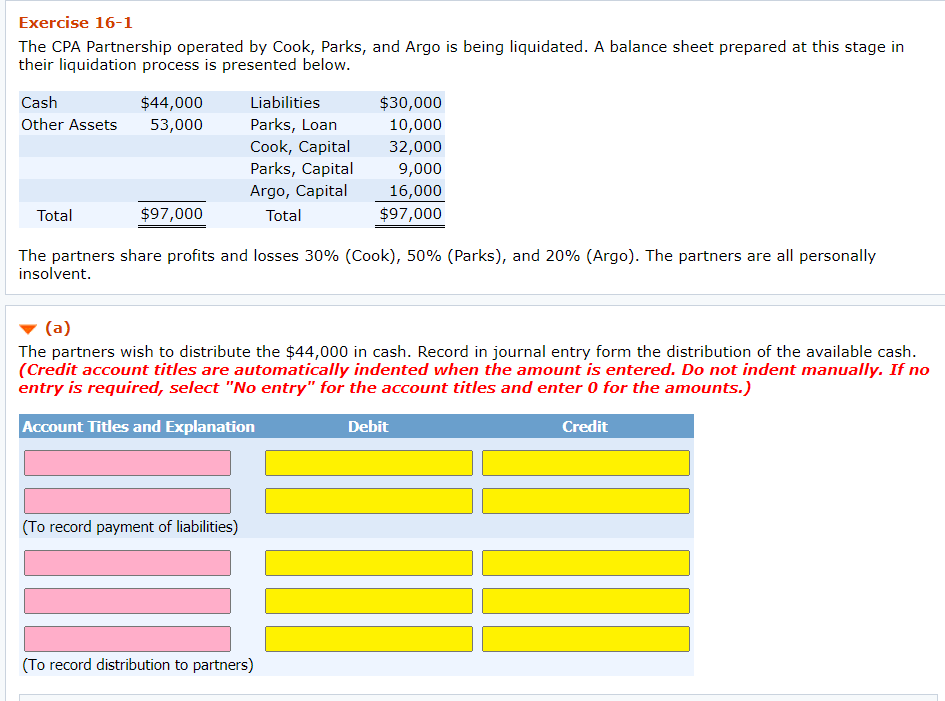

Note: You can right-click the image then open in a new tab to better see the problem Exercise 16-1 The CPA Partnership operated by Cook,

Note: You can right-click the image then open in a new tab to better see the problem

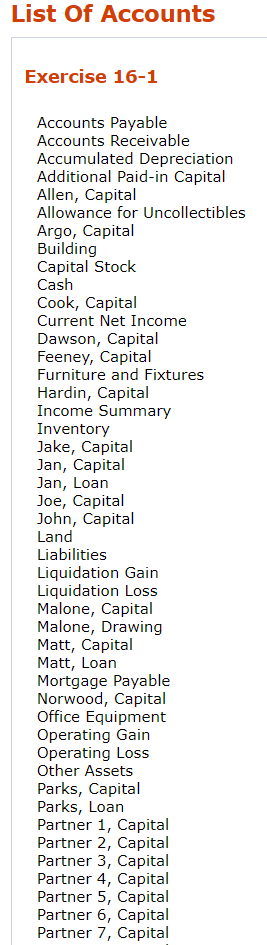

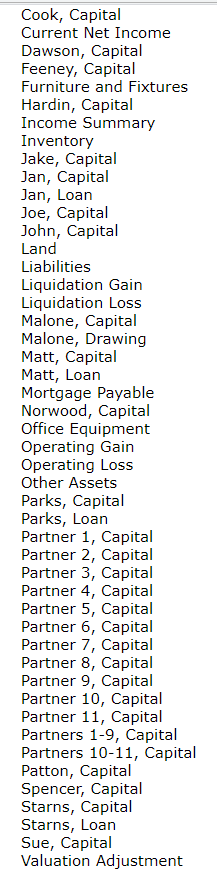

Exercise 16-1 The CPA Partnership operated by Cook, Parks, and Argo is being liquidated. A balance sheet prepared at this stage in their liquidation process is presented below. Cash Other Assets $44,000 53,000 Liabilities Parks, Loan Cook, Capital Parks, Capital Argo, Capital Total $30,000 10,000 32,000 9,000 16,000 $97,000 Total $97,000 The partners share profits and losses 30% (Cook), 50% (Parks), and 20% (Argo). The partners are all personally insolvent. (a) The partners wish to distribute the $44,000 in cash. Record in journal entry form the distribution of the available cash. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No entry" for the account titles and enter 0 for the amounts.) Account Titles and Explanation Debit Credit (To record payment of liabilities) (To record distribution to partners) List Of Accounts Exercise 16-1 Accounts Payable Accounts Receivable Accumulated Depreciation Additional Paid-in Capital Allen, Capital Allowance for Uncollectibles Argo, Capital Building Capital Stock Cash Cook, Capital Current Net Income Dawson, Capital Feeney, Capital Furniture and Fixtures Hardin, Capital Income Summary Inventory Jake, Capital Jan, Capital Jan, Loan Joe, Capital John, Capital Land Liabilities Liquidation Gain Liquidation Loss Malone, Capital Malone, Drawing Matt, Capital Matt, Loan Mortgage Payable Norwood, Capital Office Equipment Operating Gain Operating Loss Other Assets Parks, Capital Parks, Loan Partner 1, Capital Partner 2, Capital Partner 3, Capital Partner 4, Capital Partner 5, Capital Partner 6, Capital Partner 7, Capital Cook, Capital Current Net Income Dawson, Capital Feeney, Capital Furniture and Fixtures Hardin, Capital Income Summary Inventory Jake, Capital Jan, Capital Jan, Loan Joe, Capital John, Capital Land Liabilities Liquidation Gain Liquidation Loss Malone, Capital Malone, Drawing Matt, Capital Matt, Loan Mortgage Payable Norwood, Capital Office Equipment Operating Gain Operating Loss Other Assets Parks, Capital Parks, Loan Partner 1, Capital Partner 2, Capital Partner 3, Capital Partner 4, Capital Partner 5, Capital Partner 6, Capital Partner 7, Capital Partner 8, Capital Partner 9, Capital Partner 10, Capital Partner 11, Capital Partners 1-9, Capital Partners 10-11, Capital Patton, Capital Spencer, Capital Starns, Capital Starns, Loan Sue, Capital Valuation AdjustmentStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started