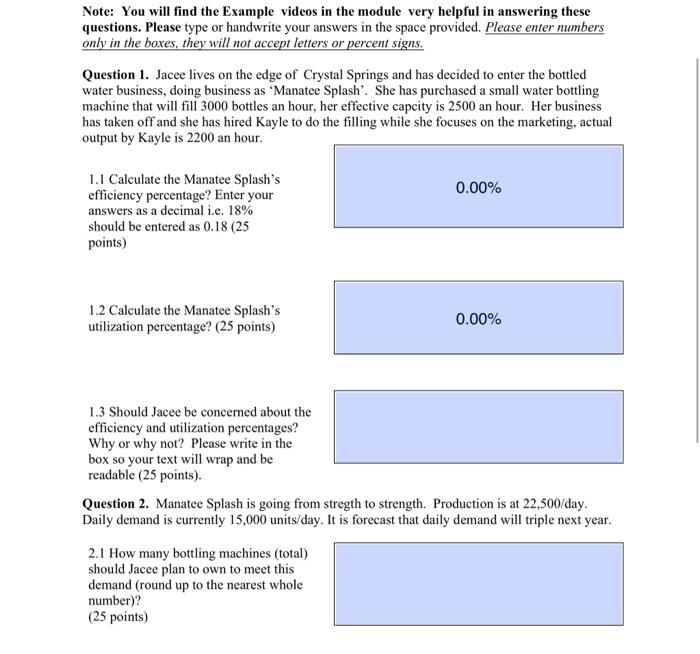

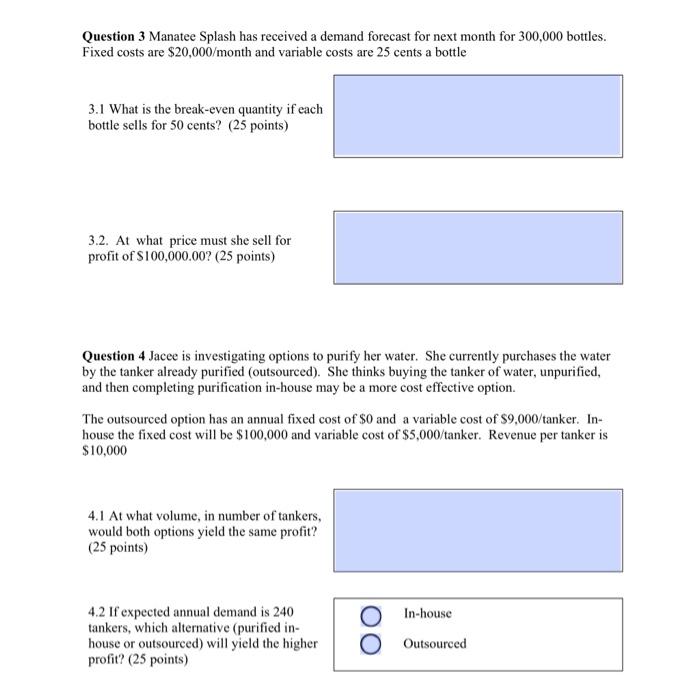

Note: You will find the Example videos in the module very helpful in answering these questions. Please type or handwrite your answers in the space provided. Please enter numbers only in the boxes, they will not accept letters or percent signs. Question 1. Jacee lives on the edge of Crystal Springs and has decided to enter the bottled water business, doing business as 'Manatee Splash'. She has purchased a small water bottling machine that will fill 3000 bottles an hour, her effective capcity is 2500 an hour. Her business has taken off and she has hired Kayle to do the filling while she focuses on the marketing, actual output by Kayle is 2200 an hour. 1.1 Calculate the Manatee Splash's efficiency percentage? Enter your answers as a decimal i.e. 18% should be entered as 0.18 (25 points) 1.2 Calculate the Manatee Splash's utilization percentage? ( 25 points) 1.3 Should Jacee be concerned about the efficiency and utilization percentages? Why or why not? Please write in the box so your text will wrap and be readable ( 25 points). Question 2. Manatee Splash is going from stregth to strength. Production is at 22,500/day. Daily demand is currently 15,000 units/day. It is forecast that daily demand will triple next year. 2.1 How many bottling machines (total) should Jacee plan to own to meet this demand (round up to the nearest whole number)? (25 points) Question 3 Manatee Splash has received a demand forecast for next month for 300,000 bottles. Fixed costs are $20,000/ month and variable costs are 25 cents a bottle 3.1 What is the break-even quantity if each bottle sells for 50 cents? ( 25 points) 3.2. At what price must she sell for profit of $100,000.00? ( 25 points) Question 4 Jacee is investigating options to purify her water. She currently purchases the water by the tanker already purified (outsourced). She thinks buying the tanker of water, unpurified, and then completing purification in-house may be a more cost effective option. The outsourced option has an annual fixed cost of $0 and a variable cost of $9,000/ tanker. Inhouse the fixed cost will be $100,000 and variable cost of $5,000/ tanker. Revenue per tanker is $10,000 4.1 At what volume, in number of tankers, would both options yield the same profit? (25 points) 4.2 If expected annual demand is 240 tankers, which alternative (purified inhouse or outsourced) will yield the higher profit? (25 points) In-house Outsourced