Question

Now assume that sales price will increase by the 4 percent inflation rate beginning after Year 0 (i.e. sales price is $2.00 per unit at

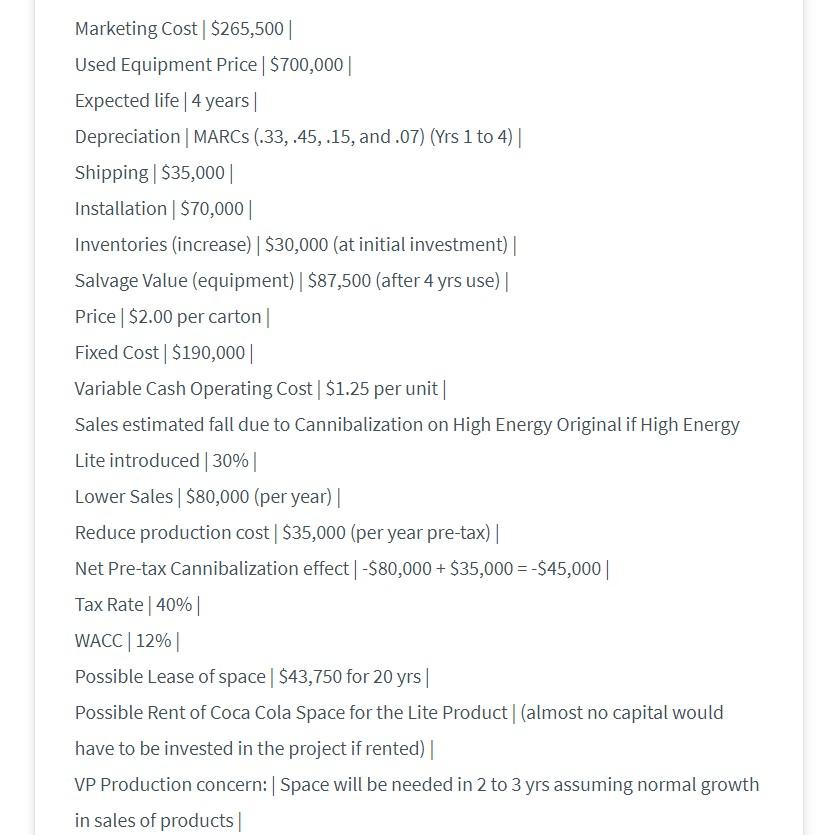

Now assume that sales price will increase by the 4 percent inflation rate beginning after Year 0 (i.e. sales price is $2.00 per unit at Year 0 and $2.08 at Year 1 the end of first year). However, cash operating costs will increase by only 2 percent annually from Year 0, because over half of the costs are fixed by long-term contracts. For simplicity, assume that no other cash flows are affect by inflation. Estimate the projects operating cash flows each year during the next four years by including cannibalization effect but excluding consideration of the cash flows associated with use of the building.

Now assume that sales price will increase by the 4 percent inflation rate beginning after Year 0 (i.e. sales price is $2.00 per unit at Year 0 and $2.08 at Year 1 the end of first year). However, cash operating costs will increase by only 2 percent annually from Year 0, because over half of the costs are fixed by long-term contracts. For simplicity, assume that no other cash flows are affect by inflation. Estimate the projects operating cash flows each year during the next four years by including cannibalization effect but excluding consideration of the cash flows associated with use of the building.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started