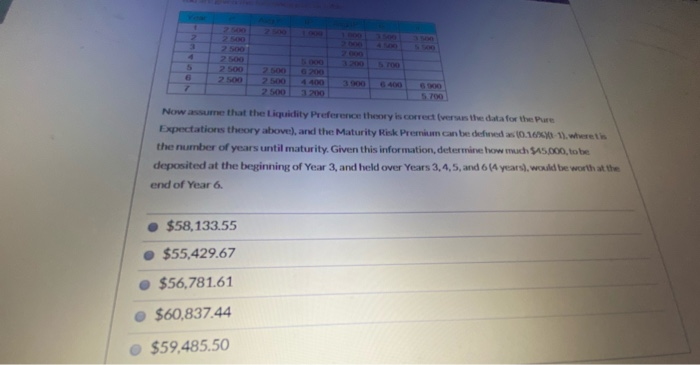

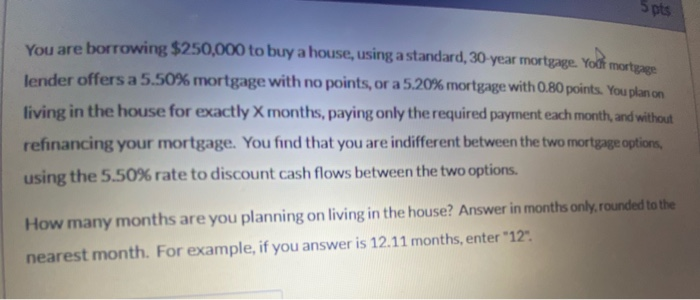

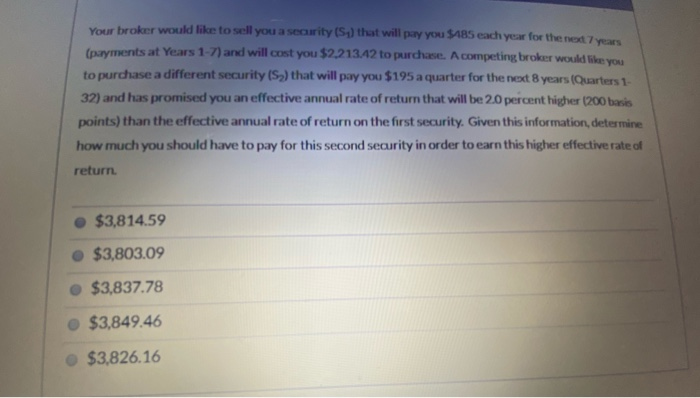

Now asume that the L ity Preference they is correct versus the data for the pure pectations theory above and the Maturity RS Prema n ewest the number of years until maturity. Given this information, determine how much 5.000, deposited at the beginning of Year 3, and held over Years 3,4,5 and 6 years be worth end of Year 6. .$58,133.55 $55,429.67 $56,781.61 . $60,837.44 .$59,485,50 5 pts You are borrowing $250,000 to buy a house, using a standard, 30 year mortgage. Your morte lender offers a 5.50% mortgage with no points, or a 5.20% mortgage with 0.80 points. You plan on living in the house for exactly X months, paying only the required payment each month, and without refinancing your mortgage. You find that you are indifferent between the two mortgage options using the 5.50% rate to discount cash flows between the two options. How many months are you planning on living in the house? Answer in months only.rounded to the nearest month. For example, if you answer is 12.11 months, enter "12". Your broker would like to sell you a security (5) that will pay you 9185 each year for the next pryments at Years 1-7) and will cost you $2.213.42 to purchase. A competing broker would like you to purchase a different security (S) that will pay you $195 a quarter for the next 8 years (karters 32) and has promised you an effective annual rate of return that will be 20 percent higher (200 basis points) than the effective annual rate of return on the first security. Given this information, determine how much you should have to pay for this second security in order to earn this higher effective rate of return $3,814.59 $3,803.09 $3,837.78 $3,849.46 $3,826.16 Now asume that the L ity Preference they is correct versus the data for the pure pectations theory above and the Maturity RS Prema n ewest the number of years until maturity. Given this information, determine how much 5.000, deposited at the beginning of Year 3, and held over Years 3,4,5 and 6 years be worth end of Year 6. .$58,133.55 $55,429.67 $56,781.61 . $60,837.44 .$59,485,50 5 pts You are borrowing $250,000 to buy a house, using a standard, 30 year mortgage. Your morte lender offers a 5.50% mortgage with no points, or a 5.20% mortgage with 0.80 points. You plan on living in the house for exactly X months, paying only the required payment each month, and without refinancing your mortgage. You find that you are indifferent between the two mortgage options using the 5.50% rate to discount cash flows between the two options. How many months are you planning on living in the house? Answer in months only.rounded to the nearest month. For example, if you answer is 12.11 months, enter "12". Your broker would like to sell you a security (5) that will pay you 9185 each year for the next pryments at Years 1-7) and will cost you $2.213.42 to purchase. A competing broker would like you to purchase a different security (S) that will pay you $195 a quarter for the next 8 years (karters 32) and has promised you an effective annual rate of return that will be 20 percent higher (200 basis points) than the effective annual rate of return on the first security. Given this information, determine how much you should have to pay for this second security in order to earn this higher effective rate of return $3,814.59 $3,803.09 $3,837.78 $3,849.46 $3,826.16