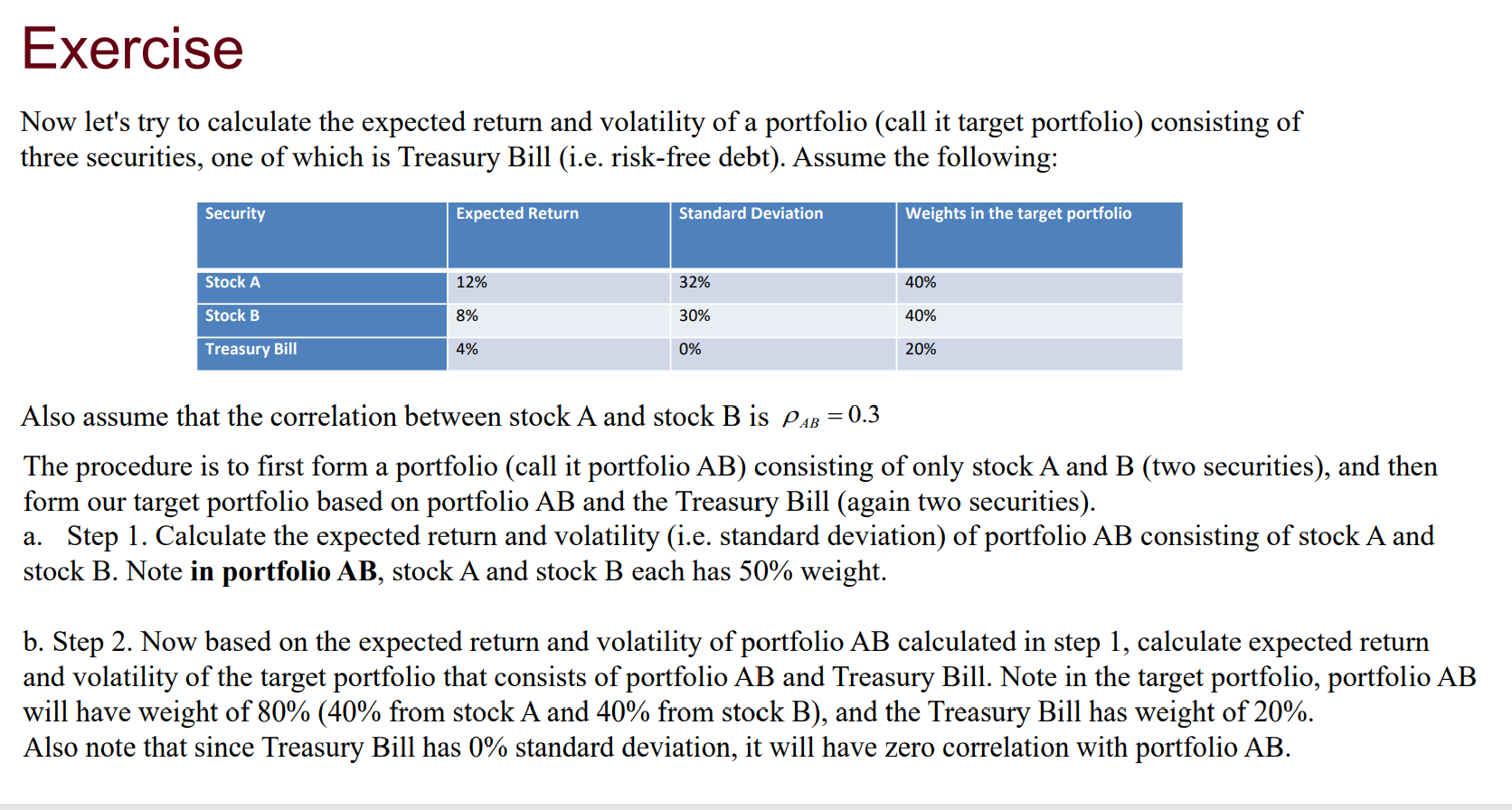

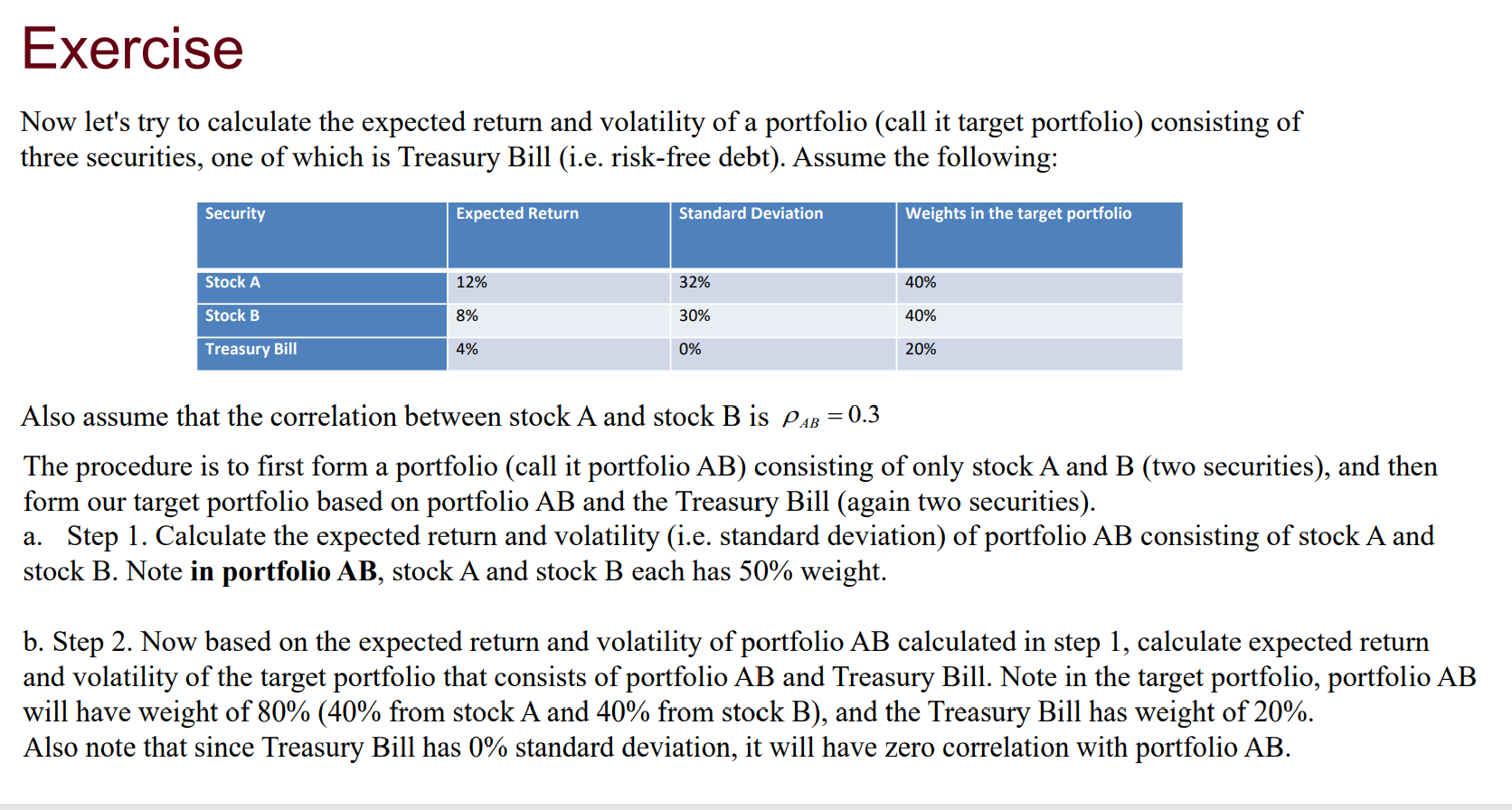

Now let's try to calculate the expected return and volatility of a portfolio (call it target portfolio) consisting of three securities, one of which is Treasury Bill (i.e. risk-free debt). Assume the following: Also assume that the correlation between stock A and stock B is AB=0.3 The procedure is to first form a portfolio (call it portfolio AB) consisting of only stock A and B (two securities), and then form our target portfolio based on portfolio AB and the Treasury Bill (again two securities). a. Step 1. Calculate the expected return and volatility (i.e. standard deviation) of portfolio AB consisting of stock A and stock B. Note in portfolio AB, stock A and stock B each has 50% weight. b. Step 2. Now based on the expected return and volatility of portfolio AB calculated in step 1, calculate expected return and volatility of the target portfolio that consists of portfolio AB and Treasury Bill. Note in the target portfolio, portfolio AB will have weight of 80% (40\% from stock A and 40% from stock B), and the Treasury Bill has weight of 20%. Also note that since Treasury Bill has 0% standard deviation, it will have zero correlation with portfolio AB. Now let's try to calculate the expected return and volatility of a portfolio (call it target portfolio) consisting of three securities, one of which is Treasury Bill (i.e. risk-free debt). Assume the following: Also assume that the correlation between stock A and stock B is AB=0.3 The procedure is to first form a portfolio (call it portfolio AB) consisting of only stock A and B (two securities), and then form our target portfolio based on portfolio AB and the Treasury Bill (again two securities). a. Step 1. Calculate the expected return and volatility (i.e. standard deviation) of portfolio AB consisting of stock A and stock B. Note in portfolio AB, stock A and stock B each has 50% weight. b. Step 2. Now based on the expected return and volatility of portfolio AB calculated in step 1, calculate expected return and volatility of the target portfolio that consists of portfolio AB and Treasury Bill. Note in the target portfolio, portfolio AB will have weight of 80% (40\% from stock A and 40% from stock B), and the Treasury Bill has weight of 20%. Also note that since Treasury Bill has 0% standard deviation, it will have zero correlation with portfolio AB