Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Now that you have an understanding of amortization, it's time to put everything together. In each of the following three tasks, you will play

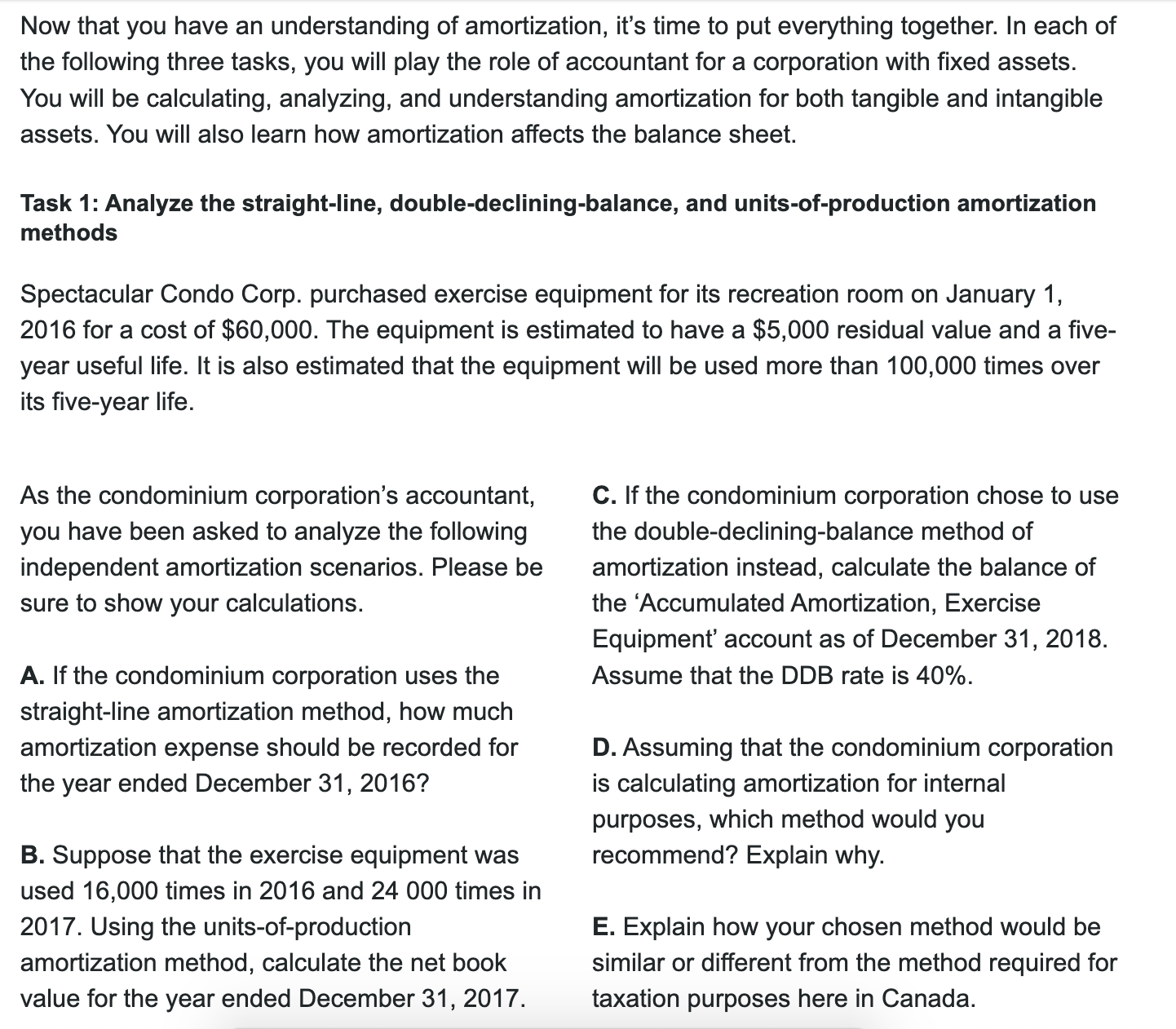

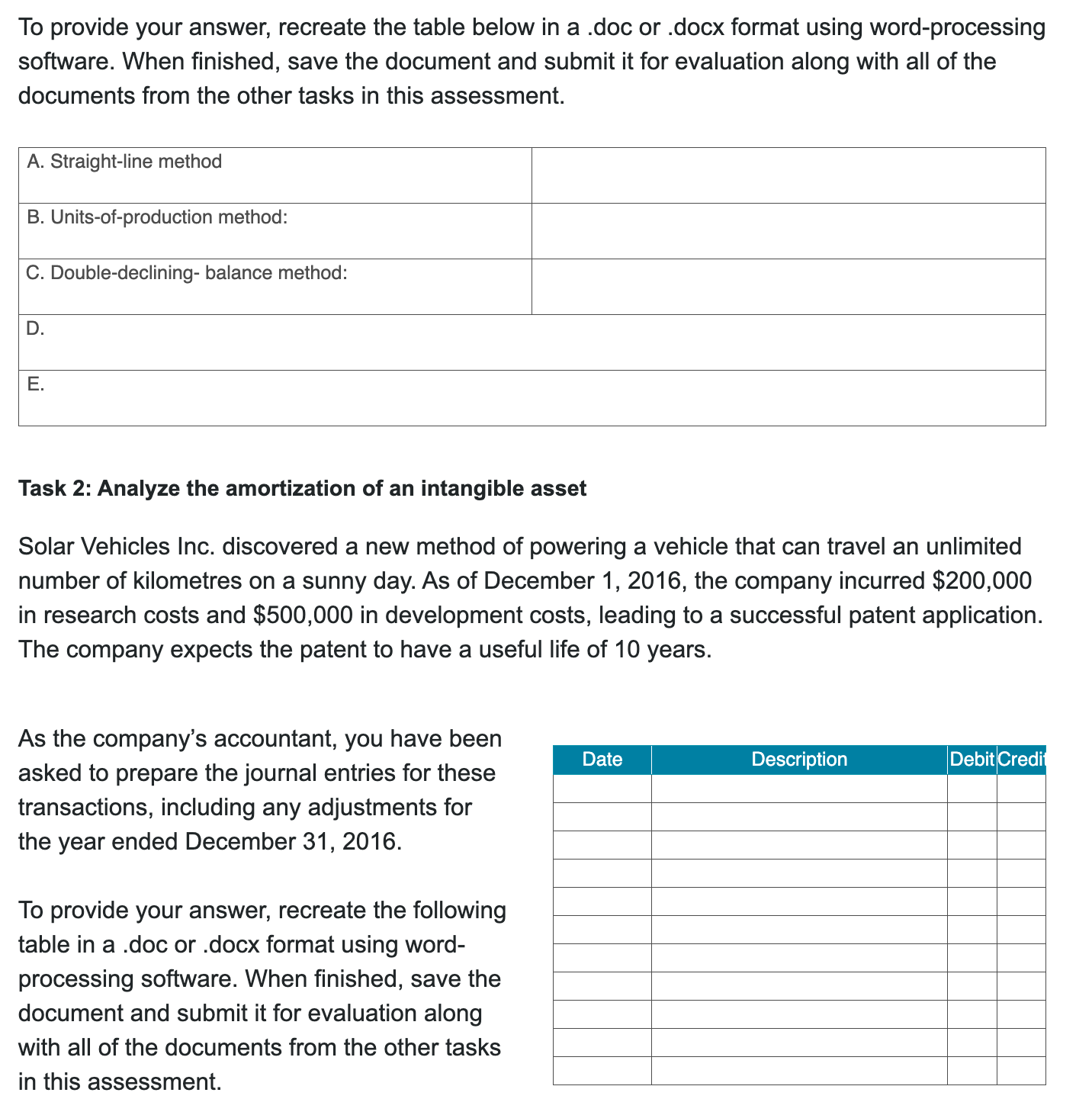

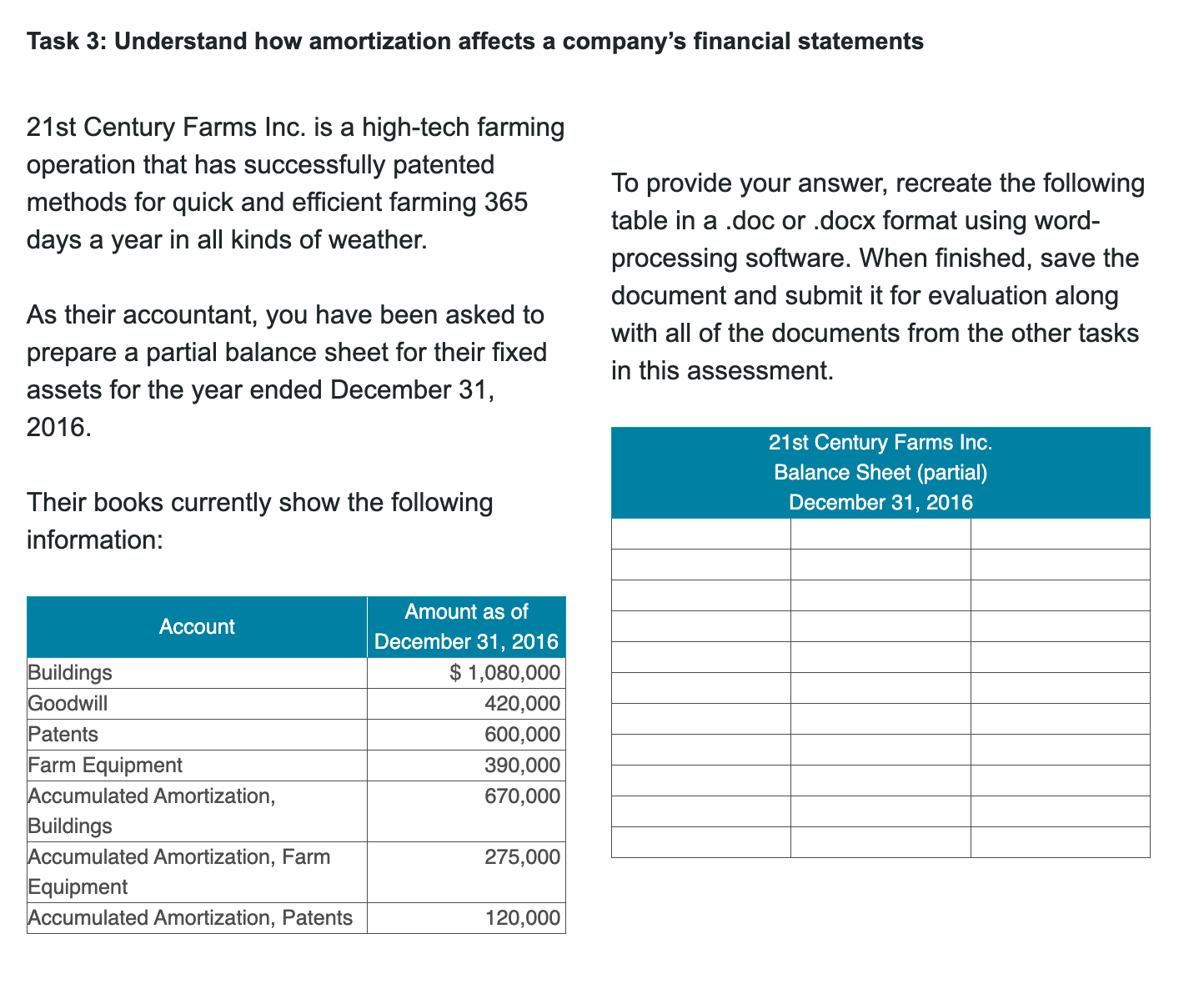

Now that you have an understanding of amortization, it's time to put everything together. In each of the following three tasks, you will play the role of accountant for a corporation with fixed assets. You will be calculating, analyzing, and understanding amortization for both tangible and intangible assets. You will also learn how amortization affects the balance sheet. Task 1: Analyze the straight-line, double-declining-balance, and units-of-production amortization methods Spectacular Condo Corp. purchased exercise equipment for its recreation room on January 1, 2016 for a cost of $60,000. The equipment is estimated to have a $5,000 residual value and a five- year useful life. It is also estimated that the equipment will be used more than 100,000 times over its five-year life. As the condominium corporation's accountant, you have been asked to analyze the following independent amortization scenarios. Please be sure to show your calculations. A. If the condominium corporation uses the straight-line amortization method, how much amortization expense should be recorded for the year ended December 31, 2016? B. Suppose that the exercise equipment was used 16,000 times in 2016 and 24 000 times in 2017. Using the units-of-production amortization method, calculate the net book value for the year ended December 31, 2017. C. If the condominium corporation chose to use the double-declining-balance method of amortization instead, calculate the balance of the 'Accumulated Amortization, Exercise Equipment' account as of December 31, 2018. Assume that the DDB rate is 40%. D. Assuming that the condominium corporation is calculating amortization for internal purposes, which method would you recommend? Explain why. E. Explain how your chosen method would be similar or different from the method required for taxation purposes here in Canada. To provide your answer, recreate the table below in a .doc or .docx format using word-processing software. When finished, save the document and submit it for evaluation along with all of the documents from the other tasks in this assessment. A. Straight-line method B. Units-of-production method: C. Double-declining- balance method: D. E. Task 2: Analyze the amortization of an intangible asset Solar Vehicles Inc. discovered a new method of powering a vehicle that can travel an unlimited number of kilometres on a sunny day. As of December 1, 2016, the company incurred $200,000 in research costs and $500,000 in development costs, leading to a successful patent application. The company expects the patent to have a useful life of 10 years. As the company's accountant, you have been asked to prepare the journal entries for these transactions, including any adjustments for the year ended December 31, 2016. To provide your answer, recreate the following table in a .doc or .docx format using word- processing software. When finished, save the document and submit it for evaluation along with all of the documents from the other tasks in this assessment. Date Description Debit Credit Task 3: Understand how amortization affects a company's financial statements 21st Century Farms Inc. is a high-tech farming operation that has successfully patented methods for quick and efficient farming 365 days a year in all kinds of weather. As their accountant, you have been asked to prepare a partial balance sheet for their fixed assets for the year ended December 31, 2016. Their books currently show the following information: To provide your answer, recreate the following table in a .doc or .docx format using word- processing software. When finished, save the document and submit it for evaluation along with all of the documents from the other tasks in this assessment. 21st Century Farms Inc. Balance Sheet (partial) December 31, 2016 Account Amount as of December 31, 2016 Buildings $ 1,080,000 Goodwill 420,000 Patents 600,000 Farm Equipment 390,000 Accumulated Amortization, 670,000 Buildings Accumulated Amortization, Farm 275,000 Equipment Accumulated Amortization, Patents 120,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started