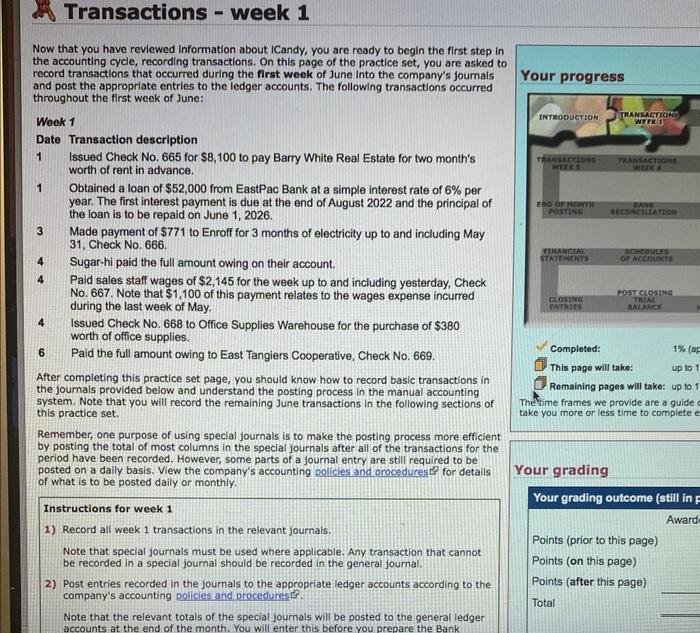

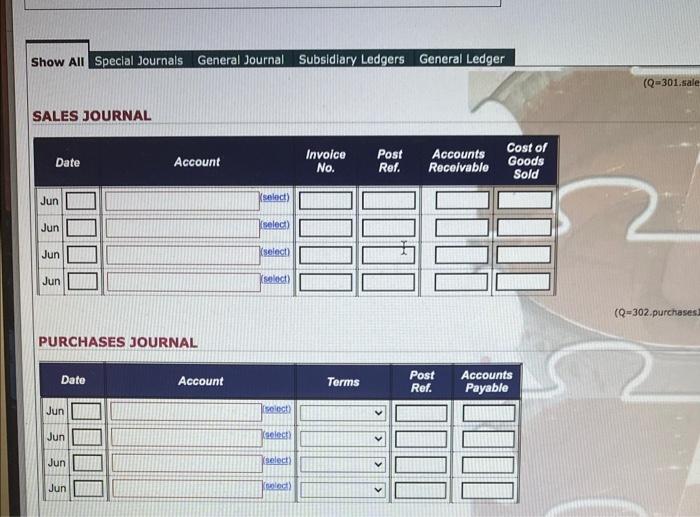

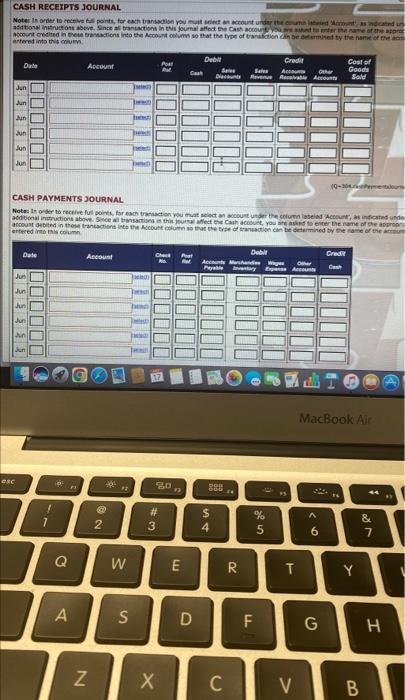

Now that you have revlewed information about iCandy, you are ready to begin the first step in the accounting cycle, recording transactions. On this page of the practice set, you are asked to record transactions that occurred during the first week of June into the company's joumals and post the approprlate entries to the ledger accounts. The following transactions occurred throughout the first week of June: Week 1 Date Transaction description 1 Issued Check No, 665 for $8,100 to pay Barry White Real Estate for two month's 1 Obtained a loan of $52,000 from EastPac Bank at a simple interest rate of 6% per year. The first interest payment is due at the end of August 2022 and the principal of 3 Made payment of $771 to Enroff for 3 months of electricity up to and including May 31, Check No. 666 . 4 Sugar-hi paid the full amount owing on their account. Paid sales staff wages of $2,145 for the week up to and including yesterday, Check No. 667 . Note that $1,100 of this payment relates to the wages expense incurred during the last week of May. Issued Check No. 668 to Office Supplies Warehouse for the purchase of $380 worth of office supplies. 6 Paid the full amount owing to East Tangiers Cooperative, Check No. 669 . After completing this practice set page, you should know how to record basic transactions in the journals provided below and understand the posting process in the manual accounting system. Note that you will record the remaining june transactions in the following sections of this practice set. Remember, one purpose of using special journals is to make the posting process more efficient by posting the total of most columns in the special journals after all of the transactions for the period have been recorded. However, some parts of a journal entry are still required to be posted on a daily basis. View the company's accounting policies and procedurestr for details Your grading of what is to be posted daily or monthly. Instructions for week 1 1) Record all week 1 transactions in the relevant journals. Note that special journals must be used where applicable. Any transaction that cannot be recorded in a special journal should be recorded in the general journal. 2) Post entries recorded in the journals to the appropriate ledger accounts according to the company's accounting policies and procedures t?. Note that the relevant totals of the special journals will be posted to the general ledger accounts at the end of the month. You will enter this before you prepare the Bank SALES JOURNAL PURCHASES JOURNAL artered into this coilurn CA5H PAYMENTS JOURNAL ortered ined lay coumn GENERAL JOURNAL SUBSTDTARY LEDGEIE Asceverti ABC - Sugarrtid Aroown Nt 110.5" Aerount NC - SiWhi Cantrevionent Mocesunt titi.210-1 Account: Cash Account No. 100 Account: ARC - Accounts Receivable Control (Q=320110.AcctsRecCon Account No. 110 Account: Office Supplies (Q=320130.5 toresuppli) Account No. 130 Account: Prepaid Rent Account No. 140 Now that you have revlewed information about iCandy, you are ready to begin the first step in the accounting cycle, recording transactions. On this page of the practice set, you are asked to record transactions that occurred during the first week of June into the company's joumals and post the approprlate entries to the ledger accounts. The following transactions occurred throughout the first week of June: Week 1 Date Transaction description 1 Issued Check No, 665 for $8,100 to pay Barry White Real Estate for two month's 1 Obtained a loan of $52,000 from EastPac Bank at a simple interest rate of 6% per year. The first interest payment is due at the end of August 2022 and the principal of 3 Made payment of $771 to Enroff for 3 months of electricity up to and including May 31, Check No. 666 . 4 Sugar-hi paid the full amount owing on their account. Paid sales staff wages of $2,145 for the week up to and including yesterday, Check No. 667 . Note that $1,100 of this payment relates to the wages expense incurred during the last week of May. Issued Check No. 668 to Office Supplies Warehouse for the purchase of $380 worth of office supplies. 6 Paid the full amount owing to East Tangiers Cooperative, Check No. 669 . After completing this practice set page, you should know how to record basic transactions in the journals provided below and understand the posting process in the manual accounting system. Note that you will record the remaining june transactions in the following sections of this practice set. Remember, one purpose of using special journals is to make the posting process more efficient by posting the total of most columns in the special journals after all of the transactions for the period have been recorded. However, some parts of a journal entry are still required to be posted on a daily basis. View the company's accounting policies and procedurestr for details Your grading of what is to be posted daily or monthly. Instructions for week 1 1) Record all week 1 transactions in the relevant journals. Note that special journals must be used where applicable. Any transaction that cannot be recorded in a special journal should be recorded in the general journal. 2) Post entries recorded in the journals to the appropriate ledger accounts according to the company's accounting policies and procedures t?. Note that the relevant totals of the special journals will be posted to the general ledger accounts at the end of the month. You will enter this before you prepare the Bank SALES JOURNAL PURCHASES JOURNAL artered into this coilurn CA5H PAYMENTS JOURNAL ortered ined lay coumn GENERAL JOURNAL SUBSTDTARY LEDGEIE Asceverti ABC - Sugarrtid Aroown Nt 110.5" Aerount NC - SiWhi Cantrevionent Mocesunt titi.210-1 Account: Cash Account No. 100 Account: ARC - Accounts Receivable Control (Q=320110.AcctsRecCon Account No. 110 Account: Office Supplies (Q=320130.5 toresuppli) Account No. 130 Account: Prepaid Rent Account No. 140