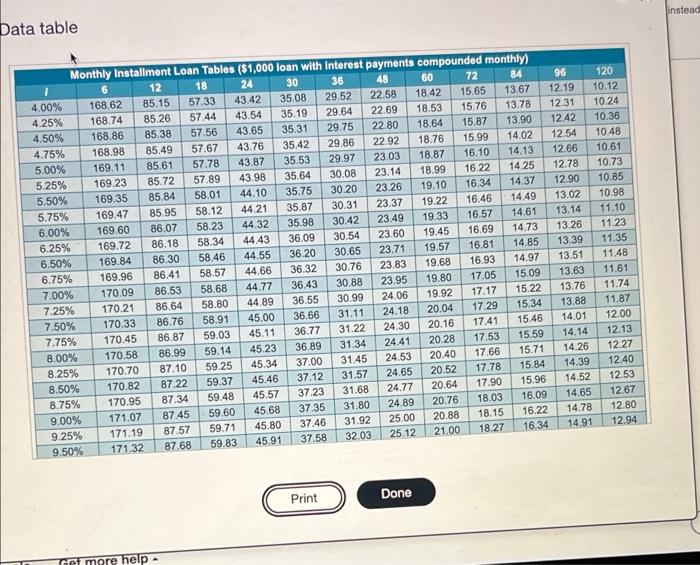

Now we recommandant FMPFT There What is the total amount Boe will have to repay for $24.710 student loan it the interest rate in 4 percent over 10 years? What is the total amouk he would have to repay the $24.710 wan agrarinnad dalam ko wow the Monthly intentLoan Payment Factor (MILPF) table CD The wount the will hawe to repay tor his student kanos Round to the reareu cent) instead Data table Monthly Installment Loan Tables ($1,000 loan with interest payments compounded monthly) 12 18 24 30 36 48 60 72 84 4.00% 168.62 85.15 57.33 43.42 35,08 29.52 22.58 1842 15.65 13.67 4.25% 168.74 85.26 57.44 43.54 35.19 29.64 22.69 18.53 15.76 13.78 4.50% 168.86 85.38 57.56 43.65 35.31 29.75 22.80 18.64 15.87 13.90 4.75% 168.98 85.49 57.67 43.76 35.42 29.86 22.92 18.76 15.99 14.02 5.00% 169.11 85.61 57.78 43.87 35.53 29.97 23.03 18.87 16.10 14.13 5.25% 169.23 85.72 57.89 43.98 35.64 30.08 23.14 18.99 16.22 14.25 5.50% 169.35 85.84 58.01 44.10 35.75 30.20 23.26 19.10 16.34 14.37 5.75% 169.47 85.95 58.12 44.21 35.87 30.31 23.37 19.22 16.46 14.49 6.00% 169.60 86.07 58.23 44.32 35.98 30.42 23.49 19.33 16.57 14.61 6.25% 169.72 86.18 58.34 44.43 36.09 30.54 23.60 19.45 16.69 14.73 6.50% 169.84 86.30 58.46 44.55 36.20 30.65 23.71 19.57 16.81 14.85 6.75% 169.96 86.41 58.57 44.66 36.32 30.76 23.83 19.68 16.93 14.97 7.00% 170.09 58.68 44.77 86.53 36.43 30.88 23.95 17.05 19.80 15.09 7.25% 170.21 86.64 58.80 44.89 36.55 30.99 24.06 19.92 17.17 15.22 7.50% 170.33 58.91 86.76 45.00 36.66 31.11 24.18 15.34 20.04 17.29 7.75% 86.87 170.45 59.03 45.11 36.77 31.22 24.30 15.46 20.16 17.41 8.00% 86.99 170.58 45.23 59.14 36.89 15.59 31.34 1753 24.41 20.28 8.25% 170.70 59.25 87.10 45.34 37.00 31.45 15.71 24.53 20.40 17.66 8.50% 170.82 15.84 59.37 87.22 45.46 17.78 31.57 37.12 24.65 20.52 170.95 87.34 45.57 59.48 8.75% 37.23 15.96 24.77 31.68 20.64 17.90 87.45 45.68 59.60 9.00% 171.07 16.09 24.89 20.76 31.80 37.35 18.03 171.19 45.80 87.57 18.15 31.92 37.46 59.71 9.25% 16.22 25.00 20.88 16.34 59.83 9.50% 171.32 21.00 45.91 87.68 18.27 32.03 25.12 37.58 96 12.19 12.31 12.42 12.54 12.66 12.78 12.90 13.02 13.14 13.26 13.39 13.51 13.63 13.76 13.88 14.01 14.14 14.26 14.39 14.52 14.65 14.78 1491 120 10.12 10.24 10.36 10.48 10.61 10.73 10.85 10.98 11.10 11.23 11.35 11.48 11.61 11.74 11.87 12.00 12.13 12.27 12.40 12.53 12.67 12.80 12.94 Print Done Tet more help