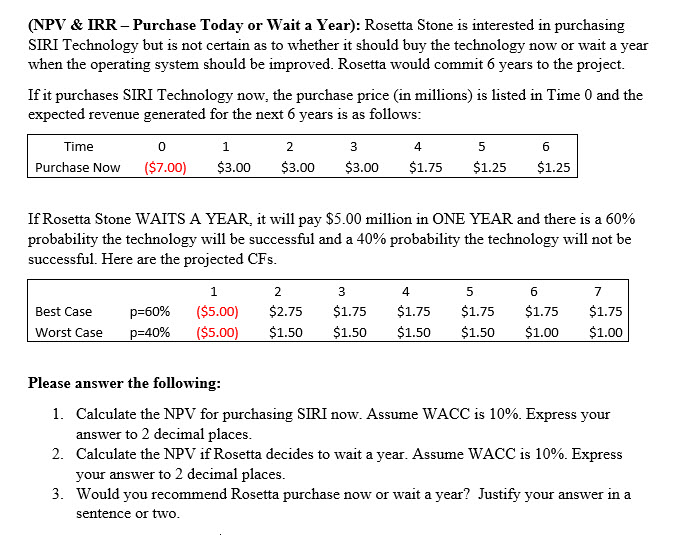

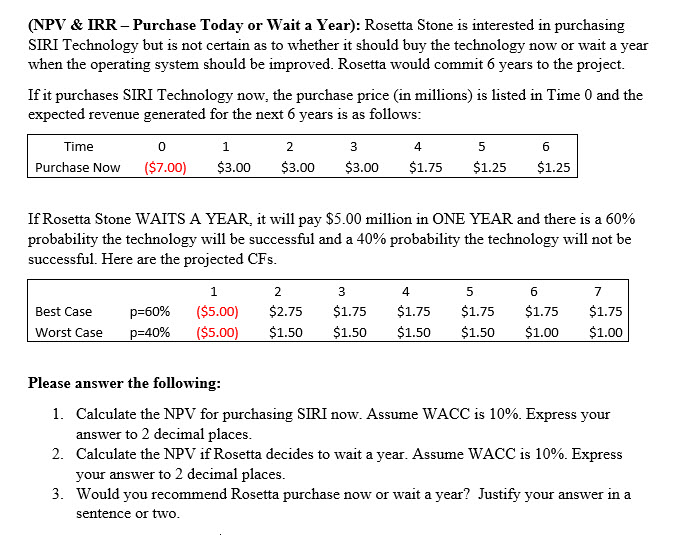

(NPV & IRR - Purchase Today or Wait a Year): Rosetta Stone is interested in purchasing SIRI Technology but is not certain as to whether it should buy the technology now or wait a year when the operating system should be improved. Rosetta would commit 6 years to the project. If it purchases SIRI Technology now, the purchase price (in millions) is listed in Time 0 and the expected revenue generated for the next 6 years is as follows Time 0 Purchase Now ($7.00) $3.00 $3.00 $3.00 $1.75 $1.25 $1.25 If Rosetta Stone WAITS A YEAR, it will pay $5.00 million in ONE YEAR and there is a 60% probability the technology will be successful and a 40% probability the technology will not be successful. Here are the projected CFs 4 $1.75 $1.50 ($5.00) ($5.00) $2.75 $1.50 $1.75 $1.50 $1.75 $1.50 $1.75 $1.00 $1.75 $1.00 Best Case p-60% p:40% worst case Please answer the following I. Calculate the NPV for purchasing SIRI now. Assume WACC is 10%. Express your answer to 2 decimal places Calculate the NPV if Rosetta decides to wait a year. Assume WACC is 10%. Express your answer to 2 decimal places. Would you recommend Rosetta purchase now or wait a year? Justity your answer in a sentence or two 2. 3. (NPV & IRR - Purchase Today or Wait a Year): Rosetta Stone is interested in purchasing SIRI Technology but is not certain as to whether it should buy the technology now or wait a year when the operating system should be improved. Rosetta would commit 6 years to the project. If it purchases SIRI Technology now, the purchase price (in millions) is listed in Time 0 and the expected revenue generated for the next 6 years is as follows Time 0 Purchase Now ($7.00) $3.00 $3.00 $3.00 $1.75 $1.25 $1.25 If Rosetta Stone WAITS A YEAR, it will pay $5.00 million in ONE YEAR and there is a 60% probability the technology will be successful and a 40% probability the technology will not be successful. Here are the projected CFs 4 $1.75 $1.50 ($5.00) ($5.00) $2.75 $1.50 $1.75 $1.50 $1.75 $1.50 $1.75 $1.00 $1.75 $1.00 Best Case p-60% p:40% worst case Please answer the following I. Calculate the NPV for purchasing SIRI now. Assume WACC is 10%. Express your answer to 2 decimal places Calculate the NPV if Rosetta decides to wait a year. Assume WACC is 10%. Express your answer to 2 decimal places. Would you recommend Rosetta purchase now or wait a year? Justity your answer in a sentence or two 2. 3