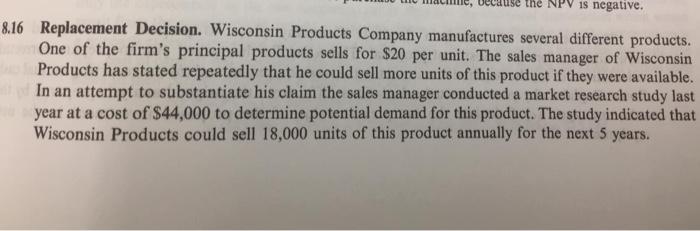

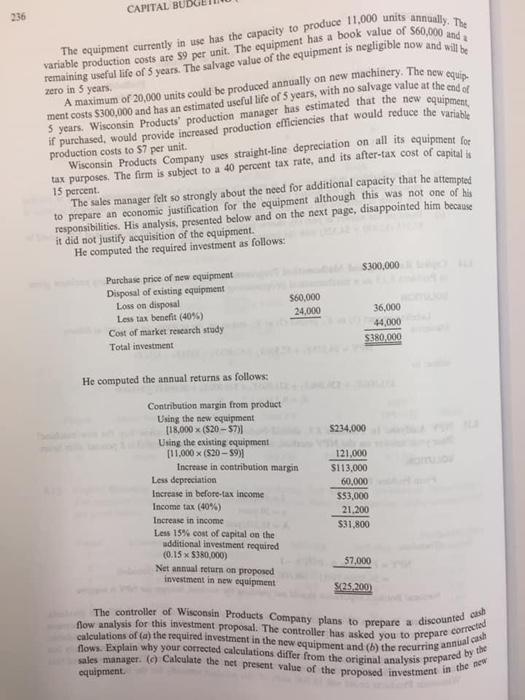

NPV is negative. 8.16 Replacement Decision. Wisconsin Products Company manufactures several different products. One of the firm's principal products sells for $20 per unit. The sales manager of Wisconsin Products has stated repeatedly that he could sell more units of this product if they were available. In an attempt to substantiate his claim the sales manager conducted a market research study last year at a cost of $44,000 to determine potential demand for this product. The study indicated that Wisconsin Products could sell 18,000 units of this product annually for the next 5 years. CAPITAL BUL if purchased, would provide increased production efficiencies that would reduce the variante Wisconsin Products Company uses straight-line depreciation on all its equipment for tax purposes. The firm is subject to a 40 percent tax rate, and its after-tax cost of capital is The sales manager felt so strongly about the need for additional capacity that he attempted to prepare an economic justification for the equipment although this was not one of his responsibilities. His analysis, presented below and on the next page, disappointed him because it did not justify acquisition of the equipment. He computed the required investment as follows: $300,000 The equipment currently in use has the capacity to produce 11.000 units annually. The variable production costs are 59 per unit. The equipment has a book value of $60,000 and remaining useful life of 5 years. The salvage value of the equipment is negligible now and will be A maximum of 20,000 units could be produced annually on new machinery. The new equip 5 years. Wisconsin Products' production manager has estimated that the new equipment, The controller of Wisconsin Products Company plans to prepare a discounted cash calculations of (a) the required investment in the new equipment and (b) the recurring annual as flow analysis for this investment proposal. The controller has asked you to prepare corrected flows. Explain why your corrected calculations differ from the original analysis prepared by the sales manager. (c) Calculate the nel present value of the proposed investment in the new 236 zero in 5 years 15 percent Purchase price of new equipment Disposal of existing equipment 560,000 Loss on disposal 24,000 Les tax benefit (40%) Cost of market research study Total investment He computed the annual returns as follows: Contribution margin from product Using the new equipment [18.000 X (S20 - 57)] Using the existing equipment [11,000x (520-59) Increase in contribution margin Less depreciation Increase in before tax income Income tax (40%) Increase in income Less 15% cost of capital on the additional investment required (0.15 x $380,000) Net annual return on proposed investment in new equipment equipment. 36,000 44,000 $380,000 $234.000 121,000 $113,000 60,000 $33,000 21.200 $31,800 57,000 5.25.200