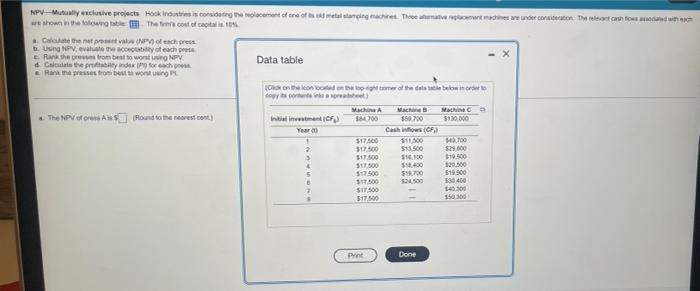

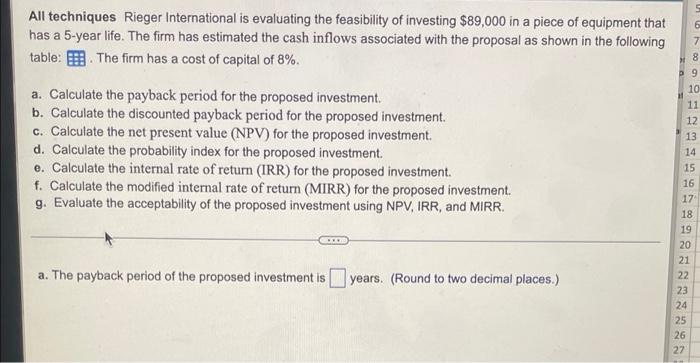

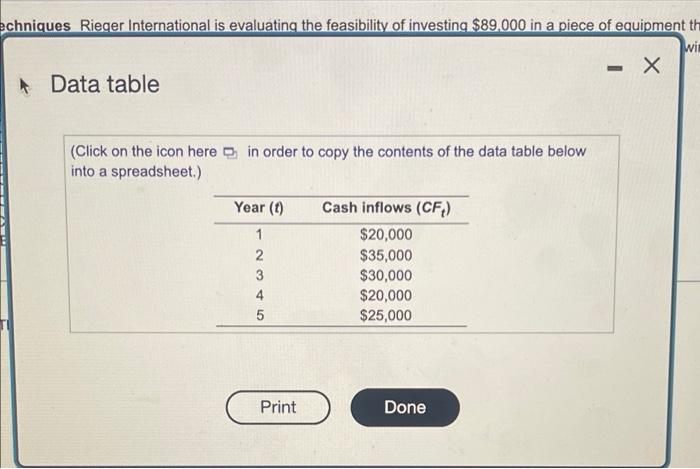

NPV-Musly exclusive projects Hooks corideteg element of one of metal string. The more achines are under consideren Tort case for men werowe w The cost of capital is 10% Cate the new Pench press Ungevuse the teaches Rank there from best to worst NPV Call the prinder for schon Data table Rank the presses troben a woning Center of the debe copy screw) MacA Mac Machine The NPV of respond to the newest bent) Iniment CF 90700 $50700 $130.000 Year Cash Wows (CN 317.500 5140 HA100 317300 $15.500 16.100 10.500 120.500 $200 $19.900 317.500 1.00 338400 $17.500 14.00 517.500 100 1750 12.450 15 Pent Done All techniques Rieger International is evaluating the feasibility of investing $89,000 in a piece of equipment that has a 5-year life. The firm has estimated the cash inflows associated with the proposal as shown in the following table: B. The firm has a cost of capital of 8%. a. Calculate the payback period for the proposed investment b. Calculate the discounted payback period for the proposed investment. C. Calculate the net present value (NPV) for the proposed investment. d. Calculate the probability index for the proposed investment e. Calculate the internal rate of return (IRR) for the proposed investment f. Calculate the modified internal rate of return (MIRR) for the proposed investment. g. Evaluate the acceptability of the proposed investment using NPV, IRR, and MIRR. Na 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 DER a. The payback period of the proposed investment is years. (Round to two decimal places.) echniques Rieger International is evaluating the feasibility of investing $89.000 in a piece of equipment th wit A Data table (Click on the icon here in order to copy the contents of the data table below into a spreadsheet.) Year (1) Cash inflows (CF) 1 $20,000 2 $35,000 3 $30,000 4 $20,000 5 $25,000 Print Done NPV-Musly exclusive projects Hooks corideteg element of one of metal string. The more achines are under consideren Tort case for men werowe w The cost of capital is 10% Cate the new Pench press Ungevuse the teaches Rank there from best to worst NPV Call the prinder for schon Data table Rank the presses troben a woning Center of the debe copy screw) MacA Mac Machine The NPV of respond to the newest bent) Iniment CF 90700 $50700 $130.000 Year Cash Wows (CN 317.500 5140 HA100 317300 $15.500 16.100 10.500 120.500 $200 $19.900 317.500 1.00 338400 $17.500 14.00 517.500 100 1750 12.450 15 Pent Done All techniques Rieger International is evaluating the feasibility of investing $89,000 in a piece of equipment that has a 5-year life. The firm has estimated the cash inflows associated with the proposal as shown in the following table: B. The firm has a cost of capital of 8%. a. Calculate the payback period for the proposed investment b. Calculate the discounted payback period for the proposed investment. C. Calculate the net present value (NPV) for the proposed investment. d. Calculate the probability index for the proposed investment e. Calculate the internal rate of return (IRR) for the proposed investment f. Calculate the modified internal rate of return (MIRR) for the proposed investment. g. Evaluate the acceptability of the proposed investment using NPV, IRR, and MIRR. Na 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 DER a. The payback period of the proposed investment is years. (Round to two decimal places.) echniques Rieger International is evaluating the feasibility of investing $89.000 in a piece of equipment th wit A Data table (Click on the icon here in order to copy the contents of the data table below into a spreadsheet.) Year (1) Cash inflows (CF) 1 $20,000 2 $35,000 3 $30,000 4 $20,000 5 $25,000 Print Done