Question

NSTRUCTIONS Begin by reviewing the tax return scenario below. Then, prepare 2021 gift tax returns (Form 709) for both of the Johnsons to compute the

NSTRUCTIONS Begin by reviewing the tax return scenario below. Then, prepare 2021 gift tax returns (Form 709) for both of the Johnsons to compute the total taxable gifts (line 3) for Frank and Nancy. Stop with line 3 of page 1, but complete pages 2 and 3 of the return.

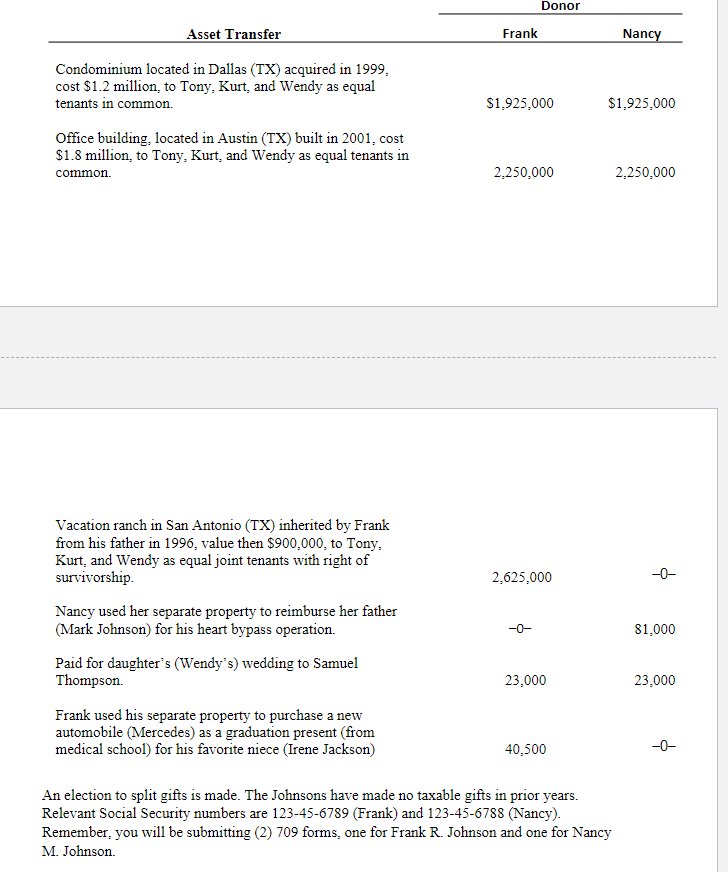

TAX RETURN SCENARIO Frank R. and Nancy M. Johnson, ages 70 and 65, are retired physicians who live at 527 Montpelier Drive, Austin, Texas 78741. Their 3 adult children (Tony Johnson, Kurt Johnson, and Wendy Thompson) are mature and responsible people. The Johnsons have heard that some in Congress have proposed lowering the Federal gift tax exclusion to $5 million. Although this change likely will not occur, the Johnsons feel they should take advantage of the more generous exclusion available under existing law. Thus, the Johnsons make transfers of many of their high value investments. These and other gifts made during 2021 are summarized below:

An election to split gifts is made. The Johnsons have made no taxable gifts in prior years. Relevant Social Security numbers are 123-45-6789 (Frank) and 123-45-6788 (Nancy). Remember, you will be submitting (2) 709 forms, one for Frank R. Johnson and one for Nancy M. Johnson. An election to split gifts is made. The Johnsons have made no taxable gifts in prior years. Relevant Social Security numbers are 123-45-6789 (Frank) and 123-45-6788 (Nancy). Remember, you will be submitting (2) 709 forms, one for Frank R. Johnson and one for Nancy M. Johnson

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started