Answered step by step

Verified Expert Solution

Question

1 Approved Answer

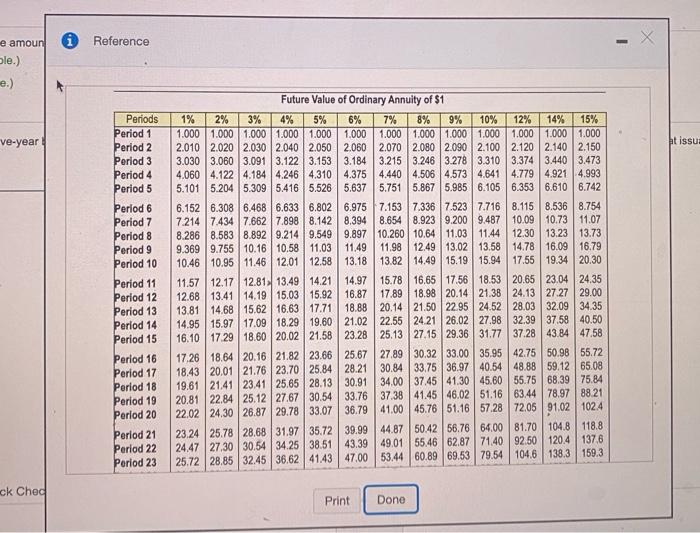

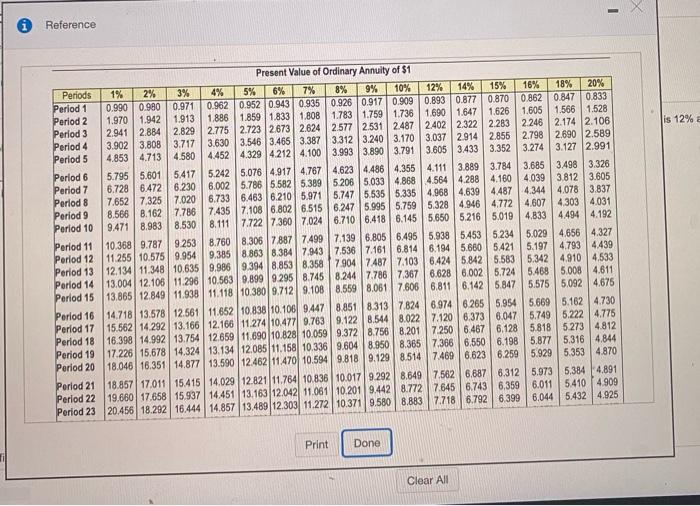

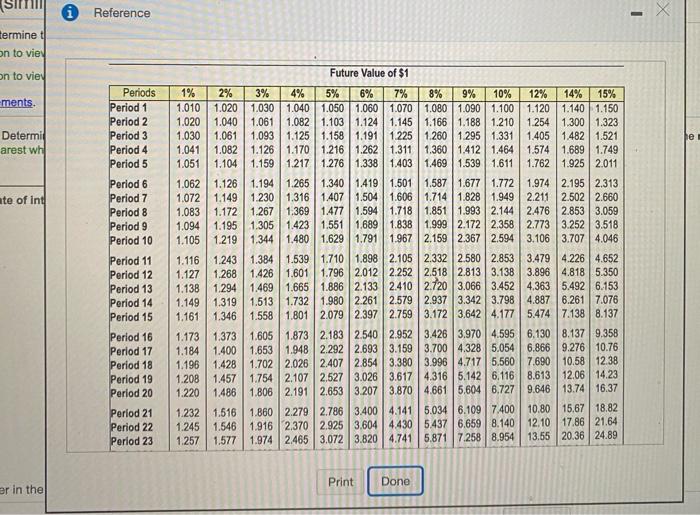

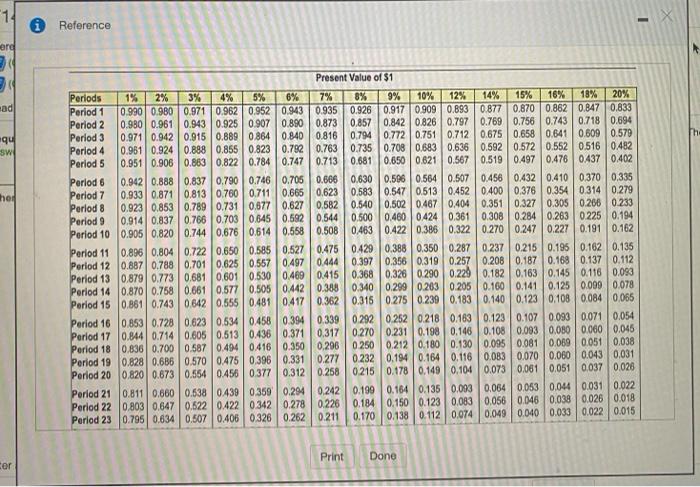

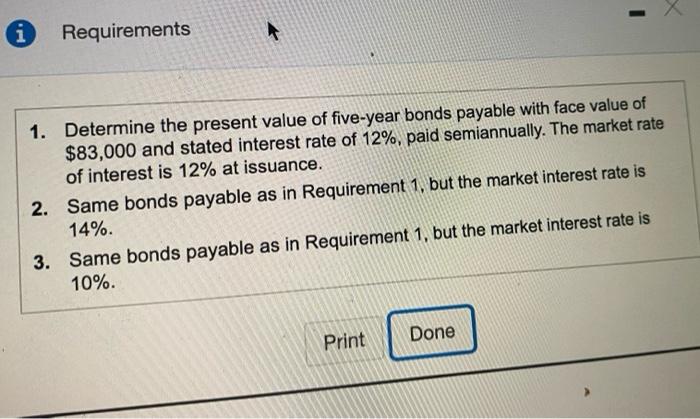

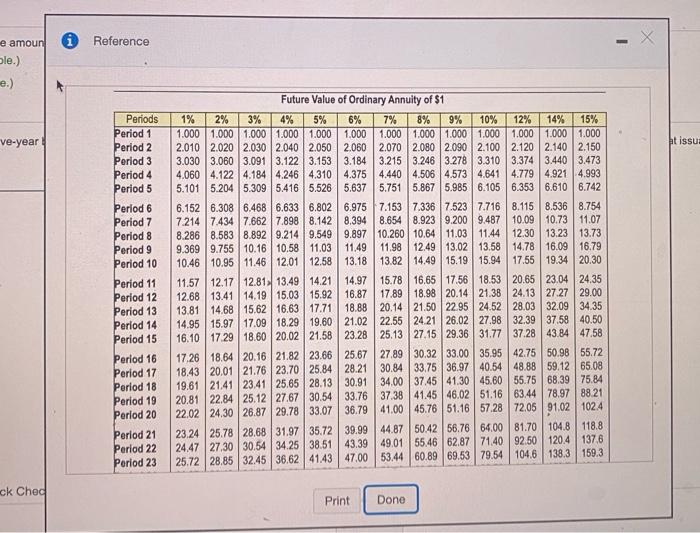

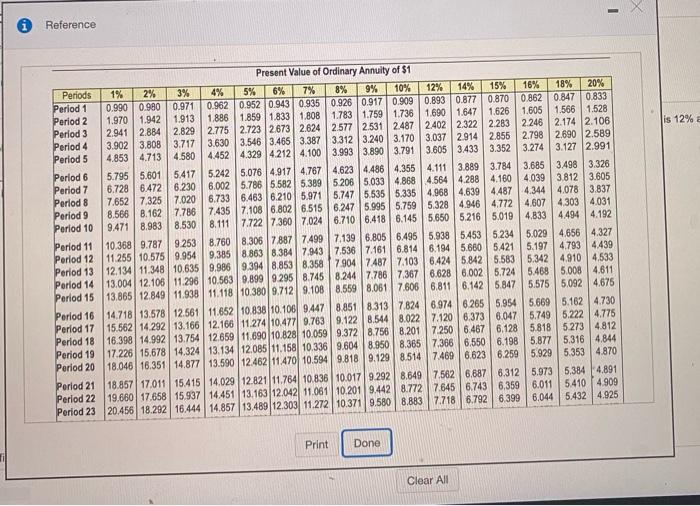

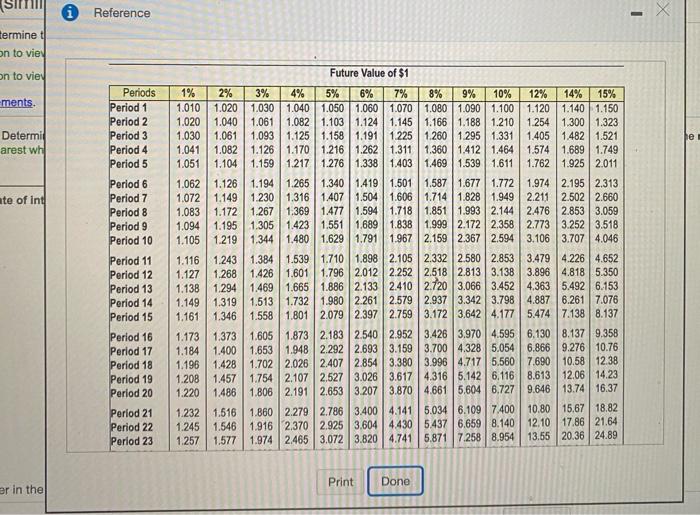

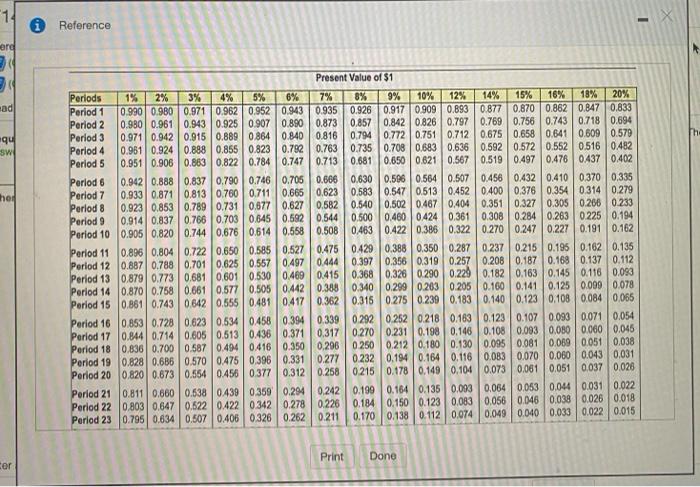

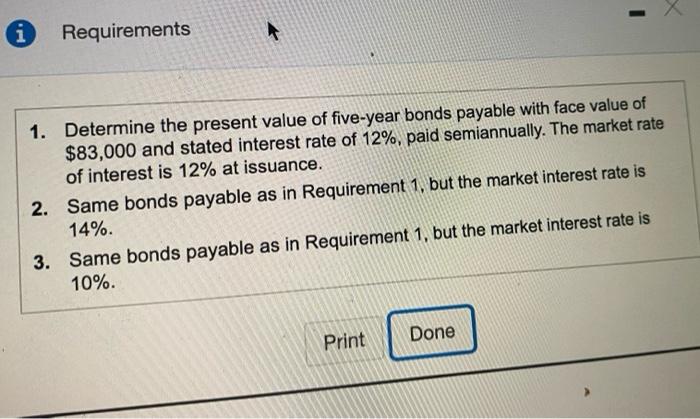

nterest rates determine the present value of future amounts. (Round to the nearest dollar.) i Reference e amoun ble.) e.) ve-year ht issus Periods Period

nterest rates determine the present value of future amounts. (Round to the nearest dollar.)

i Reference e amoun ble.) e.) ve-year ht issus Periods Period 1 Period 2 Period 3 Period 4 Period 5 Period 6 Period 7 Period 8 Period 9 Period 10 Period 11 Period 12 Period 13 Period 14 Period 15 Future Value of Ordinary Annuity of $1 1% 2% 3% 5% 6% 7% 8% 9% 10% 12% 14% 15% 1.000 1.000 1.000 1.000 1.000 1.000 1.000 1.000 1.000 1.000 1.000 1.000 1.000 2.010 2.020 2.030 2.040 2.050 2.060 2.070 2.080 2.090 2.100 2.120 2.140 2.150 3.030 3.060 3.091 3.122 3.1533.184 3.215 3.246 3.278 3.310 3.374 3.440 3.473 4.060 4.122 4.184 4.246 4.310 4.375 4.440 4.506 4.573 4.641 4.779 4.921 4.993 5.101 5.204 5.309 5.416 5.526 5.637 5.751 5.867 5.985 6.105 6.353 6.610 6.742 6.152 6.308 6.468 6.633 6.8026.975 7.1537.336 7.523 7.716 8.115 8.536 8.754 7.214 7.434 7.6627.898 8.142 8.394 8.654 8.923 9.2009.487 10.09 10.73 11.07 8.286 8.583 8.8929.2149.549 9.897 10.260 10.64 11.03 11.44 12.30 13.23 13.73 9.369 9.755 10.16 10.58 11.03 11,49 11.98 12.49 13.02 13.58 14.78 16.09 16.79 10.46 10.95 11.46 12.01 12.58 13.18 13.82 14.49 15.1915.94 17.55 19.34 20.30 11.57 12.17 12.81% 13.49 14.21 14.97 15.78 16.65 17.56 18.53 20.65 23.04 24.35 12.68 13.41 14.19 15.03 15.92 | 16.87 17.8918.98 20.14 21.38 24.13 27.27 29.00 13.81 14.68 15,62 16.63 17.71 18.88 20.14 21.50 22.95 24.52 28.03 32.09 34 35 14.95 15.97 17.09 18.2919.60 21.02 22.55 2421 26.02 27.98 32.39 37.58 40.50 16.10 17.29 18.60 20.02 21.58 23.28 25.13 27.15 29.36 31.77 37.28 43.84 47.58 17.26 18.64 20.16 21.82 23.66 25.67 27.89 30.32 33.00 35,95 42.75 50.98 55.72 18.43 20.01 21.76 23.70 25.84 28.21 30.84 33.75 36.97 40.54 48.88 59.12 65.08 19.61 21.41 23.41 25.65 28.13 30.91 34.00 37.45 41,30 45.60 55.75 68.39 75.84 20.81 22.84 25.12 27.67 30.54 33.76 37 38 41.45 46.02 51.16 63.44 78.97 88.21 22.02 24.30 26.87 29.7833.07 36.79 41.00 45.76 51.16 57.28 72.05 91.02 1024 23.24 25.78 28.68 31.97 35.72 39.99 44.87 50.42 56.76 64.00 81.70 104.8 118.8 24.47 27.30 30.5434.25 38.51 43.39 49.01 55.46 62.87 71.40 92.50 120.4 137.6 25.72 28.85 32.45 36.62 41.43 | 47.00 53.44 60.89 69.53 79.54 104.6 138.3 159.3 Period 16 Period 17 Period 18 Period 19 Perlod 20 Period 21 Period 22 Period 23 ck Ched Print Done - Reference 10% is 12% Present Value of Ordinary Annuity of S1 Periods 1% 2% 3% 4% 5% 6% 7% 8% 9% 12% 14% 15% 16% 18% 20% Period 1 0.990 0.980 0.971 0.962 0.952 0.943 0.935 0.926 0.917 0.909 0.893 0.877 0.870 0,862 0.847 0.833 Period 2 1.970 1.942 1.913 1.886 1.859 1.833 1.8081.783 1.759 1736 1.6901.6471.626 1.605 1.566 1.528 Perlod 3 2.9412.8842.829 2.775 2.723 2673 2.624 2.577 2 531 2.487 2.402 2.322 2.263 2.246 2.174 2.106 Period 4 3.902 3.808 3.717 3.630 3.546 3465 3.3873.312 3.240 3.170 3.037 2.914 2.855 2.798 2.690 2.589 Period 5 4.853 4.713 4.580 4.452 4.3294212 4.100 3.993 3.890 3.791 3.605 3433 3.352 3.274 3.127 2.991 Period 6 5.795 5.601 5.417 5.242 5.076 4.917 4.767 4.623 4.486 4.355 4.111 3.8893.784 3.685 3.498 3.326 Period 7 6.728 6.4726.230 6.002 5.786 5.582 5.3895206 5.033 48684.564 4.288 4.160 4.039 3.812 3.605 Period 8 7.652 7.325 7,020 6.733 6.463 6.210 5.971 5.747 5.535 5.335 4.968 4.639 4487 43444.0783.837 Period 9 8.566 8.1627.786 7.435 7.108 6.802 6.515 6.247 5.9955.759 5.328 4.94647724.607 4303 4.031 Period 10 9.471 8.9838.530 8.111 7.722 7.360 7.0246.710 6.418 6.145 5.6505.216 5,019 4.8334494 4.192 Period 11 10.368 9.7879 253 8.760 8.306 7887 7.499 7.139 6.805 6.495 5.938 5.453 5234 5.0294.656 4.327 Period 12 11.255 10.575 9.954 9.3858.8638.384 7.943 7.536 7.161 6.814 6.194 5.660 5421 5.197 4793 4439 Period 13 12.134 11.348 10.635 9.9869.3948.853 8.358 7.9047487 7.1036424 5.8425.583 5.342 4.910 4,533 Porlod 14 13.004 12.106 11.296 10.5639.899 9.295 8.745 8.2447.7867.3676.628 6.002 5.724 5.468 5.008 4.611 Period 15 13.865 12.849 11.938 11.118 10.380 9.712 9.108 8.559 8,061 7.606 6.811 6.142 5.847 5.575 5.092 4.675 Period 16 14.718 13.578 12.561 11.652 10.838 10.106 9.4478851 8.31378246.9746.26559545.669 5.1624.730 Period 17 15.562 14.292 13.166 12.166 11.274 10.477 0.763 9.122 8,544 8.022 7.120 6.373 6.047 5.749 5.222 4.775 Period 18 16.398 14.992 13.754 12659 11.690 10.828 10.0599.372 8.756 8.2017.250 6.4676.128 5.818 5273 4.812 Period 19 17.226 15.678 14.324 13.134 12.085 11.158 10.336 9.604 8.950 8.365 7.366 6.550 6.198 5.877 5.316 4.844 Period 20 18.046 16.351 14.877 13.590 12.462 11.470 10.5949.818 9.129 8.5147.4696.623 6.259 5.929 5.353 4.870 Perlod 21 18.857 17.011 15.415 14.029 12821 11.764 10.836 10.017 9.292 8.6497.562 6.687 6.312 5.973 5.384 4.891 Period 22 19.660 17.658 15937 14.451 13.163 12.042 11.061 10.2019.442 8.772 7.645 6.743 6.359 6.0115.410 4.909 Period 23 20.456 18.292 16.444 14.857 13.489 12.303 11.272 10.371 9.580 8.8837.718 6.792 6.399 6.044 5.432 4.925 Print Done Clear All Reference termine t on to vie on to vie ments. Determit arest w te of int Periods Period 1 Period 2 Period 3 Period 4 Period 5 Period 6 Period 7 Period 8 Period 9 Period 10 Period 11 Period 12 Period 13 Period 14 Period 15 Future Value of $1 1% 2% 3% 4% 5% 6% 7% 8% 9% 10% 12% 14% 15% 1.010 1.020 1.030 1.040 1.050 1.060 1.070 1.080 1.090 1.100 1.120 1.140 1.150 1.020 1.040 1.061 1.082 1.103 1.1241.145 1.166 1.1881.210 1.254 1.300 1.323 1.030 1.061 1.093 1.125 1.158 1.191 1.225 1.260 1295 1.331 1.405 1.482 1.521 1.041 1.0821.126 1.170 1.216 1.262 1.311 1.360 1.4121.464 1.574 1.689 1.749 1.051 1.104 1.159 1.217 1.276 1.338 1.403 1.469 1.539 1.611 1.762 1.925 2.011 1.062 1.126 1.194 1.265 1.340 1.419 1.501 1.587 1.677 1.772 1.974 2.1952.313 1.072 1.149 1.230 1.316 1.407 1.504 1.606 1.7141.828 1.949 2.211 2.502 2.660 1.083 1.1721.267 1.369 1477 1.594 1.718 1.851 1.993 2.144 2.476 2.853 3.059 1.094 1.1951.305 1.423 1.551 1.689 1.838 1.999 2.172 2.358 2.773 3.252 3.518 1.105 1.219 1,344 1.480 1.629 1.7911.967 2.159 2.367 2.594 3.106 3.707 4.046 1.116 1.243 1.384 1.539 1.710 1.898 2.105 2.332 2.580 2.853 3.479 4.226 4652 1.1271.268 1.426 1.601 1.796 2012 2.252 2.518 2.813 3.138 3.896 4.818 5.350 1.138 1.294 1.469 1.665 1.886 2.1332.410 2.720 3.066 3.4524,363 5.492 6.153 1.149 1.319 | 1.513 1.732 1.980 2.261 2.579 2.937 3.342 3.798 4.887 6.261 7.076 1.161 1.346 1.558 1.801 2.079 2.3972.759 3.172 3,642 4.177 5.474 7.1388.137 1.173 1.373 1.605 1.873 2.183 2.540 2.952 3.426 3.970 4.595 6.130 8.137 9.358 1.1841.400 1.653 1.948 2.292 2.693 3.159 3.700 4.328 5.054 6.866 9.276 10.76 1.196 1.428 1.702 2.026 | 2.407 2.854 3.380 3.996 4.717 5.560 7.690 10.58 12.38 1.208 1.457 1.754 2.107 2.527 3.026 3.617 4.316 5.1426.116 8.613 12.06 14.23 1.220 1.486 1.806 2.191 2.653 3.2073.870 4.661 5,6046.727 9.646 13.74 16.37 1.232 1.516 1.860 2.279 2.786 3.400 4.141 5.034 6.1097.400 10.80 15.67 18.82 1.245 1.546 1.916 2.370 2.925 3.604 4.430 54376.659 8.140 12.10 17.86 21.64 1.257 1.5771.9742465 3,072 3.820 4.741 5.871 7.258 8.954 13.55 20.36 24.89 Period 16 Period 17 Period 18 Period 19 Period 20 Period 21 Period 22 Period 23 Print Done er in the 1 Reference ard ad 94 SW her Present Value of $1 Periods 1% 2% 3% 4% 5% 7% 8% 9% 10% 12% 14% 15% 16% 18% 20% Period 1 0.990 0.980 0.971 0.962 0.952 0.9430.935 0.926 0.917 0.909 0.893 0.877 0.870 0.862 0.847 0.833 Period 2 0.980 0.961 0.943 0.925 0.907 0.890 0.873 0.857 0.8420.826 0.797 0.769 0.756 0.743 0.718 0.694 Perlod 3 0.971 0.942 0.915 0.889 0864 0.840 0.816 0.794 0.772 0.751 0.712 0.675 0.658 0.641 0.609 0.579 Period 4 0.961 0.924 0.888 0.855 0.823 0.782 0.763 0.735 0.708 0.683 0.636 0.592 0.572 0.552 05160482 Perlod 5 0.951 0.906 0.863 0.822 0.784 0.747 0.713 0.681 0.650 0.621 0.567 0.519 0497 0.476 0437 0.402 Period 6 0.942 0.888 0.837 0.790 0.746 0.705 0.6660.630 0.596 0.564 0.507 0.456 0.432 0.410 0.370 0.335 Period 7 0.933 0.871 0.813 0.7600.7110.665 0.623 0.5830.547 0.513 0.452 0.400 0.376 0.3540.314 0.279 Period 8 0.923 0.853 0.789 0.731 0.677 0.627 0.582 0.540 0.502 0.467 0.404 0.351 0.327 0.305 0.206 0233 Period 9 0.914 0.837 0.766 0.703 0.6450.5920.5440.500 0.460 0424 0.361 0.308 0284 0.263 0225 0.194 Period 10 0.905 0.820 0.744 0.676 0.614 0.558 0.508 0463 0422 0.386 0.322 0.270 0.247 0.227 0.191 0.162 Period 11 0.896 0.8040.722 0.650 0.585 0.527 0.4750429 0.388 0.350 0.287 0.237 0.215 0.195 0.162 0.135 Period 12 0.887 0.788 0.701 0.625 0.557 04970444 0.397 0.356 0.319 0.257 0.208 0.187 0.168 0.137 0.112 Period 13 0.879 0.773 0.681 0.601 0.530 0,469 0.415 0.368 0.326 0.290 0.229 0.182 0.163 0.145 0.116 0.093 Period 14 0.870 0.758 0.661 0.577 0.505 0442 0.388 0.340 0.299 0.263 0.205 0.160 0.141 0.125 0.000 0.078 Period 15 0.861 0.743 0.642 0,555 0.4810417 0.362 0.315 0.275 0.239 0.183 0.140 0.123 0.108 0.084 0.065 Period 16 0.853 0.728 0.623 0.534 04580394 0.3390292 0.252 0.218 0.163 0.123 0.107 0.093 0.071 0.054 Period 17 0.844 0.714 0.605 0.5130436 0.371 0.3170.270 0.2310.198 0.146 0.108 0.003 0.080 0.060 0.045 Period 18 0.836 0.700 0.587 0.4940416 0.350 0.2060 250 0.212 0.180 0.130 0.095 0.081 0.069 0.051 0.038 Period 19 0.828 0.686 0.570 0.475 0.396 0.331 0.277 0.232 0.1940.164 0.116 0.003 0.070 0.060 0.043 0.031 Period 20 0.820 0.673 0.554 0.456 0.377 0.3120.258 0.215 0.178 0.149 0.104 0.073 0.061 0.051 0.037 0.026 Period 21 0.811 0.660 0.538 0439 0.359 0.294 0,242 0.1990.1640.135 0.003 0.064 0.053 0.044 0.031 0.022 Period 22 0.803 0.647 0.622 0422 0.342 0.278 0.226 0.184 0.150 0.123 0,083 0.056 0.046 0.038 0.026 0.018 Period 23 0.795 0.634 0.507 0.406 0.326 0.262 0.211 0.1700.138 0.112 0.074 0.049 0.040 0.033 0.022 0.015 Print Done cer i Requirements 1. Determine the present value of five-year bonds payable with face value of $83,000 and stated interest rate of 12%, paid semiannually. The market rate of interest is 12% at issuance. 2. Same bonds payable as in Requirement 1, but the market interest rate is 14%. 3. Same bonds payable as in Requirement 1, but the market interest rate is 10%. Done Print

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started