Answered step by step

Verified Expert Solution

Question

1 Approved Answer

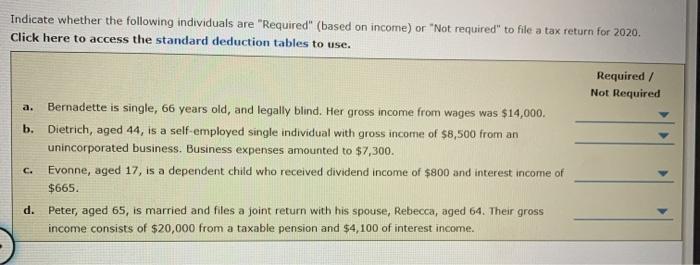

Indicate whether the following individuals are Required (based on income) or Not required to file a tax return for 2020. Click here to access

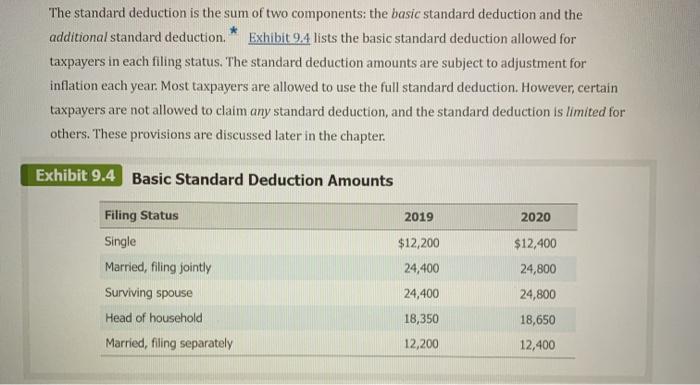

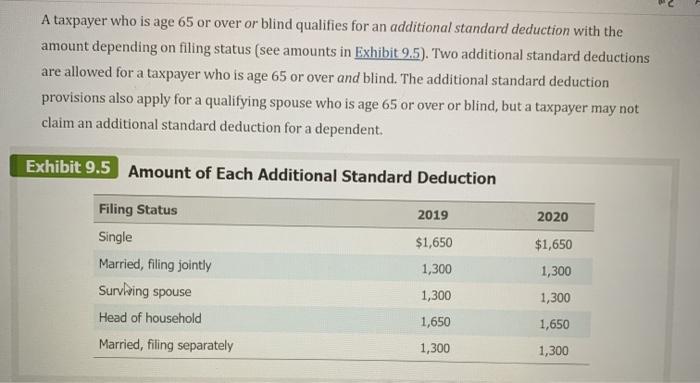

Indicate whether the following individuals are "Required" (based on income) or "Not required" to file a tax return for 2020. Click here to access the standard deduction tables to use. Required / Not Required a. Bernadette is single, 66 years old, and legally blind. Her gross income from wages was $14,000. b. Dietrich, aged 44, is a self-employed single individual with gross income of $8,500 from an unincorporated business. Business expenses amounted to $7,300. C. Evonne, aged 17, is a dependent child who received dividend income of $800 and interest income of $665. d. Peter, aged 65, is married and files a joint return with his spouse, Rebecca, aged 64. Their gross income consists of $20,000 from a taxable pension and $4,100 of interest income. The standard deduction is the sum of two components: the basic standard deduction and the additional standard deduction. Exhibit 9.4 lists the basic standard deduction allowed for taxpayers in each filing status. The standard deduction amounts are subject to adjustment for inflation each year. Most taxpayers are allowed to use the full standard deduction. However, certain taxpayers are not allowed to claim any standard deduction, and the standard deduction is limited for others. These provisions are discussed later in the chapter. Exhibit 9.4 Basic Standard Deduction Amounts Filing Status 2020 Single $12,400 Married, filing jointly 24,800 Surviving spouse 24,800 Head of household 18,650 Married, filing separately 12,400 2019 $12,200 24,400 24,400 18,350 12,200 A taxpayer who is age 65 or over or blind qualifies for an additional standard deduction with the amount depending on filing status (see amounts in Exhibit 9.5). Two additional standard deductions are allowed for a taxpayer who is age 65 or over and blind. The additional standard deduction provisions also apply for a qualifying spouse who is age 65 or over or blind, but a taxpayer may not claim an additional standard deduction for a dependent. Exhibit 9.5 Amount of Each Additional Standard Deduction Filing Status 2019 2020 Single $1,650 $1,650 Married, filing jointly 1,300 1,300 Surviving spouse 1,300 1,300 Head of household 1,650 1,650 Married, filing separately 1,300 1,300 To determine whether to itemize, the taxpayer compares the total standard deduction (the sum of the basic standard deduction and any additional standard deductions) with total itemized deductions. Taxpayers are allowed to deduct the greater of itemized deductions or the standard deduction. The choice is elective and may be changed each year. For example, a taxpayer who buys a home may change from using the standard deduction to itemizing deductions (because of mortgage interest and property tax deductions). The taxpayer's age can also make a difference. Prior to 2018, approximately 30 percent of taxpayers itemized their deductions. As a result of the increased standard deduction and elimination of some itemized deductions by the TCJA of 2017, the number of itemizers dropped to about 13 percent.

Step by Step Solution

★★★★★

3.42 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

Aug1231821 Answer is highlighted in yellow Solution Answ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started