Answered step by step

Verified Expert Solution

Question

1 Approved Answer

ntroduction: For this Project we will be looking at Financial Data from Walmart and Target from 2 0 1 9 - 2 0 2 1

ntroduction: For this Project we will be looking at Financial Data from Walmart and Target

from We will use Financial Ratios from Chapter to look at performance over

these years. These years will cov Target Corp TGT

in wie value your raedtacks. Lot us icnow what you think. WalMart Stores Inc WMT Target Corp TGTer the preCovid period, the Big Impact year, and

the New Normal year, We will also look at how each company responded to the

pandemic, as well as looking to see if the pandemic had an impact on the financial ratios. When

working in the Excel workbook, the pages are locked except for the yellow and green cells where

data or formulas need to be entered. Yellow cells will turn green when the correct answer is

entered.

Part will focus on reading the Financial Statements and Identifying the data and numbers we

need to complete part and

Step : Download all the files in the folder.

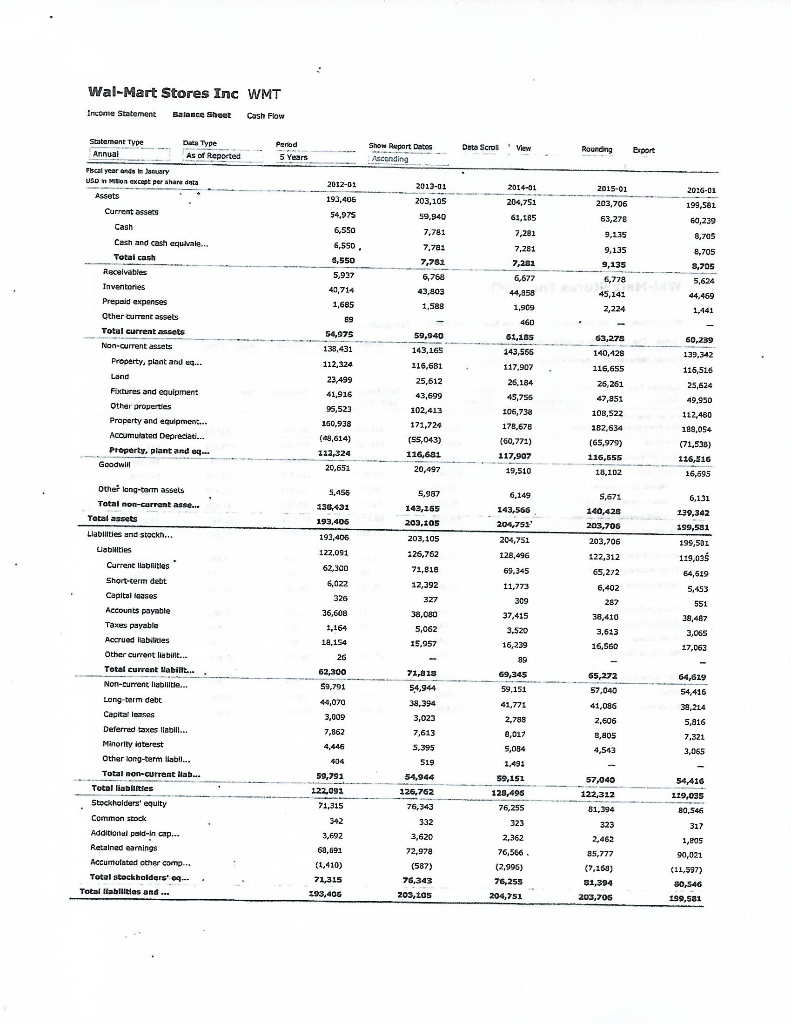

Step : Using the report for Walmart, fill in the numbers for and in the Walmart

Numbers Tab.

Note : Walmarts Fiscal year ends on January st For this project, will refer to the fiscal

year that ends January st and so on

Note : We will use Total Revenues, Interest, Net, Provisions for Income Tax, and Consolidated

Net Income for the select income statement accounts.

Note : Gross profit is not listed, you will have to calculate it yourself.

Note : On the Balance sheet, Total Liabilities are not listed, you will have to calculate them by

adding all the longterm liabilities to the current liabilities.

Note : The shares outstanding are listed on page on the file of the k report. Look for

the column for Common Stock Shares and the Bolded Balance Rows.

Step : Using the report for Target, fill in the numbers for and in the Target

Numbers Tab.

Note : Just like Walmart, Target ends its fiscal year at the end of January or Beginning of

February. One the Income statement, they list as the first years listed. This will match up

the balance sheet at Balance on January Sorry that this is a bit confusing.

Note : We will use Total Revenues, Net Interest Expense, Provisions for Income Tax, and Net

Earnings for the select income statement accounts.

Note : Gross profit is not listed, you will have to calculate it yourself.

Note : Target does not do sales on account, so there are no accounts receivable.

Note : One the Balance sheet, Total Liabilities are not listed, you will have to calculate them by

adding current liabilities with total noncurrent liabilities.

Note : Share outstanding are listed at the bottom of the Balance sheet. Type them as presented,

excel will convert them into Millions for the calculations.

Step : Repeat Step and for reports.

Step : Rename the Excel File as Financial Project Excel Last Name and upload to the drop

box by the due date. Each Numbers tab is worth points.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started