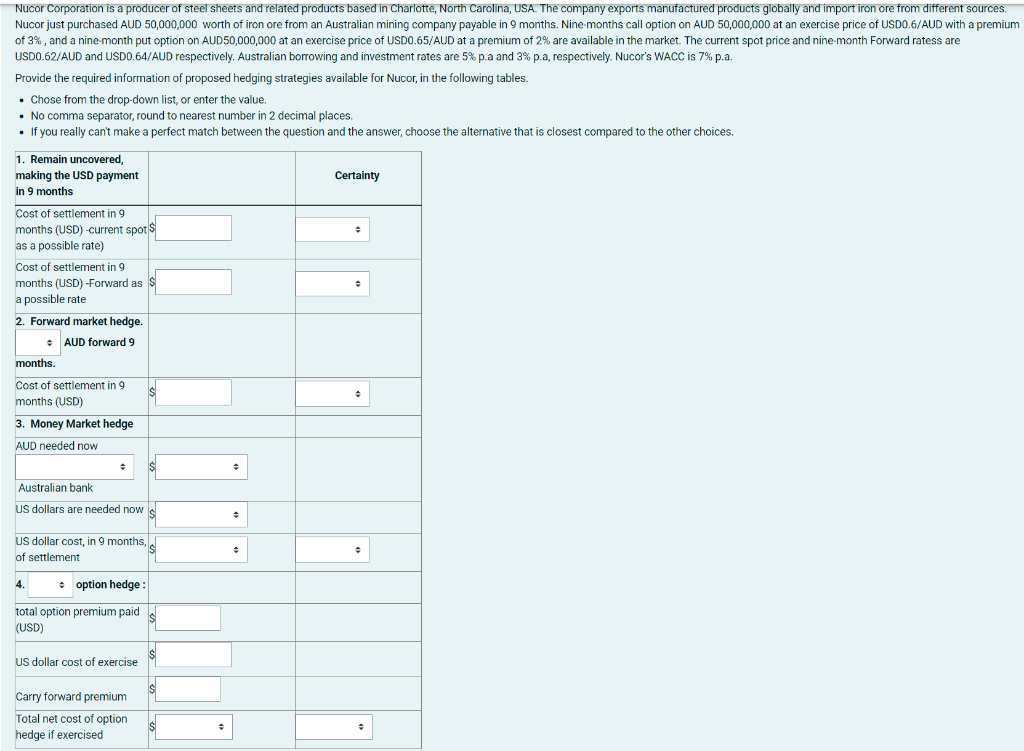

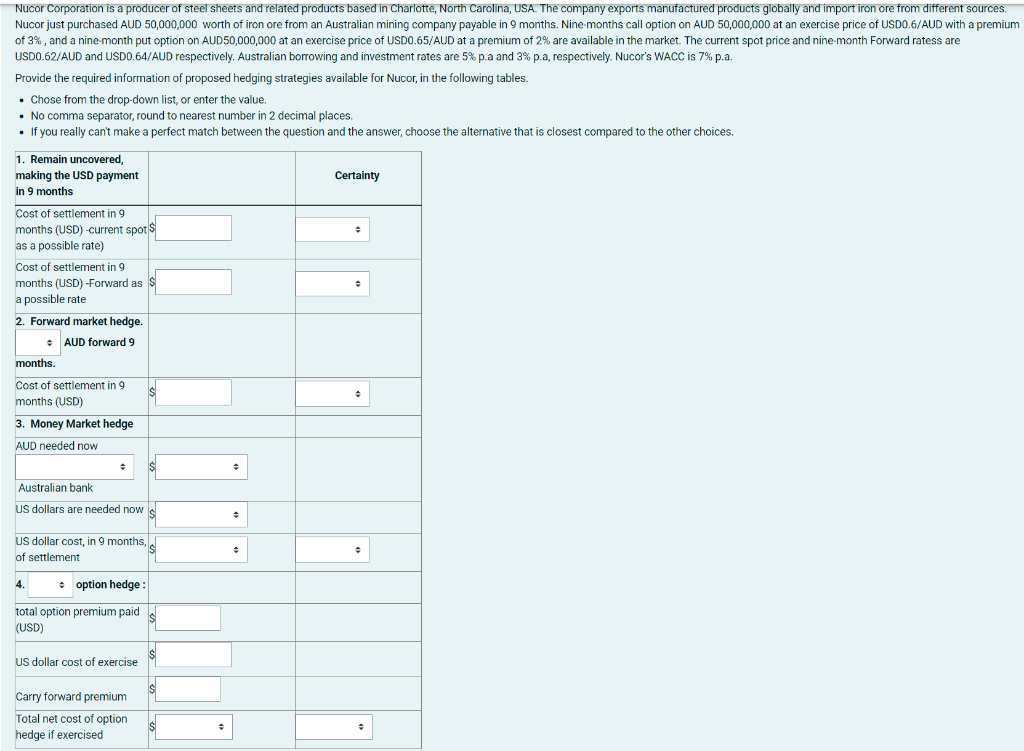

Nucor Corporation is a producer of steel sheets and related products based in Charlotte, North Carolina, USA. The company exports manufactured products globally and import iron ore from different sources Nucor just purchased AUD 50,000,000 worth of iron ore from an Australian mining company payable in 9 months. Nine-months call option on AUD 50,000,000 at an exercise price of USD0.6/AUD with a premium of 3%, and a nine-month put option on AUD50,000,000 at an exercise price of USD0.65/AUD at a premium of 2% are available in the market. The current spot price and nine month Forward ratess are USDO.62/AUD and USD0.64/AUD respectively, Australian borrowing and investment rates are 5% p.a and 3% p.a, respectively. Nucor's WACC is 7% p.a. Provide the required information of proposed hedging strategies available for Nucor, in the following tables. . Chose from the drop-down list, or enter the value. No comma separator, round to nearest number in 2 decimal places. . If you really can't make a perfect match between the question and the answer, choose the alternative that is closest compared to the other choices. Certainty 1. Remain uncovered, making the USD payment in 9 months Cost of settlement in 9 months (USD)-current spots as a possible rate) Cost of settlement in 9 months (USD) -Forward as S a possible rate 2. Forward market hedge. AUD forward 9 months Cost of settlement in 9 months (USD) 3. Money Market hedge AUD needed now Australian bank US dollars are needed now US dollar cost, in 9 months, of settlement 4. option hedge total option premium paid (USD) US dollar cost of exercise Carry forward premium Total net cost of option hedge if exercised Nucor Corporation is a producer of steel sheets and related products based in Charlotte, North Carolina, USA. The company exports manufactured products globally and import iron ore from different sources Nucor just purchased AUD 50,000,000 worth of iron ore from an Australian mining company payable in 9 months. Nine-months call option on AUD 50,000,000 at an exercise price of USD0.6/AUD with a premium of 3%, and a nine-month put option on AUD50,000,000 at an exercise price of USD0.65/AUD at a premium of 2% are available in the market. The current spot price and nine month Forward ratess are USDO.62/AUD and USD0.64/AUD respectively, Australian borrowing and investment rates are 5% p.a and 3% p.a, respectively. Nucor's WACC is 7% p.a. Provide the required information of proposed hedging strategies available for Nucor, in the following tables. . Chose from the drop-down list, or enter the value. No comma separator, round to nearest number in 2 decimal places. . If you really can't make a perfect match between the question and the answer, choose the alternative that is closest compared to the other choices. Certainty 1. Remain uncovered, making the USD payment in 9 months Cost of settlement in 9 months (USD)-current spots as a possible rate) Cost of settlement in 9 months (USD) -Forward as S a possible rate 2. Forward market hedge. AUD forward 9 months Cost of settlement in 9 months (USD) 3. Money Market hedge AUD needed now Australian bank US dollars are needed now US dollar cost, in 9 months, of settlement 4. option hedge total option premium paid (USD) US dollar cost of exercise Carry forward premium Total net cost of option hedge if exercised