Number 15. Please detail it !!

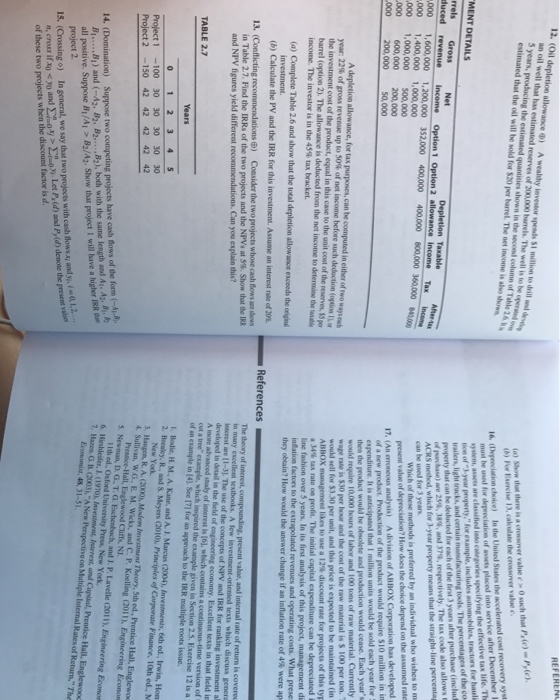

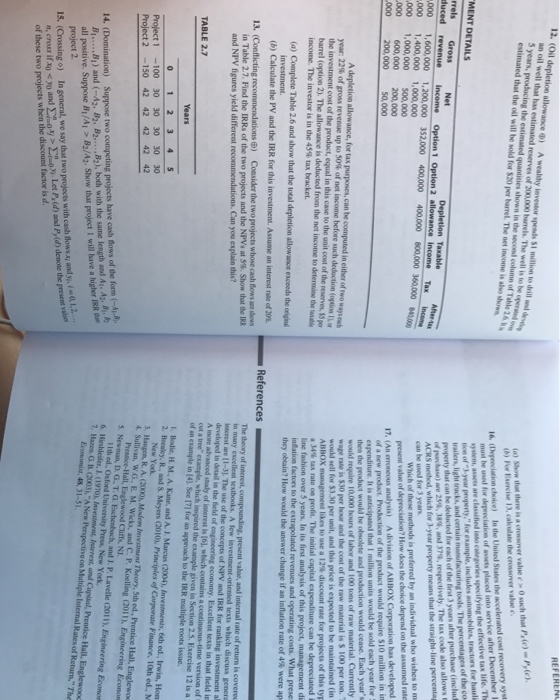

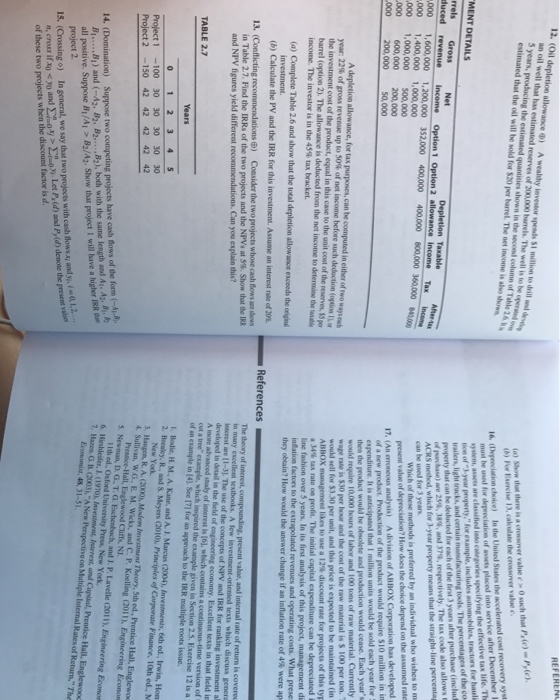

REFEREN 12. (Oil depletion allowance o) A wealthy investor speds S1 million to drill nd eve an oil well that has estimated reserves of 200,000 harrels. The well is to be operd 5 years, producing the estimated quantities shown in the second column of Table2 estimated that the oil will be sold for $20 per barrel. The net income is also shown (a) Show thae there is a crossover value c O such that Ps(e)Pyte b) For Exercise 13, calculate the crossover value e 16. (Depeeciation choice) In the United States the accelerated cost recovery syst f ts pla ed into service after December 1 " must be ued for e trailers, light trucks, and certain monufacturing tools. The percentages of the co property that can be MENT DETAILS deducted for each of the irst 3 years after p Net ACRS medhod, which for 3-year property means that the straight-line percenta can be used for 3 years Depletion Taxable ,000 1,400,000 1,000,000 000 1,000,000 500,000 000 600,000 200,000 000 200,000 50,000 _ _ which of these methods is preferred by an individual who wishes to m present valus of deprociation? How does the choice depend on the assumed rate 17. (An erroncous analysis) A division of ABBOx c of a new prodact Production of the product would require S10 million in in expenditure. It is anticipated that I million units would be sold each year for : then the product would be obsolete and production would cease. Each year's would require 10,000 hours of labor and 100 tons of raw material. Currently wage rate is $30 per hour and the cost of the raw material is $ 100 per ton. would sell for 53.30 per unit, and this price is 22% of gross reveme up to 50% of net income before such deduction (option ILor barrel (option 2). The income. The investor is in the 45% tax bracket. is deducted from the net income to determine the t line fashion over 5 years, In its first analysis of this project, management di inflation factoes to the extrapolated revenues and operating costs. What prese they obtain? How would the answer change if an inflation rate of 4% were ap (b) Calculate the PV and the IRR for this investment. Assume an interest rate of 20 %. References 13. (Conflicting recommendations ) Consider the two projects whose cash flows aue sw value, and internal rate of return is covere in Table 2.7. Find the IRRs of the two projects and the NPVs at 5%. Show that the IRR and NPV figures yield different recommendations, Can you explain this? istcrest are 11-3]. The use of the concepts of NPV and IRR for ranking of an example in [41. See 17] for an approach to the IRR multiple roots issue. 1. Bolie. H M..Kane, and J. Marcus (2004), Investments, 6th ed.. Irwin, Hon 2. Beakey, R, und S Meyers (0010, Principles of Corponate Finance, 10th ed, M New York Project 1-100 30 30 30 30 30 Project 2-150 42 42 42 42 42 3 Haugen, R. A.(2000), Modem Ievestoment Sullivan, W.G. E. M. Wicks, and C. P. Koelling (2011). Engineering Econon h, and J. P. Lavelle (2011), Engineering Econor 7, Hazen G.B.(2003),"A New Perspective on Multiple Internal Rates of Return." The 5. Newman, D. G T. G all positive. Suppose BIA.> B2/A2. Show that project I will have a higher lRR project 2 Econoosist, 48. 31-51 n,cross ifx0 _oyi-Let Plo) and Py(d) denote the present of these two projects when the discount factor is d 15. (Crossing.) In general, we say that two projects with cash flows andy.0.1.2. REFEREN 12. (Oil depletion allowance o) A wealthy investor speds S1 million to drill nd eve an oil well that has estimated reserves of 200,000 harrels. The well is to be operd 5 years, producing the estimated quantities shown in the second column of Table2 estimated that the oil will be sold for $20 per barrel. The net income is also shown (a) Show thae there is a crossover value c O such that Ps(e)Pyte b) For Exercise 13, calculate the crossover value e 16. (Depeeciation choice) In the United States the accelerated cost recovery syst f ts pla ed into service after December 1 " must be ued for e trailers, light trucks, and certain monufacturing tools. The percentages of the co property that can be MENT DETAILS deducted for each of the irst 3 years after p Net ACRS medhod, which for 3-year property means that the straight-line percenta can be used for 3 years Depletion Taxable ,000 1,400,000 1,000,000 000 1,000,000 500,000 000 600,000 200,000 000 200,000 50,000 _ _ which of these methods is preferred by an individual who wishes to m present valus of deprociation? How does the choice depend on the assumed rate 17. (An erroncous analysis) A division of ABBOx c of a new prodact Production of the product would require S10 million in in expenditure. It is anticipated that I million units would be sold each year for : then the product would be obsolete and production would cease. Each year's would require 10,000 hours of labor and 100 tons of raw material. Currently wage rate is $30 per hour and the cost of the raw material is $ 100 per ton. would sell for 53.30 per unit, and this price is 22% of gross reveme up to 50% of net income before such deduction (option ILor barrel (option 2). The income. The investor is in the 45% tax bracket. is deducted from the net income to determine the t line fashion over 5 years, In its first analysis of this project, management di inflation factoes to the extrapolated revenues and operating costs. What prese they obtain? How would the answer change if an inflation rate of 4% were ap (b) Calculate the PV and the IRR for this investment. Assume an interest rate of 20 %. References 13. (Conflicting recommendations ) Consider the two projects whose cash flows aue sw value, and internal rate of return is covere in Table 2.7. Find the IRRs of the two projects and the NPVs at 5%. Show that the IRR and NPV figures yield different recommendations, Can you explain this? istcrest are 11-3]. The use of the concepts of NPV and IRR for ranking of an example in [41. See 17] for an approach to the IRR multiple roots issue. 1. Bolie. H M..Kane, and J. Marcus (2004), Investments, 6th ed.. Irwin, Hon 2. Beakey, R, und S Meyers (0010, Principles of Corponate Finance, 10th ed, M New York Project 1-100 30 30 30 30 30 Project 2-150 42 42 42 42 42 3 Haugen, R. A.(2000), Modem Ievestoment Sullivan, W.G. E. M. Wicks, and C. P. Koelling (2011). Engineering Econon h, and J. P. Lavelle (2011), Engineering Econor 7, Hazen G.B.(2003),"A New Perspective on Multiple Internal Rates of Return." The 5. Newman, D. G T. G all positive. Suppose BIA.> B2/A2. Show that project I will have a higher lRR project 2 Econoosist, 48. 31-51 n,cross ifx0 _oyi-Let Plo) and Py(d) denote the present of these two projects when the discount factor is d 15. (Crossing.) In general, we say that two projects with cash flows andy.0.1.2