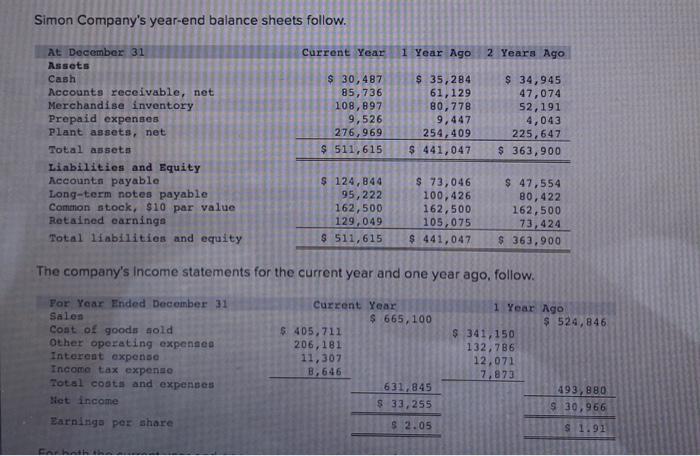

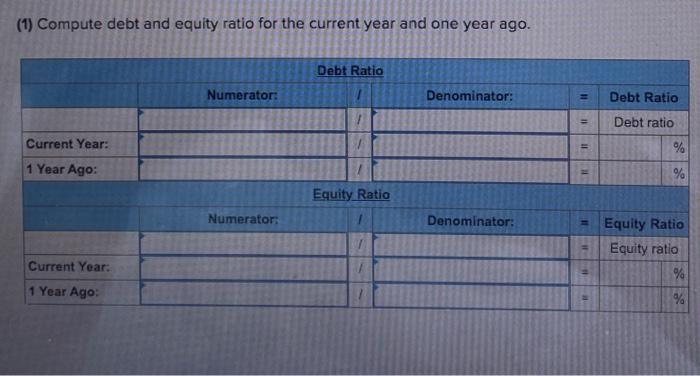

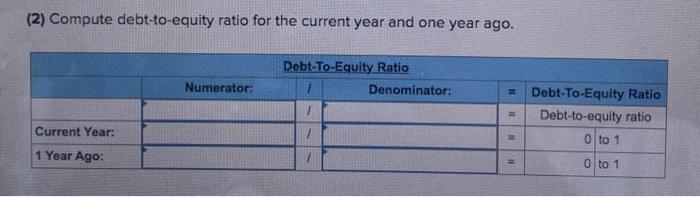

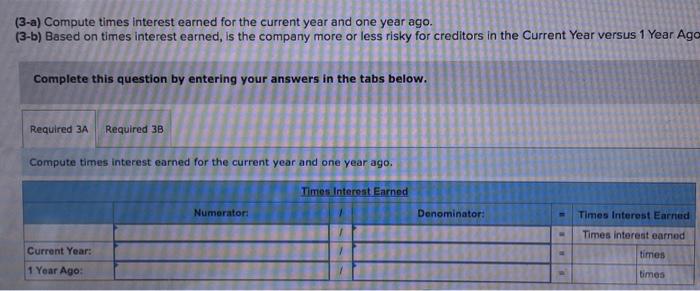

Simon Company's year-end balance sheets follow. Current Year 1 Year Ago 2 Years Ago At December 31 Assets Cash Accounts receivable, net Merchandise inventory Prepaid expenses Plant assets, net Total assets Liabilities and Equity Accounts payable Long-term notes payable Common stock, $10 par value Retained earnings Total liabilities and equity $ 30,487 85,736 108,897 9,526 276,969 $ 511,615 $ 35, 284 61,129 80, 778 9,447 254,409 $ 441,047 $ 34,945 47,074 52,191 4,043 225,647 363,900 $ 124,844 95, 222 162,500 129,049 $ 511,615 $ 73,046 100,426 162,500 105,075 $ 441,047 $ 47,554 80, 422 162,500 73,424 $363,900 The company's Income statements for the current year and one year ago, follow. For Year Ended December 31 Salen Coat of goods sold Other operating expenses Interont expense Income tax expenso Total costs and expenses Het income Earninga per share Current Year $ 665,100 $ 405,711 206,181 11,307 B.646 631,845 $ 33,255 1 Year Ago $ 524,846 $ 341,150 132,736 12,071 7.873 493,880 S 30,966 $ 2.05 s 1.91 (1) Compute debt and equity ratio for the current year and one year ago. Debt Ratio Numerator: Denominator: = Debt Ratio 11 Debt ratio Current Year: 11 % 1 Year Ago: % Equity Ratio Numerator: Denominator: Equity Ratio Equity ratio Current Year: % 1 Year Ago: % (2) Compute debt-to-equity ratio for the current year and one year ago. Numerator: Debt-To-Equity Ratio Denominator: 1 Debt-To-Equity Ratio Debt-to-equity ratio O to 1 Current Year: 1 Year Ago: 11 Oto 1 (3-a) Compute times interest earned for the current year and one year ago. (3-6) Based on times interest earned, is the company more or less risky for creditors in the Current Year versus 1 Year Ago Complete this question by entering your answers in the tabs below. Required 3A Required 3B Compute times interest earned for the current year and one year ago Times Interest Earned Numerator: Denominator: Times Interest Earned ## Times interest earned times Current Year: 1 Year Ago times (3-a) Compute times interest earned for the current year and one year ago. (3-b) Based on times interest earned, is the company more or less risky for creditors in the Current Year versus 1 Year Complete this question by entering your answers in the tabs below. Required 3A Required 38 Based on times interest earned, is the company more or less risky for creditors in the Current Year versus 1 Year Ago? Based on times interest earned, the company is for creditors in the current year versus one year ago