Answered step by step

Verified Expert Solution

Question

1 Approved Answer

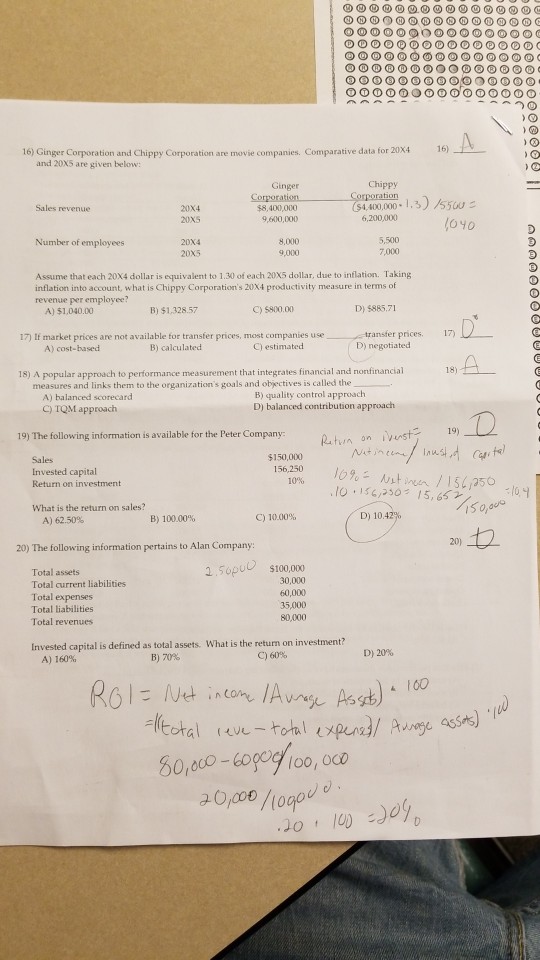

number 17 please. others would be nice. 16) Ginger Corporation and Chippy Corporation are movie companies. Comparative data for 20x4 16) and 20X5 are given

number 17 please. others would be nice.

16) Ginger Corporation and Chippy Corporation are movie companies. Comparative data for 20x4 16) and 20X5 are given below: Ginger Chippy $4,400,000- 1,3) /5500 Sales revenue 20x4 20XS $8,400,000 9,600,000 6,200,000 Number of employees 8,000 9,000 20X4 7,000 Assume that each 20X4 dollar is equivalent to 1.30 of each 20X5 dollar, due to inflation. Taking inflation into account, what is Chippy Corporation's 20x4 productivity measure in terms of revenue per employee? A) $1,040.00 B) $1,328.57 C) 5800.00 D) $885,71 17) If market prices are not available for transfer prices, most companies use B) calculatecd transfer prices. 17) D) negotiated A) cost-based C) estimated 18) A popular approach to performance measurement that integrates financial and nonfinancial measures and links them to the organization's goals and objectives is called the )balanced scorecard C) TQM approach B) quality control approach D) balanced contribution approach 19) The following information is available for the Peter Company- Sales $150,000 Invested capital Return on investment 10% No. 156,2502 15,6 What is the return on sales? A) 62.50% B) 100.00% C) 10.00% D) 10 20) 20) The following information pertains to Alan Company 15p s100,000 Total assets Total current liabilities Total expenses Total liabilities Total revenues 30,000 60,000 35,000 80,000 What is the returm on investment? C)60% Invested capital is defined as total assets. D)20% A) 160% B)70% 160Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started