Number 3 is the question that I am having a hard time understanding.

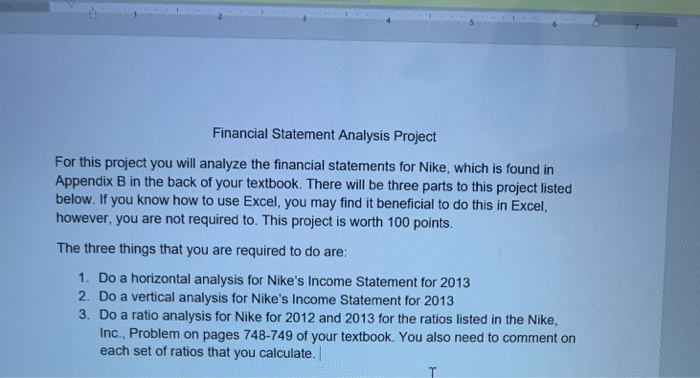

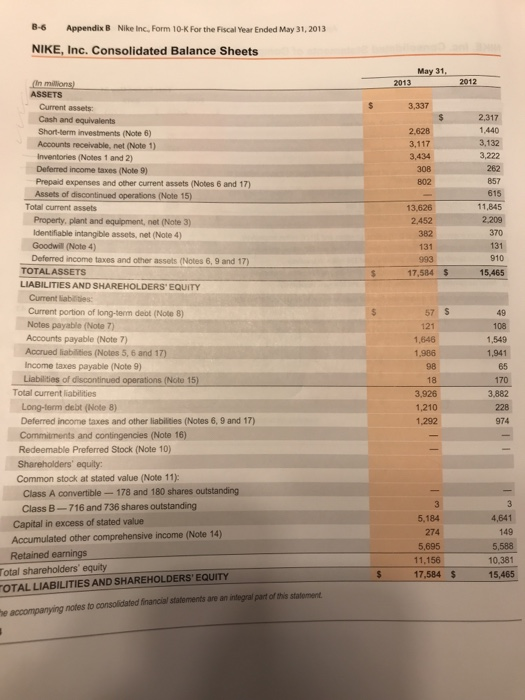

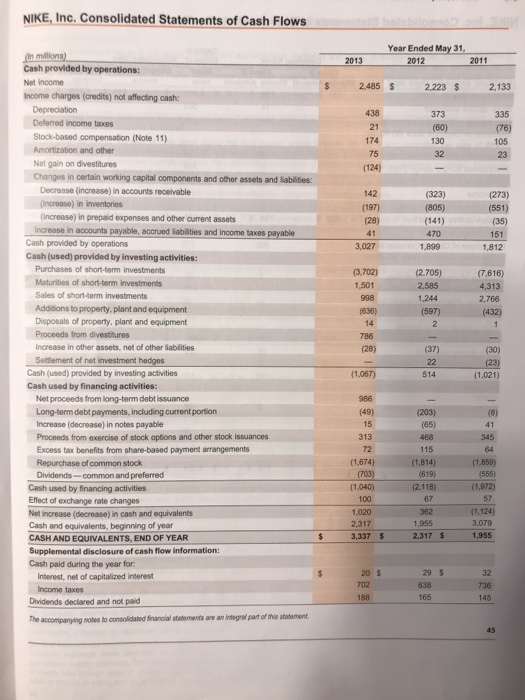

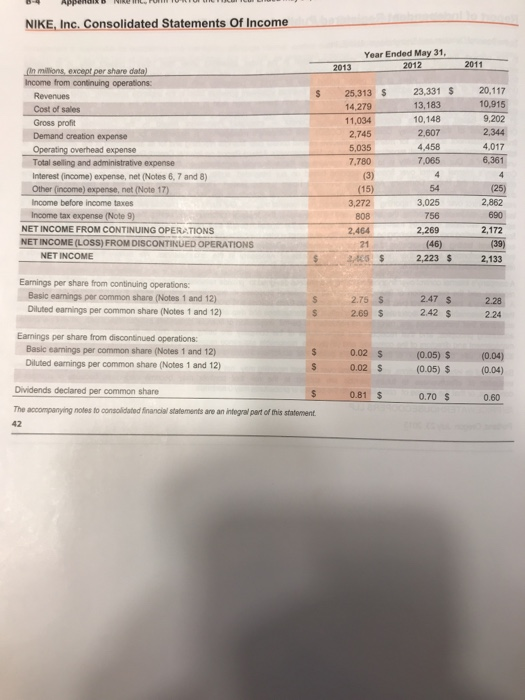

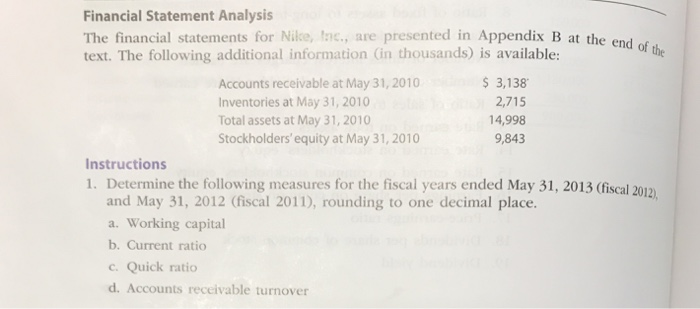

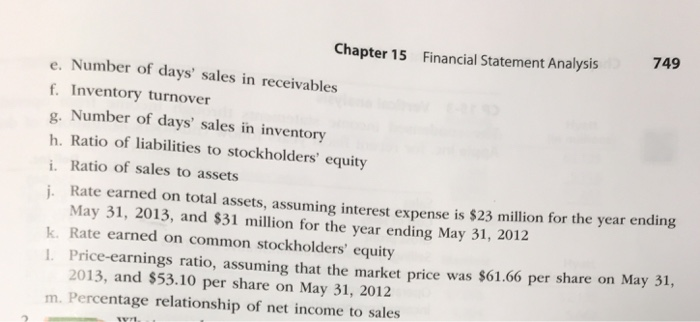

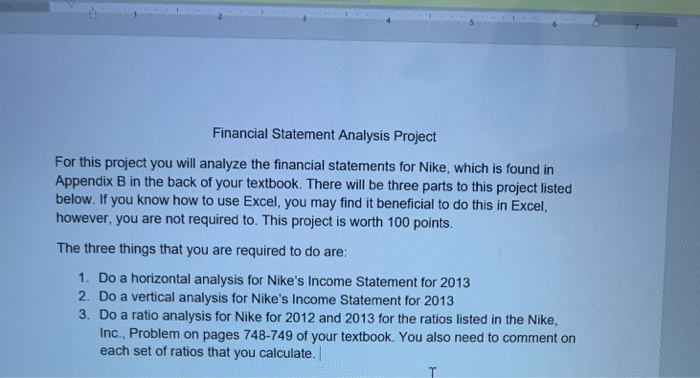

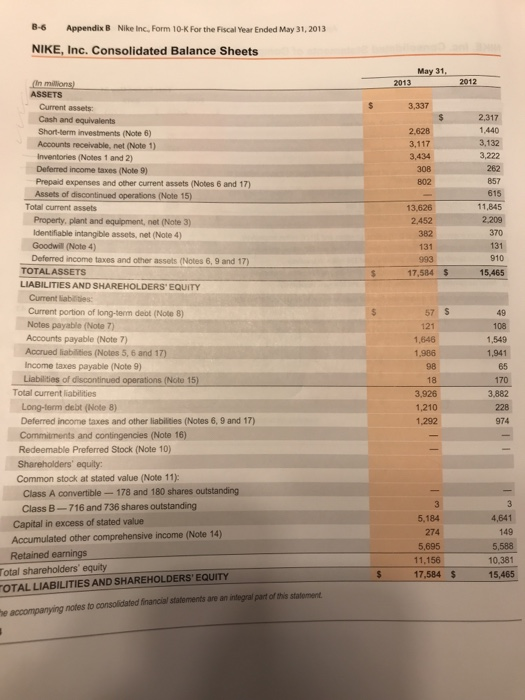

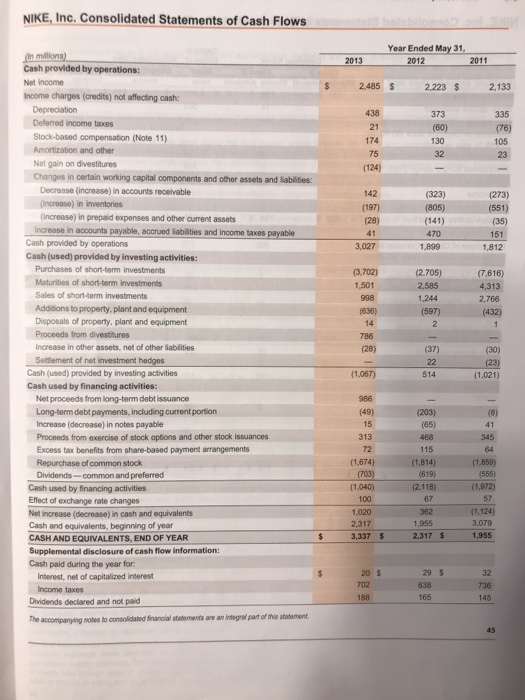

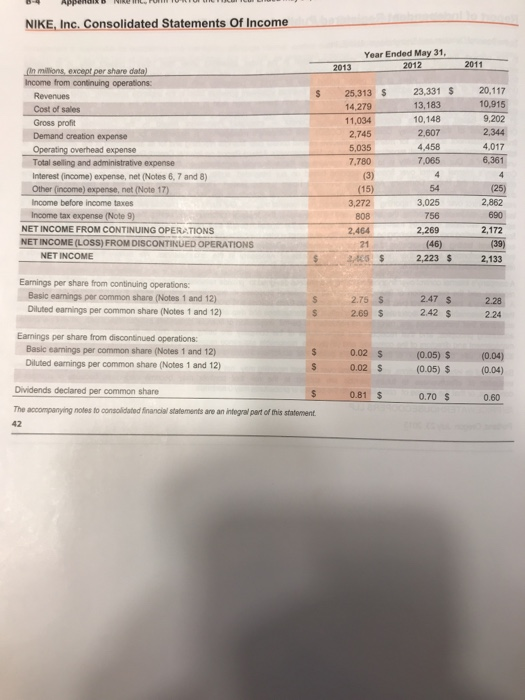

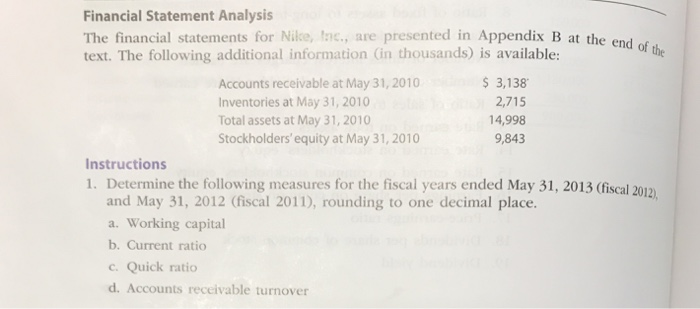

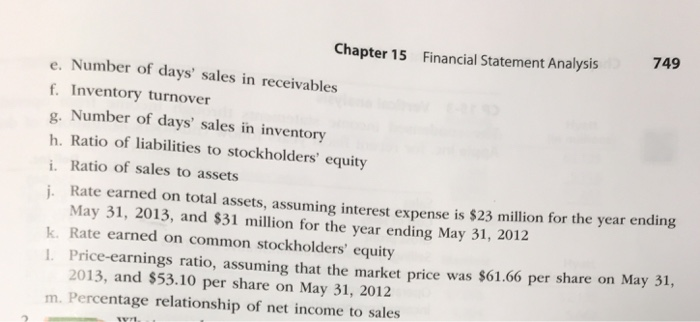

Financial Statement Analysis Project For this project you will analyze the financial statements for Nike, which is found in Appendix B in the back of your textbook. There will be three parts to this project listed below. If you know how to use Excel, you may find it beneficial to do this in Excel, however, you are not required to. This project is worth 100 points. The three things that you are required to do are: 1. Do a horizontal analysis for Nike's Income Statement for 2013 2. Do a vertical analysis for Nike's Income Statement for 2013 3. Do a ratio analysis for Nike for 2012 and 2013 for the ratios listed in the Nike, Inc., Problem on pages 748-749 of your textbook. You also need to comment on each set of ratios that you calculate. B-6 Appendix B Nike Inc, Form 10-K For the Fiscal Year Ended May 31, 2013 NIKE, Inc. Consolidated Balance Sheets May 31 2013 2012 ASSETS Current assets 2,317 1,440 3,132 Cash and equivalents Short-term investments (Note 6) 3,117 3,434 308 802 Accounts receivable, net (Note 1) inventories (Notes 1 and 2) Deferred income taxes (Note 9) Prepaid expenses and other current assets (Notes 6 and 17) Assets of discontinued operations (Note 15) Total current assets 857 615 11,845 13,626 Property, plant and equipment, net (Note 3) Identifiable intangible assets, net (Note 4) Goodwill (Note 4) Deferred income taxes and other assets (Notes 6,9 and 17) 382 131 131 910 15,465 TOTALASSETS 17,584 S LIABILITIES AND SHAREHOLDERS' EQUITY Current liablities: Current portion of long-term deot (Note 8) Notes payable (Note 7) Accounts payable (Note 7) Accrued liabilities (Notes 5, 6 and 17) 57 S 49 121 1,646 1,986 98 1,549 ,941 65 170 3,882 Income taxes payable (Note 9) (Note 15) Total current liabilities 3,926 1,210 1,292 Long-term debt (Note 8) Deferred income taxes and other liabilities (Notes 6, 9 and 17) Commitments and contingencies (Note 16) Redeemable Preferred Stock (Note 10) 974 Common stock at stated value (Note 11) Class A convertible- 178 and 180 shares outstanding Class B-716 and 736 shares outstanding Capital in excess of stated value Accumulated other comprehensive income (Note 14) Retained earnings 5,184 274 5,695 11,156 4,641 149 5,588 10,381 15,465 otal shareholders' equity OTAL LIABILITIES AND SHAREHOLDERS' EQUITY 17,584 S notes to consolidated financial statements are an integral part of this statoment NIKE, Inc. Consolidated Statements Of Income Year Ended May 31 2013 2012 2011 Income from continuing operations $ 25,313 S 23,331 $20,117 Cost of sales Gross profit Demand creation expense 14,279 11,034 2,745 5,035 7,780 13,183 10,148 2,607 4,458 7,065 0.915 9,202 2,344 4,017 6,361 Total selling and administrative expense Interest (income) expense, net (Notes 6, 7 and 8) Other (income) expense, net (Note 17) Income before income taxes Income tax expense (Note 9) (15) 54 3,025 2,862 690 2,172 (39) 2,133 808 2.464 21 756 2,269 NET INCOME FROM CONTINUING OPERATIONS NET INCOME (LOSS) FROM DISCONTINUED OPERATIONS NET INCOME 2,223 $ Earnings per share from continuing operations Basic earnings por common share (Notes 1 and 12) Oiluted earnings per common share (Notes 1 and 12) 2.75 2.69$ 242 $ 2.24 Eamings per share from discontinued operations Basic earnings per common share (Notes 1 and 12) s0.02 0.02 $ (0.05) (0.04) (0.05) $ Diluted earnings per common share (Notes 1 and 12) Diwidends deciared per common share The accompanying notes to consolidated financial statements are an integral part of this statement (0.04) 0.81 $ 0.70 $ 0.60 42 Financial Statement Analysis The financial statements for Nike, ac, are presented in Appendix B at the end of text. The following additional information in thousands) is available: Accounts receivable at May 31, 2010 Inventories at May 31, 2010 Total assets at May 31, 2010 Stockholders' equity at May 31, 2010 3,138 2.715 14,998 9,843 Instructions 1. Determine the following measures for the fiscal years ended May 31, 2013 (fiscal 2012 and May 31, 2012 (fiscal 2011), rounding to one decimal place. a. Working capital b. Current ratio c. Quick ratio d. Accounts receivable turnover Chapter 15 Financial Statement Analysis749 e. Number of days' sales in receivables f. Inventory turnover Number of days' sales in inventory g. h. Ratio of liabilities to stockholders' equity i. Ratio of sales to assets j. Rate earned on total assets, assuming interest expense is $23 million for the year ending May 31, 2013, and $31 million for the year ending May 31, 2012 k. Rate earned on common stockholders' equity I. Price-earnings ratio, assuming that the market price was $61.66 per share on May 31, 2013, and $53.10 per share on May 31, 2012 m. Percentage relationship of net income to sales Financial Statement Analysis Project For this project you will analyze the financial statements for Nike, which is found in Appendix B in the back of your textbook. There will be three parts to this project listed below. If you know how to use Excel, you may find it beneficial to do this in Excel, however, you are not required to. This project is worth 100 points. The three things that you are required to do are: 1. Do a horizontal analysis for Nike's Income Statement for 2013 2. Do a vertical analysis for Nike's Income Statement for 2013 3. Do a ratio analysis for Nike for 2012 and 2013 for the ratios listed in the Nike, Inc., Problem on pages 748-749 of your textbook. You also need to comment on each set of ratios that you calculate. B-6 Appendix B Nike Inc, Form 10-K For the Fiscal Year Ended May 31, 2013 NIKE, Inc. Consolidated Balance Sheets May 31 2013 2012 ASSETS Current assets 2,317 1,440 3,132 Cash and equivalents Short-term investments (Note 6) 3,117 3,434 308 802 Accounts receivable, net (Note 1) inventories (Notes 1 and 2) Deferred income taxes (Note 9) Prepaid expenses and other current assets (Notes 6 and 17) Assets of discontinued operations (Note 15) Total current assets 857 615 11,845 13,626 Property, plant and equipment, net (Note 3) Identifiable intangible assets, net (Note 4) Goodwill (Note 4) Deferred income taxes and other assets (Notes 6,9 and 17) 382 131 131 910 15,465 TOTALASSETS 17,584 S LIABILITIES AND SHAREHOLDERS' EQUITY Current liablities: Current portion of long-term deot (Note 8) Notes payable (Note 7) Accounts payable (Note 7) Accrued liabilities (Notes 5, 6 and 17) 57 S 49 121 1,646 1,986 98 1,549 ,941 65 170 3,882 Income taxes payable (Note 9) (Note 15) Total current liabilities 3,926 1,210 1,292 Long-term debt (Note 8) Deferred income taxes and other liabilities (Notes 6, 9 and 17) Commitments and contingencies (Note 16) Redeemable Preferred Stock (Note 10) 974 Common stock at stated value (Note 11) Class A convertible- 178 and 180 shares outstanding Class B-716 and 736 shares outstanding Capital in excess of stated value Accumulated other comprehensive income (Note 14) Retained earnings 5,184 274 5,695 11,156 4,641 149 5,588 10,381 15,465 otal shareholders' equity OTAL LIABILITIES AND SHAREHOLDERS' EQUITY 17,584 S notes to consolidated financial statements are an integral part of this statoment NIKE, Inc. Consolidated Statements Of Income Year Ended May 31 2013 2012 2011 Income from continuing operations $ 25,313 S 23,331 $20,117 Cost of sales Gross profit Demand creation expense 14,279 11,034 2,745 5,035 7,780 13,183 10,148 2,607 4,458 7,065 0.915 9,202 2,344 4,017 6,361 Total selling and administrative expense Interest (income) expense, net (Notes 6, 7 and 8) Other (income) expense, net (Note 17) Income before income taxes Income tax expense (Note 9) (15) 54 3,025 2,862 690 2,172 (39) 2,133 808 2.464 21 756 2,269 NET INCOME FROM CONTINUING OPERATIONS NET INCOME (LOSS) FROM DISCONTINUED OPERATIONS NET INCOME 2,223 $ Earnings per share from continuing operations Basic earnings por common share (Notes 1 and 12) Oiluted earnings per common share (Notes 1 and 12) 2.75 2.69$ 242 $ 2.24 Eamings per share from discontinued operations Basic earnings per common share (Notes 1 and 12) s0.02 0.02 $ (0.05) (0.04) (0.05) $ Diluted earnings per common share (Notes 1 and 12) Diwidends deciared per common share The accompanying notes to consolidated financial statements are an integral part of this statement (0.04) 0.81 $ 0.70 $ 0.60 42 Financial Statement Analysis The financial statements for Nike, ac, are presented in Appendix B at the end of text. The following additional information in thousands) is available: Accounts receivable at May 31, 2010 Inventories at May 31, 2010 Total assets at May 31, 2010 Stockholders' equity at May 31, 2010 3,138 2.715 14,998 9,843 Instructions 1. Determine the following measures for the fiscal years ended May 31, 2013 (fiscal 2012 and May 31, 2012 (fiscal 2011), rounding to one decimal place. a. Working capital b. Current ratio c. Quick ratio d. Accounts receivable turnover Chapter 15 Financial Statement Analysis749 e. Number of days' sales in receivables f. Inventory turnover Number of days' sales in inventory g. h. Ratio of liabilities to stockholders' equity i. Ratio of sales to assets j. Rate earned on total assets, assuming interest expense is $23 million for the year ending May 31, 2013, and $31 million for the year ending May 31, 2012 k. Rate earned on common stockholders' equity I. Price-earnings ratio, assuming that the market price was $61.66 per share on May 31, 2013, and $53.10 per share on May 31, 2012 m. Percentage relationship of net income to sales