Answered step by step

Verified Expert Solution

Question

1 Approved Answer

number 7 b. Daughter Brenda, age 22, who is a full-time college student. Brenda lives in a dor- mitory during the school year, but her

number 7

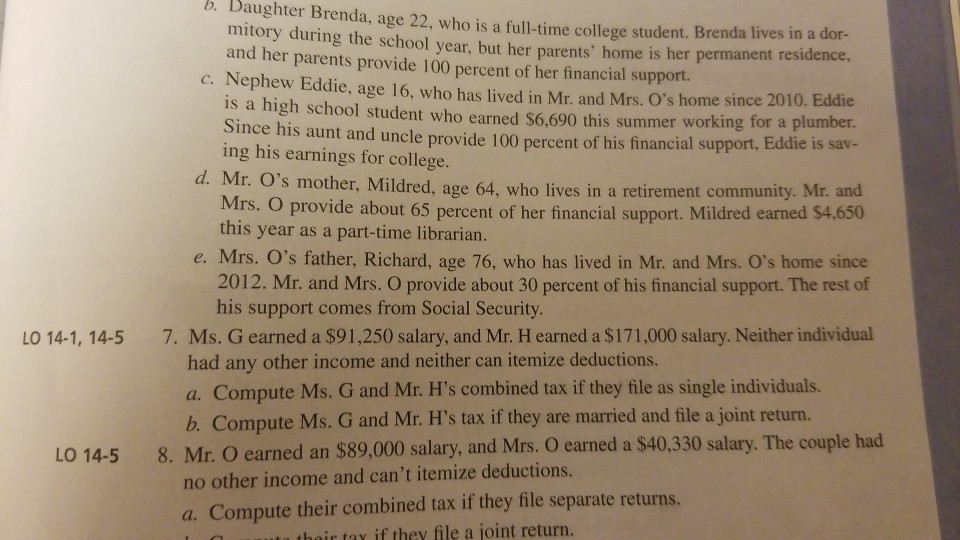

b. Daughter Brenda, age 22, who is a full-time college student. Brenda lives in a dor- mitory during the school year, but her parents' home is her permanent residence. and her parents provide 100 percent of her financial support. c. Nephew Eddie, age 16, who has lived in Mr. and Mrs. O's home since 2010. Eddie is a high school student who earned $6.690 this summer working for a plumber. Since his aunt and uncle provide 100 percent of his financial support, Eddie is sav- ing his earnings for college. Mr. O's mother, Mildred, age 64, who lives in a retirement community. Mr. and Mrs. O this year as a part-time librarian. provide about 65 percent of her financial support. Mildred earned $4,650 e. Mrs. O's father, Richard, age 76, who has lived in Mr. and Mrs. O's home since 2012. Mr. and Mrs. O provide about 30 percent of his financial support. The rest of his support comes from Social Security LO 14-1, 14-5 7. Ms. G earned a $91,250 salary, and Mr. H earned a $171,000 salary. Neither individual had any other income and neither can itemize deductions. a. Compute Ms. G and Mr. H's combined tax if they file as single individuals. b. Compute Ms. G and Mr. H's tax if they are married and file a joint return. LO 14-5 8, Mr. O earned an $89,000 salary, and Mrs. O earned a $40,330 salary. The couple had no other income and can't itemize deductions. a. Compute their combined tax if they file separate returns. heir tay if they file a joint returnStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started