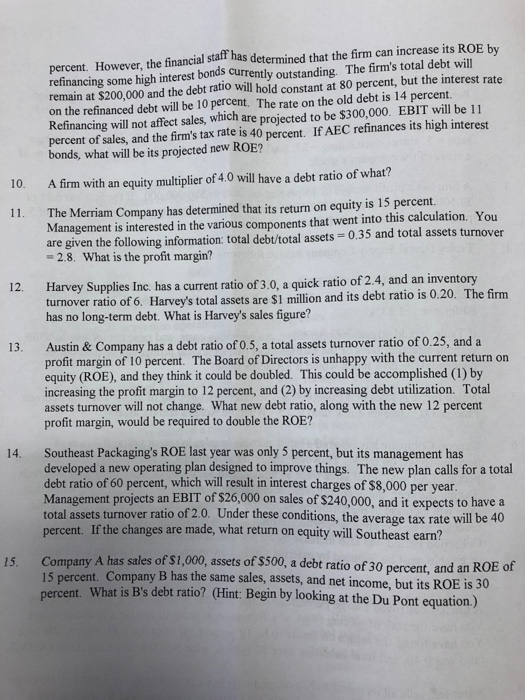

Number 9 spills onto the second page

Thank you for this assistance

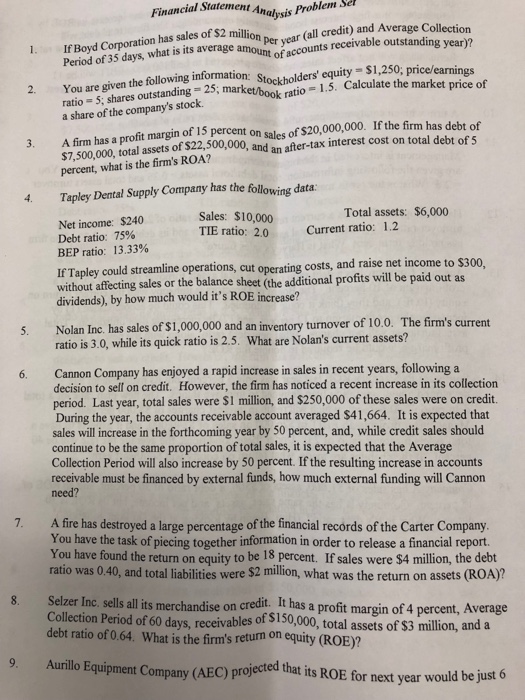

cial Statement Analysis Se Problem all credit) and Average Collection If Boyd Corporation has sales of $2 million Period of 35 days, what is is average amount of accounts receivable outstanding year)? Per year ofaccou en the following information: Stockholders' equity $1,250; price/earnings 2. You are given information 3. A firm has a profit margin of 15 percent on sales of $20,000,000. If the firm has debt of 4. Tapley Dental Supply Company has the following data market/book ra Stock mio 1.5. Calculate the market price of ratio 5; shares outstanding 25 a share of the company's stock S7500,000, total assets of $22,500,000, and an after-tax interest cost on total debt of S percent, what is the firm's ROA? Total assets: $6,000 Net income: $240 Debt ratio: 75% BEP ratio: 13.33% Sales: $10,000 TIE ratio: 2.0 Current ratio: 1.2 d raise net income to $300 If Tapley could streamline operations, cut operating costs, an without affecting sales or the balance sheet (the additional profits will be paid out as dividends), by how much would it's ROE increase? Nolan Inc. has sales of $1,000,000 and an inventory turnover of 10.0. The firm's current ratio is 3.0, while its quick ratio is 2.5. What are Nolan's current assets? 5. Cannon Company has enjoyed a rapid increase in sales in recent years, following a decision to sell on credit. However, the firm has noticed a recent increase in its collection period. Last year, total sales were $1 million, and $250,000 of these sales were on credit. During the year, the accounts receivable account averaged $41,664. It is expected that sales will increase in the forthcoming year by 50 percent, and, while credit sales should continue to be the same proportion of total sales, it is expected that the Average Collection Period will also increase by 50 percent. If the resulting increase in accounts receivable must be financed by external funds, how much external funding will Cannon need? 6. 7. A fire has destroyed a large percentage of the financial records of the Carter Company. You have the task of piecing together information in order to release a financial report. You have found the return on equity to be 18 percent. If sales were $4 million, the debt ratio was 0.40, and total liabilities were $2 million, what was the return on assets (ROA)? Selzer Inc. sells all its merchandise on credit. It has a profit Collection Period of 60 days, receivables of S150,000, total debt ratio of 0.64. What is the firm's return on equity (ROE)? 8. margin of 4 percent, Average assets of $3 million, and a 9. Aurillo Equipment Company (AEC) projected that ts ROE for next year would be just 6