Answered step by step

Verified Expert Solution

Question

1 Approved Answer

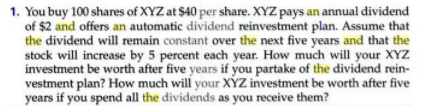

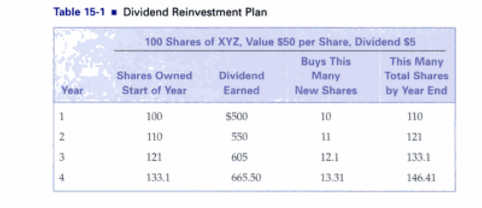

Number Cruncher #1 - p. 429 1. In preparing this case refer to Table 15-1 on p. 408 to help with your calculations. Use the

Number Cruncher #1 - p. 429

1. In preparing this case refer to Table 15-1 on p. 408 to help with your calculations. Use the column headings to prepare a table for your calculations.

2. When preparing your table, add a column for 5% Increase. (Between Dividend Earned and Buy This Many New Shares)

3. Now show how much the stock will be worth if you spend the dividends as you receive them and do not reinvest them. Show all calculations.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started