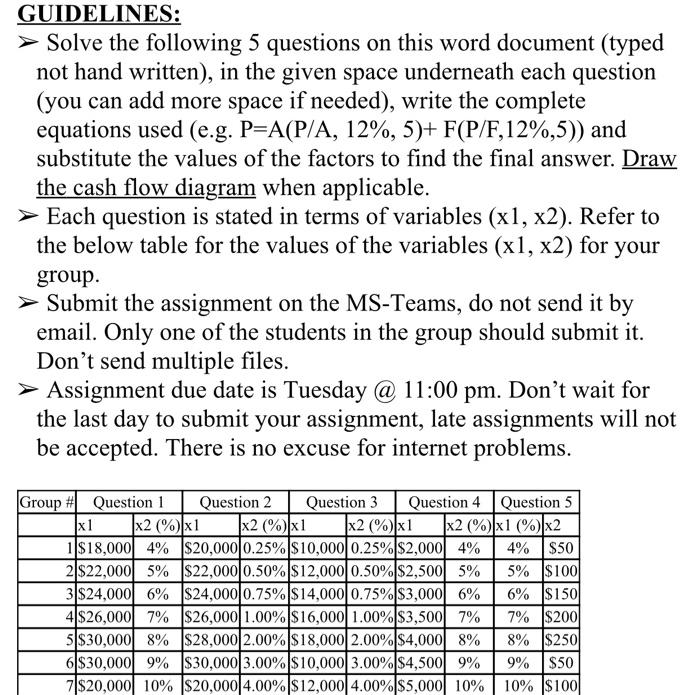

number of group 6

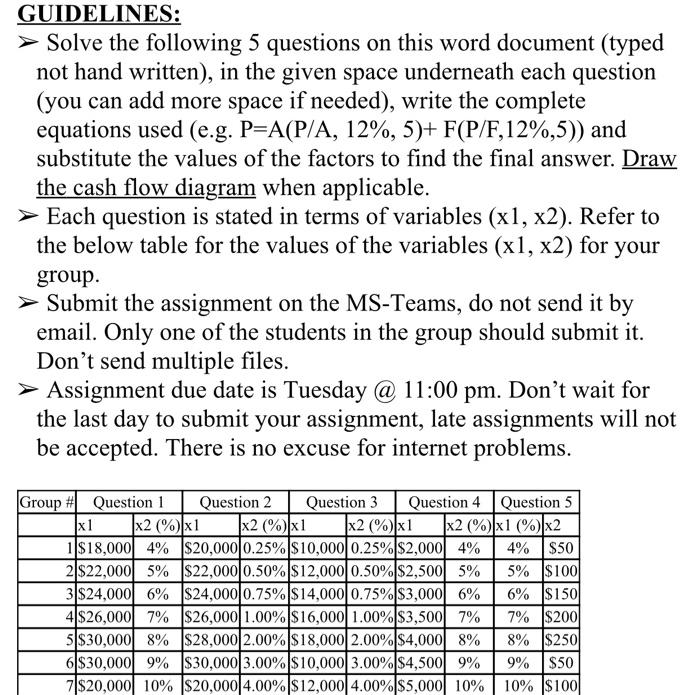

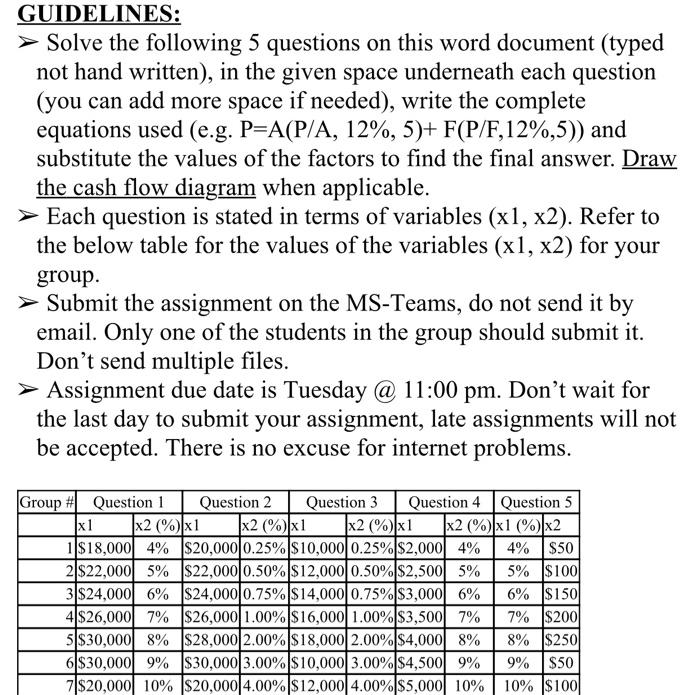

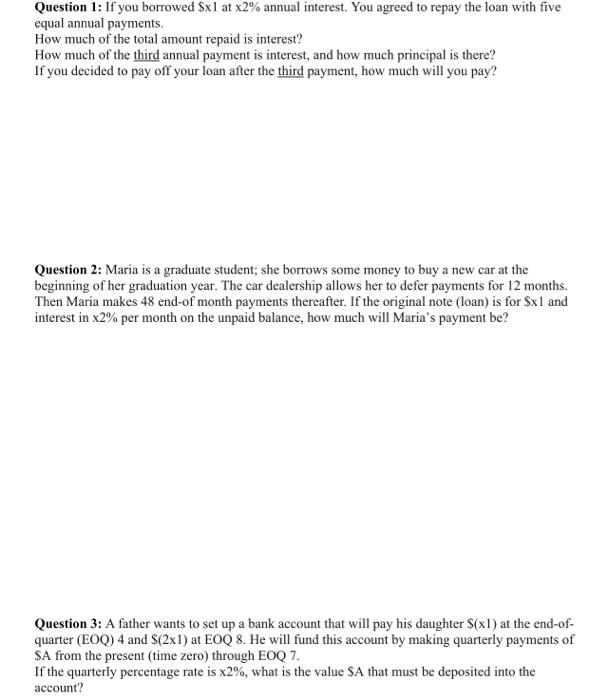

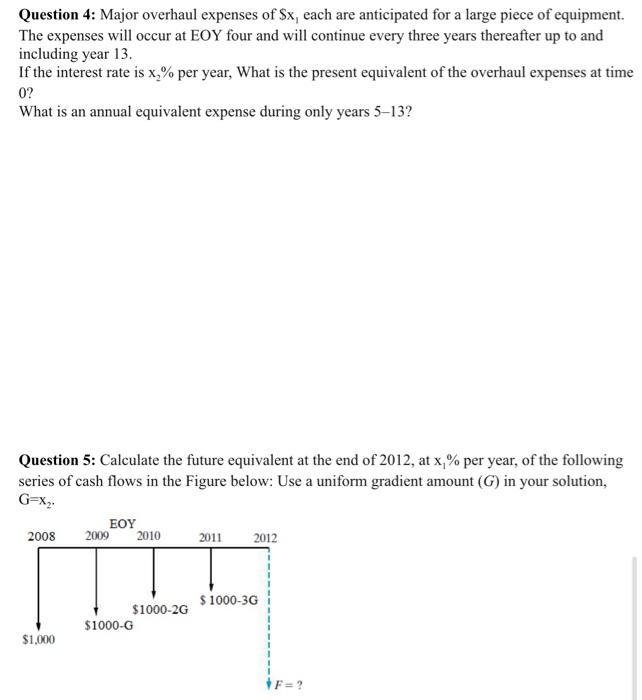

GUIDELINES: Solve the following 5 questions on this word document (typed not hand written), in the given space underneath each question (you can add more space if needed), write the complete equations used (e.g. P=A(P/A, 12%, 5)+ F(P/F,12%,5)) and substitute the values of the factors to find the final answer. Draw the cash flow diagram when applicable. > Each question is stated in terms of variables (x1, x2). Refer to the below table for the values of the variables (x1, x2) for your group. Submit the assignment on the MS-Teams, do not send it by email. Only one of the students in the group should submit it. Don't send multiple files. > Assignment due date is Tuesday @ 11:00 pm. Don't wait for the last day to submit your assignment, late assignments will not be accepted. There is no excuse for internet problems. Group # Question 1 Question 2 Question 3 Question 4 Question 5 x1 x2 (%) x1 x2 (%x1 x2 %)x1 x2 (%)x1 (%)x2 1 $18,000 4% $20,000 0.25% $10,000 0.25%$2,000 4% 4% $50 2 $22,000 5% $22,000 0.50% $12,000 0.50% $2,5005% 5% $100 3 $24,000 6% $24,000 0.75% $14,000 0.75%$3,000 6% 6% $150 4 $26,000 7% $26,000 1.00% $16,000 1.00% $3,500 7% 7% $200 5 $30,000 8% $28,000 2.00% $18,000 2.00%$4,000 8% 8% $250 6 $30,000 9% $30,000 3.00% $10,000 3.00 $4,500 9% 9% $50 7 $20,000 10% $20,000 4.00% $12,000 4.00% $5,000 10% 10% $100 Question 1: If you borrowed Sxl at x2% annual interest. You agreed to repay the loan with five equal annual payments. How much of the total amount repaid is interest? How much of the third annual payment is interest, and how much principal is there? If you decided to pay off your loan after the third payment, how much will you pay? Question 2: Maria is a graduate student; she borrows some money to buy a new car at the beginning of her graduation year. The car dealership allows her to defer payments for 12 months. Then Maria makes 48 end-of month payments thereafter. If the original note (loan) is for $xl and interest in x2% per month on the unpaid balance, how much will Maria's payment be? Question 3: A father wants to set up a bank account that will pay his daughter S(xl) at the end-of- quarter (EOQ) 4 and $(2x1) at EOQ 8. He will fund this account by making quarterly payments of SA from the present time zero) through EOQ 7. If the quarterly percentage rate is x2%, what is the value SA that must be deposited into the account? Question 4: Major overhaul expenses of $x, each are anticipated for a large piece of equipment. The expenses will occur at EOY four and will continue every three years thereafter up to and including year 13. If the interest rate is x,% per year, What is the present equivalent of the overhaul expenses at time 0? What is an annual equivalent expense during only years 5-13? Question 5: Calculate the future equivalent at the end of 2012, at x, % per year, of the following series of cash flows in the Figure below: Use a uniform gradient amount (G) in your solution, 2008 EOY 2009 2010 2011 2012 $ 1000-3G $1000-2G $1000-G $1,000 F=? GUIDELINES: Solve the following 5 questions on this word document (typed not hand written), in the given space underneath each question (you can add more space if needed), write the complete equations used (e.g. P=A(P/A, 12%, 5)+ F(P/F,12%,5)) and substitute the values of the factors to find the final answer. Draw the cash flow diagram when applicable. > Each question is stated in terms of variables (x1, x2). Refer to the below table for the values of the variables (x1, x2) for your group. Submit the assignment on the MS-Teams, do not send it by email. Only one of the students in the group should submit it. Don't send multiple files. > Assignment due date is Tuesday @ 11:00 pm. Don't wait for the last day to submit your assignment, late assignments will not be accepted. There is no excuse for internet problems. Group # Question 1 Question 2 Question 3 Question 4 Question 5 x1 x2 (%) x1 x2 (%x1 x2 %)x1 x2 (%)x1 (%)x2 1 $18,000 4% $20,000 0.25% $10,000 0.25%$2,000 4% 4% $50 2 $22,000 5% $22,000 0.50% $12,000 0.50% $2,5005% 5% $100 3 $24,000 6% $24,000 0.75% $14,000 0.75%$3,000 6% 6% $150 4 $26,000 7% $26,000 1.00% $16,000 1.00% $3,500 7% 7% $200 5 $30,000 8% $28,000 2.00% $18,000 2.00%$4,000 8% 8% $250 6 $30,000 9% $30,000 3.00% $10,000 3.00 $4,500 9% 9% $50 7 $20,000 10% $20,000 4.00% $12,000 4.00% $5,000 10% 10% $100 Question 1: If you borrowed Sxl at x2% annual interest. You agreed to repay the loan with five equal annual payments. How much of the total amount repaid is interest? How much of the third annual payment is interest, and how much principal is there? If you decided to pay off your loan after the third payment, how much will you pay? Question 2: Maria is a graduate student; she borrows some money to buy a new car at the beginning of her graduation year. The car dealership allows her to defer payments for 12 months. Then Maria makes 48 end-of month payments thereafter. If the original note (loan) is for $xl and interest in x2% per month on the unpaid balance, how much will Maria's payment be? Question 3: A father wants to set up a bank account that will pay his daughter S(xl) at the end-of- quarter (EOQ) 4 and $(2x1) at EOQ 8. He will fund this account by making quarterly payments of SA from the present time zero) through EOQ 7. If the quarterly percentage rate is x2%, what is the value SA that must be deposited into the account? Question 4: Major overhaul expenses of $x, each are anticipated for a large piece of equipment. The expenses will occur at EOY four and will continue every three years thereafter up to and including year 13. If the interest rate is x,% per year, What is the present equivalent of the overhaul expenses at time 0? What is an annual equivalent expense during only years 5-13? Question 5: Calculate the future equivalent at the end of 2012, at x, % per year, of the following series of cash flows in the Figure below: Use a uniform gradient amount (G) in your solution, 2008 EOY 2009 2010 2011 2012 $ 1000-3G $1000-2G $1000-G $1,000 F=