Numbers 3,4,5,6,7,8,9

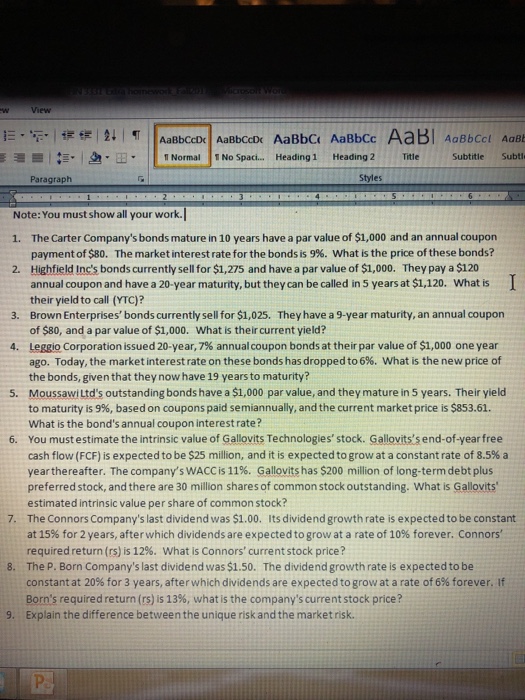

View : . | |||TNormalI1No Spaci Heading 1 Heading 2 Title Subtitle Subti Paragraph Styles Note: You must show all your work. 1. The Carter Company's bonds mature in 10 years have a par value of $1,000 and an annual couporn 2. Highfield Inc's bonds currently sell for $1,275 and have a par value of $1,000. They pay a $120 payment of $80. The market interest rate for the bonds is 9%. What is the price of these bonds? l annual coupon and have a 20-year maturity, but they can be called in 5 years at $1,120. their yield to call (YTC)? Brown Enterprises' bonds currently sell for $1,025. of $80, and a par value of $1,000. Leggio Corporation issued 20-year, 7% annual coupon bonds at their par value of $1,000 one year ago. Today, the market interest rate on these bonds has dropped to 6%, what is the new price of the bonds, given that they now have 19 years to maturity? MoussawiLtd's outstanding bonds have a $1,000 par value, and they mature in 5 years. Their yield to maturity is 9%, based on coupons paid semiannually, and the current market price is $853.61. What is the bond's annual coupon interest rate? You must estimate the intrinsic value of Gallovits Technologies' stock. Gallovits'send-of-year free cash flow (FCF) is expected to be$25 million, and it is expecte d to grow at a constant rate of 8.5% a yearthereafter. The com pany's WACC is 11%. Gallovitshas S200 million of long-term debt plus preferred stock, and there are 30 million shares of common stock outstanding. What is Gallovits estimated intrinsic value per share of common stock? The Connors Company's last dividend was $1.00. Its dividend growth rate is expected to be constant at 15% for 2 years, after which dividends are expected to grow at a rate of 10% forever. Connors' required return (rs) is 12%, what is Connors' current stock price? The P. Born Company's last dividend was $1.50. constant at 20% for 3 years, after which dividends are expected to grow at a rate of 6% forever. If Born's required return (rs) is 13%, what is the company's current stock price? What is 3. They have a 9-year maturity, an annual coupon What is their current yield? 4. 5. 6. 7. 8. The dividend growth rate is expected to be 9. Explain the difference between the unique risk and the marketrisk

Numbers 3,4,5,6,7,8,9

Numbers 3,4,5,6,7,8,9