Numbers are in thousands. Please help me with filling out the financials.

Numbers are in thousands. Please help me with filling out the financials.

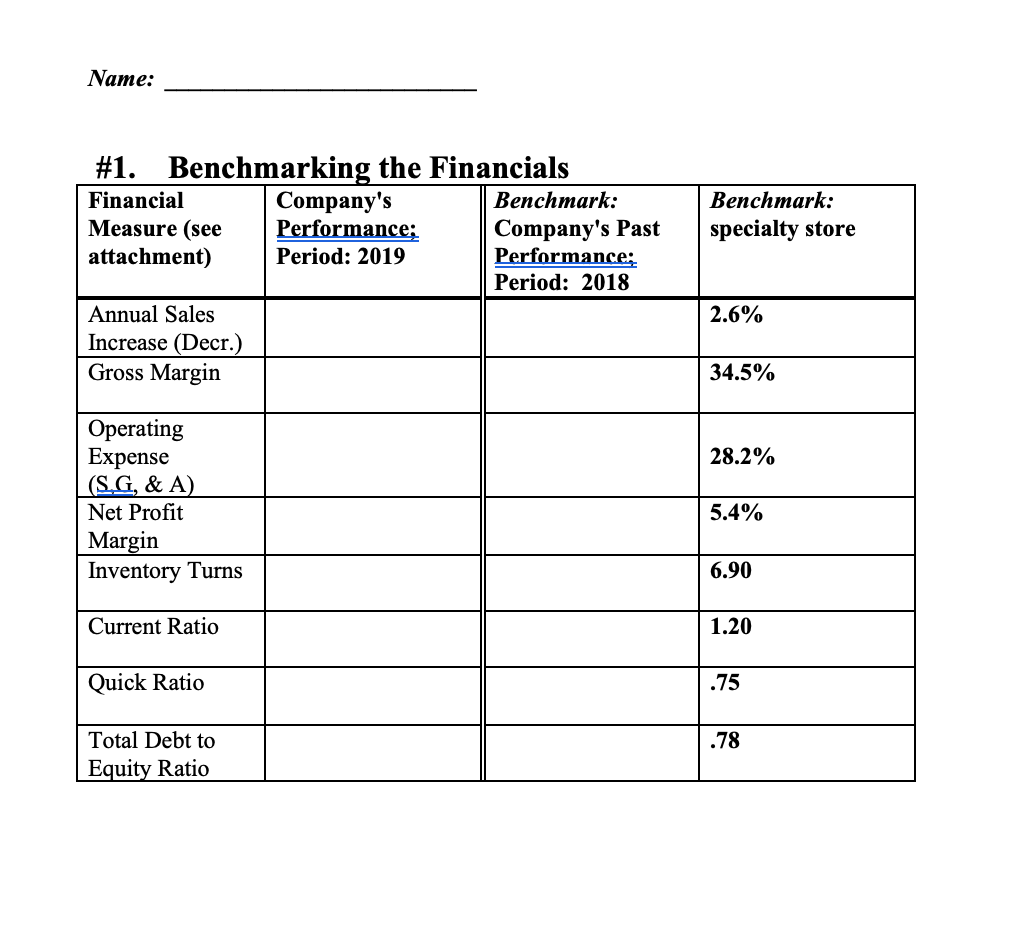

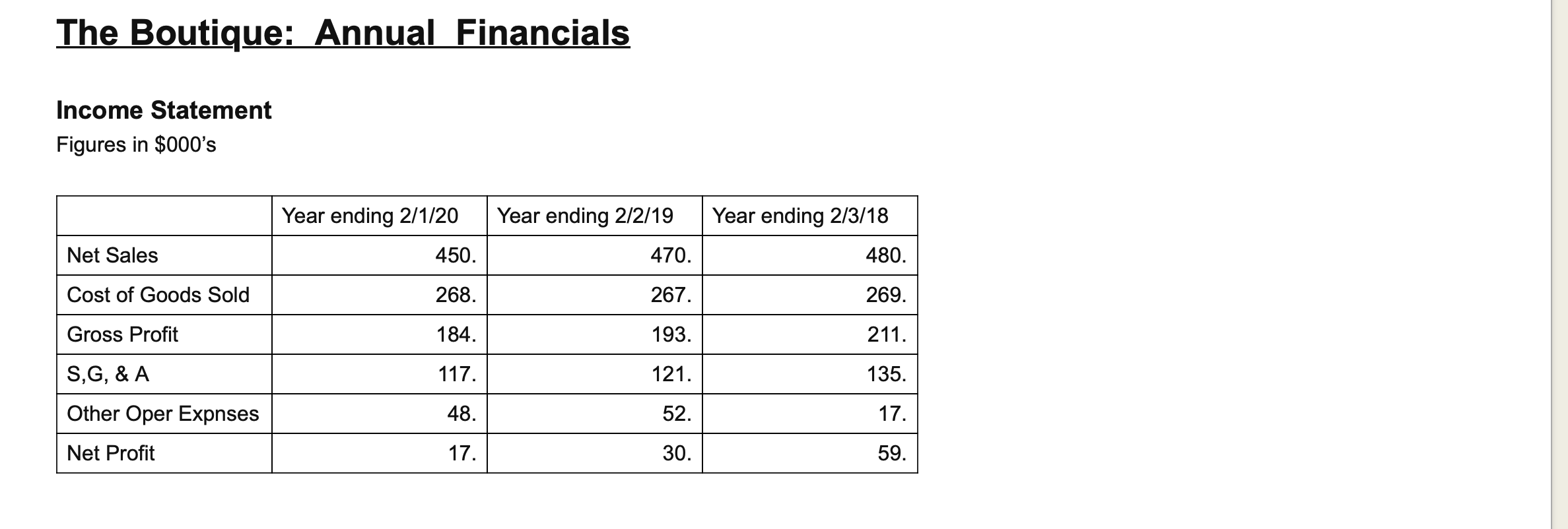

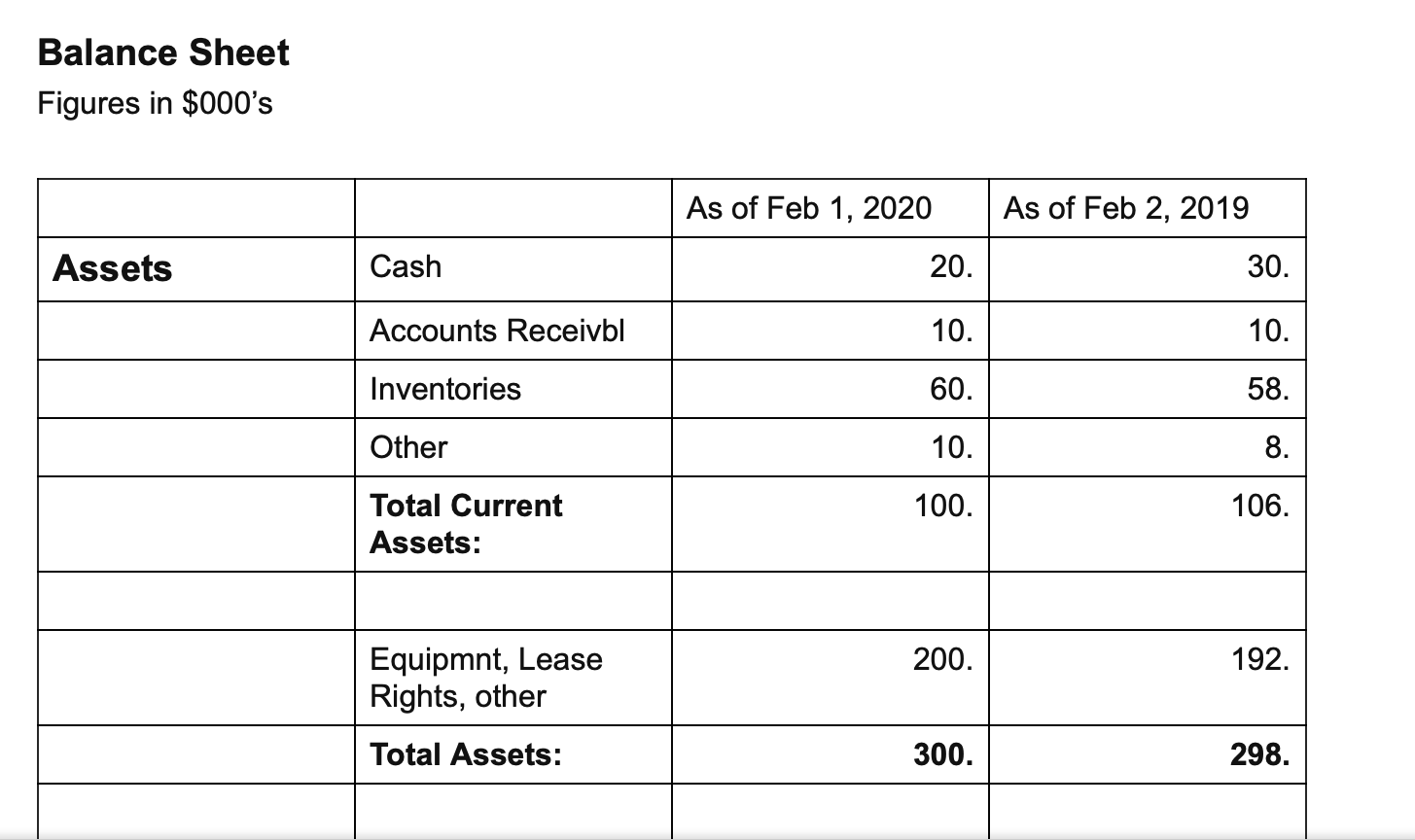

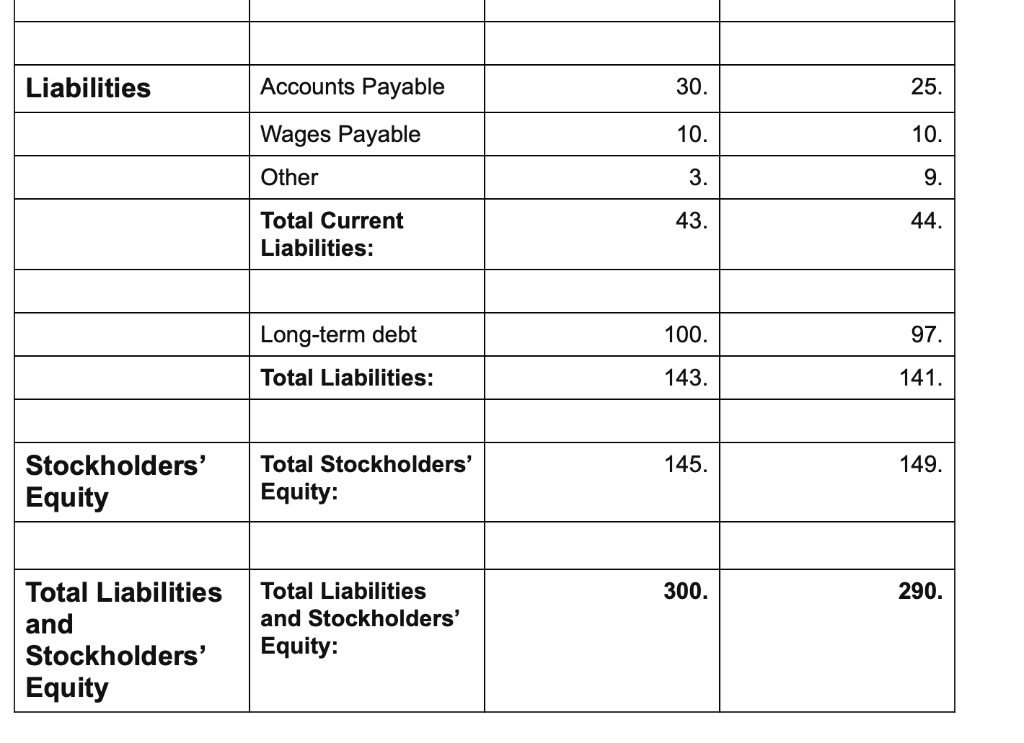

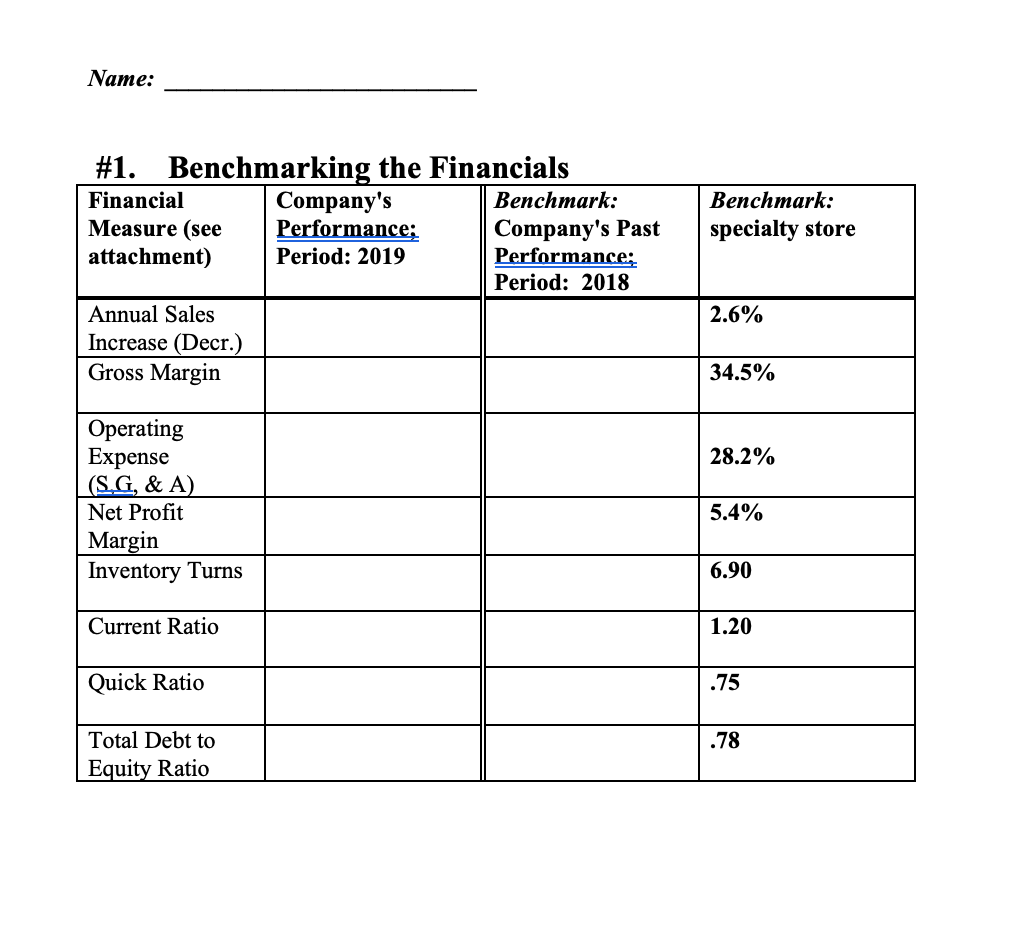

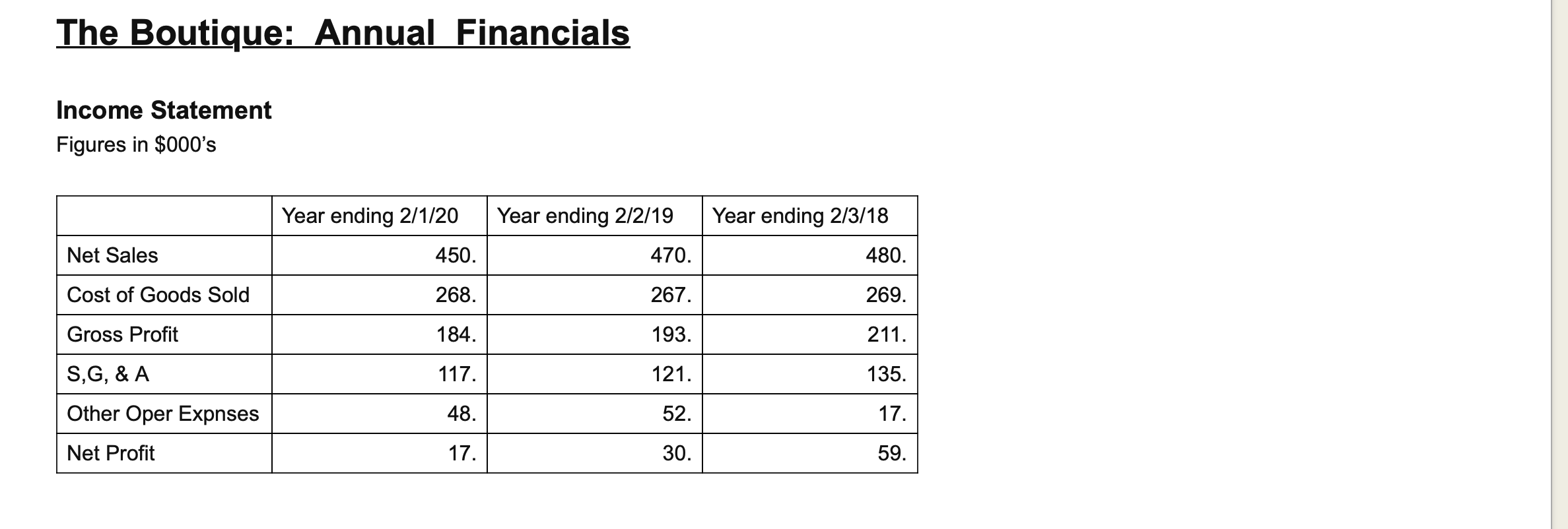

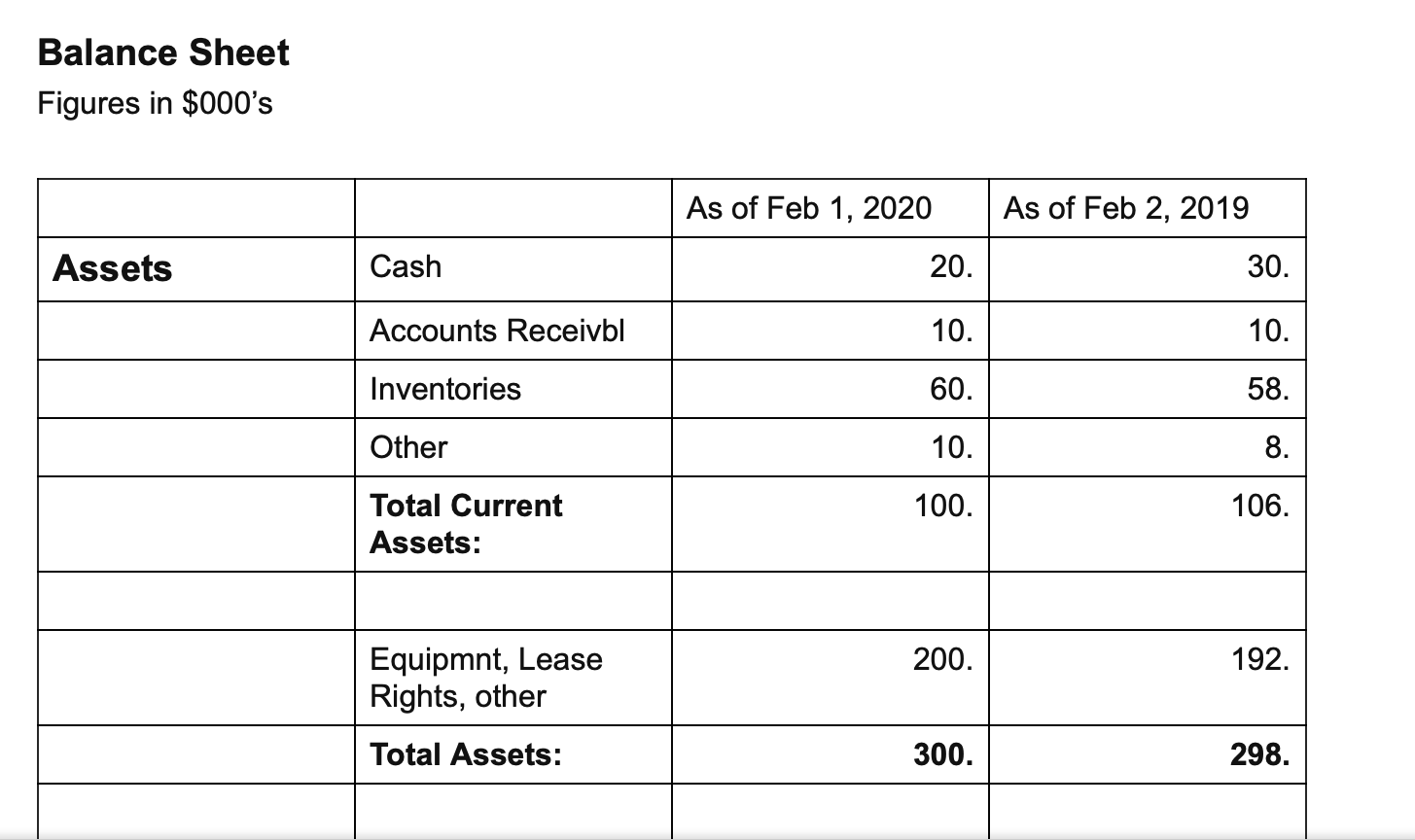

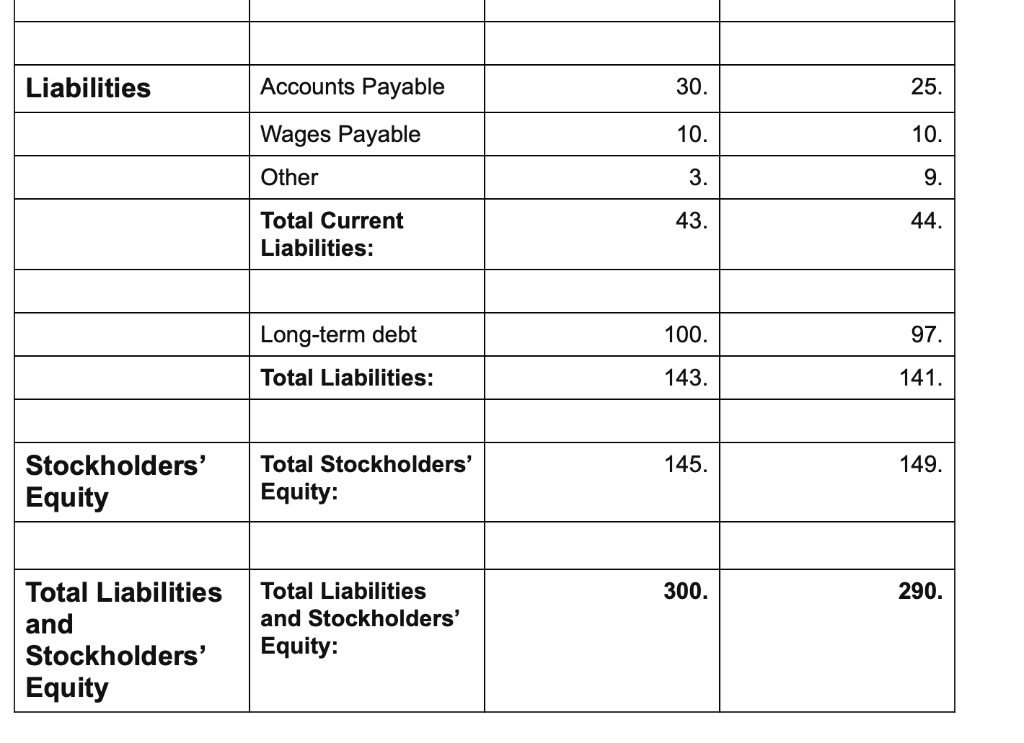

Name: Benchmark: specialty store #1. Benchmarking the Financials Financial Company's Benchmark: Measure (see Performance; Company's Past attachment) Period: 2019 Performance; Period: 2018 Annual Sales Increase (Decr.) Gross Margin 2.6% 34.5% 28.2% Operating Expense (S.G, & A) Net Profit Margin Inventory Turns 5.4% 6.90 Current Ratio 1.20 Quick Ratio .75 .78 Total Debt to Equity Ratio The Boutique: Annual Financials Income Statement Figures in $000's Year ending 2/1/20 Year ending 2/2/19 Year ending 2/3/18 Net Sales 450. 470. 480. Cost of Goods Sold 268. 267. 269. Gross Profit 184. 193. 211. S,G, & A 117. 121. 135. Other Oper Expnses 48. 52. 17. Net Profit 17. 30. 59. Balance Sheet Figures in $000's As of Feb 1, 2020 As of Feb 2, 2019 Assets Cash 20. 30. Accounts Receivbl 10. 10. Inventories 60. 58. Other 10. 8. 100. 106. Total Current Assets: 200. 192. Equipmnt, Lease Rights, other Total Assets: 300. 298. Liabilities Accounts Payable 30. 25. Wages Payable 10. 10. Other 3. 9. 43. 44. Total Current Liabilities: Long-term debt 100. 97. Total Liabilities: 143. 141. 145. 149. Stockholders' Equity Total Stockholders' Equity: 300. 290. Total Liabilities and Stockholders' Equity Total Liabilities and Stockholders' Equity: Name: Benchmark: specialty store #1. Benchmarking the Financials Financial Company's Benchmark: Measure (see Performance; Company's Past attachment) Period: 2019 Performance; Period: 2018 Annual Sales Increase (Decr.) Gross Margin 2.6% 34.5% 28.2% Operating Expense (S.G, & A) Net Profit Margin Inventory Turns 5.4% 6.90 Current Ratio 1.20 Quick Ratio .75 .78 Total Debt to Equity Ratio The Boutique: Annual Financials Income Statement Figures in $000's Year ending 2/1/20 Year ending 2/2/19 Year ending 2/3/18 Net Sales 450. 470. 480. Cost of Goods Sold 268. 267. 269. Gross Profit 184. 193. 211. S,G, & A 117. 121. 135. Other Oper Expnses 48. 52. 17. Net Profit 17. 30. 59. Balance Sheet Figures in $000's As of Feb 1, 2020 As of Feb 2, 2019 Assets Cash 20. 30. Accounts Receivbl 10. 10. Inventories 60. 58. Other 10. 8. 100. 106. Total Current Assets: 200. 192. Equipmnt, Lease Rights, other Total Assets: 300. 298. Liabilities Accounts Payable 30. 25. Wages Payable 10. 10. Other 3. 9. 43. 44. Total Current Liabilities: Long-term debt 100. 97. Total Liabilities: 143. 141. 145. 149. Stockholders' Equity Total Stockholders' Equity: 300. 290. Total Liabilities and Stockholders' Equity Total Liabilities and Stockholders' Equity

Numbers are in thousands. Please help me with filling out the financials.

Numbers are in thousands. Please help me with filling out the financials.