numbers just have to be plugged.

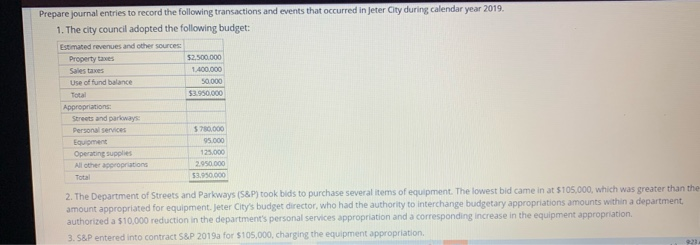

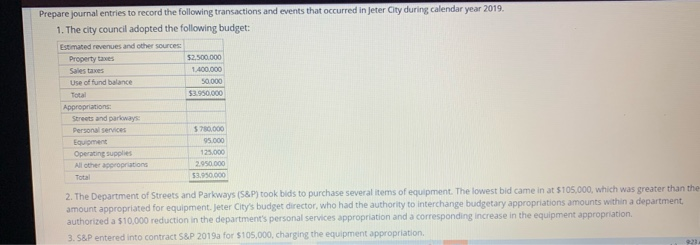

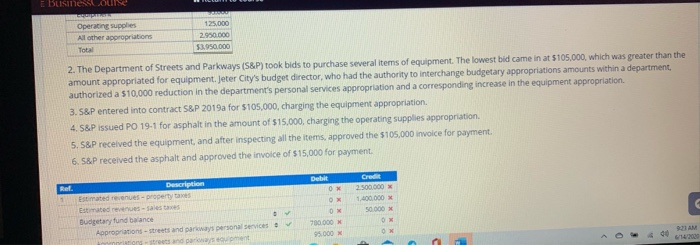

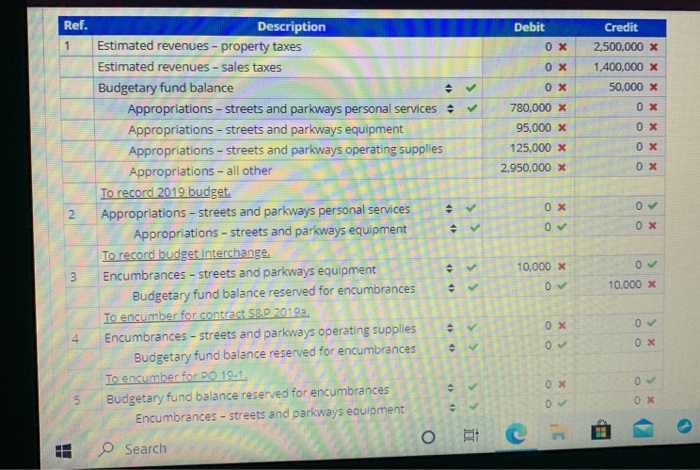

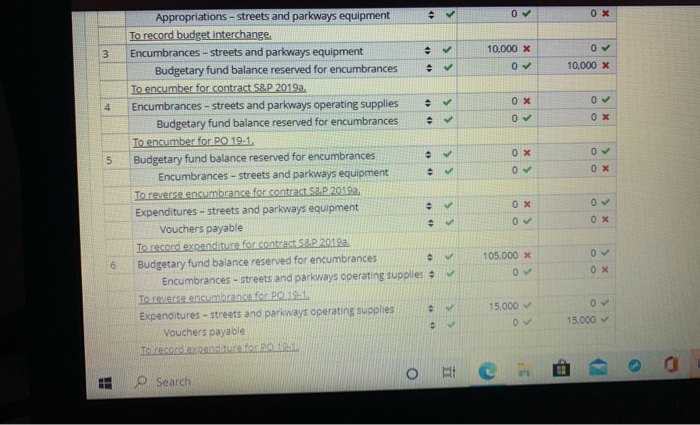

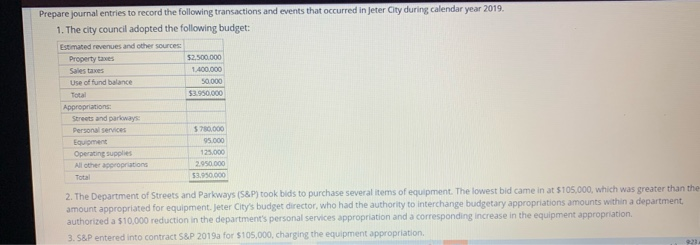

Prepare journal entries to record the following transactions and events that occurred in jeter City during calendar year 2019. 1. The city council adopted the following budget: Estimated revenues and other sources Property taxes $2.500.000 Sales taxes 1.400.000 Use of fund balance 50.000 Total $3.950.000 Appropriations: Streets and parkways: Personal services $ 780,000 Equipment 95.000 Operating Supplies 125.000 All other appropriations 2.950.000 Total $3.950.000 2. The Department of Streets and Parkways (S&P) took bids to purchase several items of equipment. The lowest bid came in at 5105,000, which was greater than the amount appropriated for equipment. Jeter City's budget director, who had the authority to interchange budgetary appropriations amounts within a department authorized a $10,000 reduction in the departments personal services appropriation and a corresponding increase in the equipment appropriation 3. S&P entered into contract S&P 2019a for $105,000, charging the equipment appropriation 21 E BUSINESLOLINS Operating supplies All other appropriations Total 125,000 2.950.000 53.950.000 2. The Department of Streets and Parkways (S&P) took bids to purchase several items of equipment. The lowest bid came in at 5105,000, which was greater than the amount appropriated for equipment. Jeter City's budget director, who had the authority to interchange budgetary appropriations amounts within a department authorized a $10,000 reduction in the department's personal services appropriation and a corresponding increase in the equipment appropriation 3. S&P entered into contract S&P 2019a for $105,000, charging the equipment appropriation 4. S&P issued PO 19-1 for asphalt in the amount of $15,000, charging the operating supplies appropriation 5.5&P received the equipment, and after inspecting all the items, approved the 5105,000 invoice for payment 6. S&P received the asphalt and approved the invoice of $15,000 for payment. Debi OM Credit 2.500.000 1.400.000 x 50 000 X Description Estimated revenues-property taxes Estimated revenues sales taxes Budgetary fund balance Appropriations-streets and parkways personal services og tanda pent 700.000 95.000 OX 0 Ref. Debit 0 x 1 Credit 2,500,000 X 1,400,000 X 0 x 0 x 50,000 X 0 X 780,000 X 95,000 x 125,000 X 0 x OX 2.950,000 X OX 0 x 0 2 Description Estimated revenues-property taxes Estimated revenues - sales taxes Budgetary fund balance Appropriations - streets and parkways personal services Appropriations - streets and parkways equipment Appropriations - streets and parkways operating supplies Appropriations - all other To record 2019 budget. Appropriations - streets and parkways personal services Appropriations - streets and parkways equipment To record budget interchange. Encumbrances - streets and parkways equipment Budgetary fund balance reserved for encumbrances To encumber for contract SRP 2019a. Encumbrances - streets and parkways operating supplies Budgetary fund balance reserved for encumbrances To encumber for PO 19:13 Budgetary fund balance reserved for encumbrances Encumbrances - streets and parkways equipment O 0 x 10,000 x 0 3 10.000 X 0 x . . 0 0 x 0 OX 0 5 OX 11 O Search 0 OX e 0 3 10,000 X 0 10,000 X . OX 4 0 0 x 0 OX 0 5 0 OX Appropriations - streets and parkways equipment To record budget interchange. Encumbrances - streets and parkways equipment Budgetary fund balance reserved for encumbrances To encumber for contract S&P 2019a. Encumbrances - streets and parkways operating supplies Budgetary fund balance reserved for encumbrances To encumber for PO 19.1. Budgetary fund balance reserved for encumbrances Encumbrances - streets and parkways equipment To reverse encumbrance for contract S&P 2019 Expenditures - streets and parkways equipment Vouchers payable To record expenditure for contract SP 2019a Budgetary fund balance reserved for encumbrances Encumbrances - streets and parkways operating supplies To reverse encumbrance for PO1 Expenditures - streets and parkways operating supplies Vouchers payable To recordexpenditure for 1 >> OX 0 OX 0 6 105.000 x 0 OX 15.000 15.000 o O Search