Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Nvidia, one of the world's largest semiconductor companies that manufacture microchips, reported earnings per share in 2021 of $3.95, and paid dividends per share

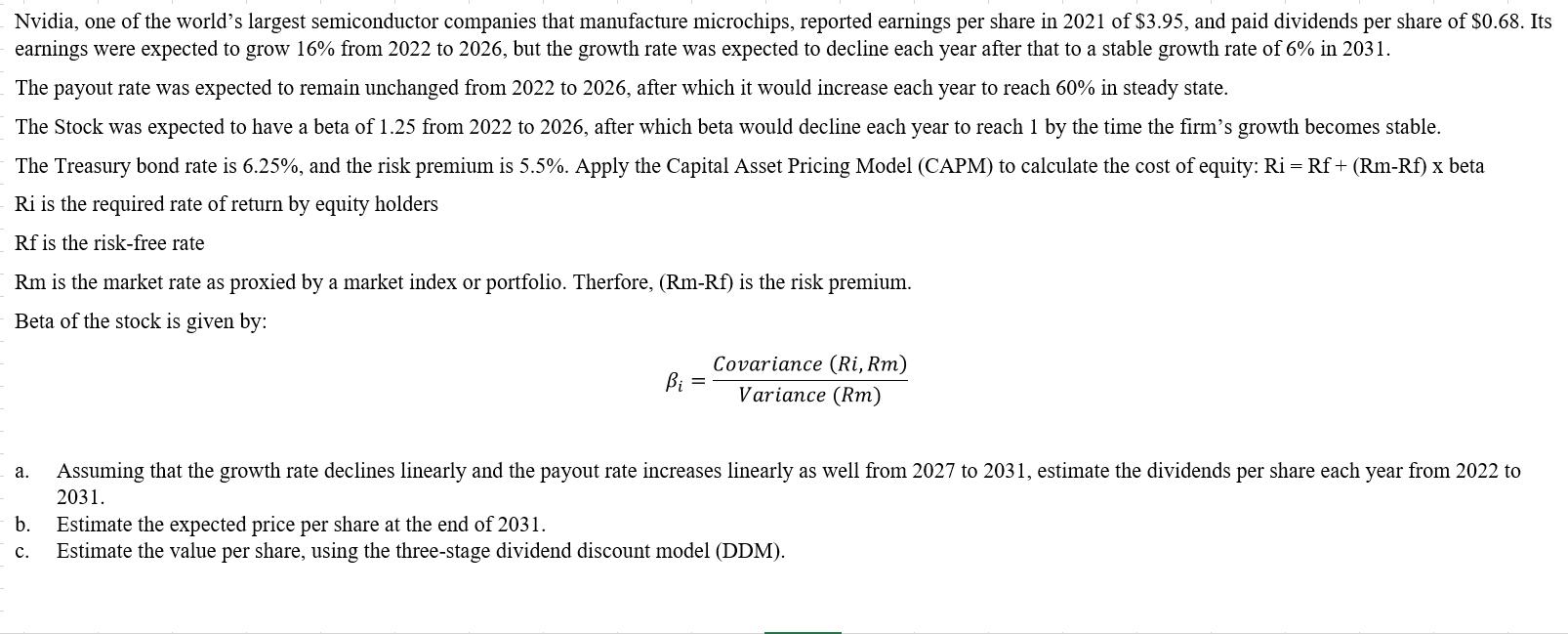

Nvidia, one of the world's largest semiconductor companies that manufacture microchips, reported earnings per share in 2021 of $3.95, and paid dividends per share of $0.68. Its earnings were expected to grow 16% from 2022 to 2026, but the growth rate was expected to decline each year after that to a stable growth rate of 6% in 2031. The payout rate was expected to remain unchanged from 2022 to 2026, after which it would increase each year to reach 60% in steady state. The Stock was expected to have a beta of 1.25 from 2022 to 2026, after which beta would decline each year to reach 1 by the time the firm's growth becomes stable. The Treasury bond rate is 6.25%, and the risk premium is 5.5%. Apply the Capital Asset Pricing Model (CAPM) to calculate the cost of equity: Ri = Rf + (Rm-Rf) x beta Ri is the required rate of return by equity holders Rf is the risk-free rate Rm is the market rate as proxied by a market index or portfolio. Therfore, (Rm-Rf) is the risk premium. Beta of the stock is given by: a. b. C. Bi = Covariance (Ri, Rm) Variance (Rm) Assuming that the growth rate declines linearly and the payout rate increases linearly as well from 2027 to 2031, estimate the dividends per share each year from 2022 to 2031. Estimate the expected price per share at the end of 2031. Estimate the value per share, using the three-stage dividend discount model (DDM).

Step by Step Solution

★★★★★

3.56 Rating (146 Votes )

There are 3 Steps involved in it

Step: 1

a Dividends per share from 20222031 2022 068 2023 068 2024 068 2025 068 2026 068 2027 072 2028 076 2...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started