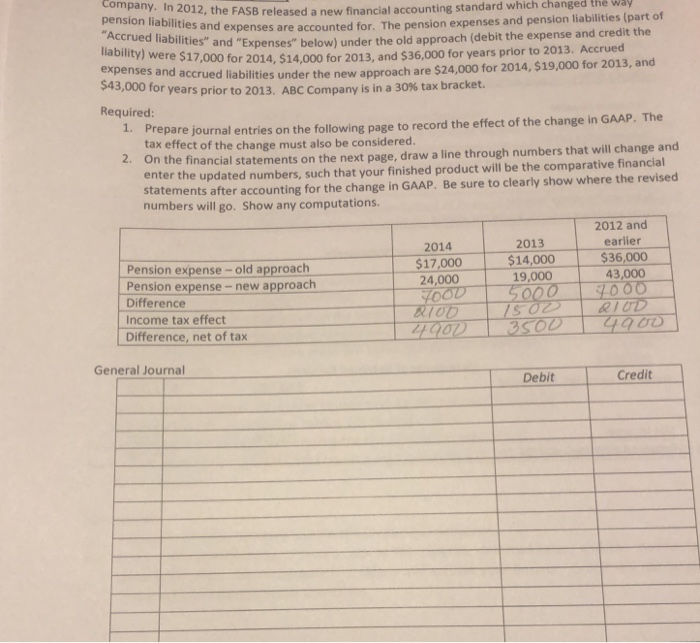

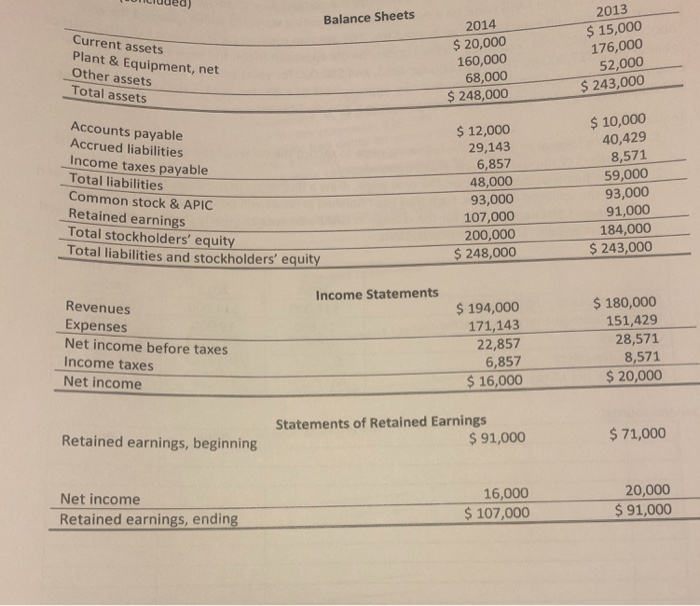

ny n 2012, the FASB released a new financial accounting standard which changed th way pension liabilities and expenses are accoun Accrued liabilities" and liability) were $ expenses and $43,000 for years ted for. The pension expenses and pension liabilities (part of Expenses" below) under the old approach (debit the expense and credit the 17,000 for 2014, $14,000 for 2013, and $36,000 for years prior to 2013. Accrued accrued liabilities under the new approach are $24,000 for 2014, $19,000 for 2013, and prior to 2013, ABC Company is in a 30% tax bracket. Required: 1. P repare journal entries on the following page to record the effect of the change in GAAP. The tax effect of the change must also be considered. e financial statements on the next page, draw a line through numbers that will change and ccounting for the change in GAAP. Be sure to clearly show where the revised 2. On th enter the updated numbers, such that your finished product will be the comparative financial statements after a numbers will go. Show any computations. 2014 $17,000 24,000 2013 $14,000 19,000 2012 and earlier $36,000 43,000 Pension expense-old approach Pension expense-new approach Difference Income tax effect Difference, net of tax General Journal Debit Credit 2013 15,000 176,000 52,000 Balance Sheets 2014 Current assets Plant & Equipment, net $ 20,000 160,000 Other assets Total assets 68,000243,000 248,000 Accounts payable Accrued liabilities Income taxes payable Total liabilities Common stock &APIC Retained earnings Total stockholders' equity Total liabilities and stockholders' equity $12,000 29,143 6,857 48,000 93,000 107,000 200,000 $248,000 $ 10,000 40,429 8,571 59,000 93,000 91,000 184,000 $243,000 Income Statements Revenues Expenses Net income before taxes Income taxes Net income 180,000 171,143151,429 28,571 8,571 $ 20,000 $194,000 22,857 6,857 16,000 Statements of Retained Earnings Retained earnings, beginning 91,000 $71,000 Net income Retained earnings, ending 16,000 $ 107,000 20,000 $91,000 ny n 2012, the FASB released a new financial accounting standard which changed th way pension liabilities and expenses are accoun Accrued liabilities" and liability) were $ expenses and $43,000 for years ted for. The pension expenses and pension liabilities (part of Expenses" below) under the old approach (debit the expense and credit the 17,000 for 2014, $14,000 for 2013, and $36,000 for years prior to 2013. Accrued accrued liabilities under the new approach are $24,000 for 2014, $19,000 for 2013, and prior to 2013, ABC Company is in a 30% tax bracket. Required: 1. P repare journal entries on the following page to record the effect of the change in GAAP. The tax effect of the change must also be considered. e financial statements on the next page, draw a line through numbers that will change and ccounting for the change in GAAP. Be sure to clearly show where the revised 2. On th enter the updated numbers, such that your finished product will be the comparative financial statements after a numbers will go. Show any computations. 2014 $17,000 24,000 2013 $14,000 19,000 2012 and earlier $36,000 43,000 Pension expense-old approach Pension expense-new approach Difference Income tax effect Difference, net of tax General Journal Debit Credit 2013 15,000 176,000 52,000 Balance Sheets 2014 Current assets Plant & Equipment, net $ 20,000 160,000 Other assets Total assets 68,000243,000 248,000 Accounts payable Accrued liabilities Income taxes payable Total liabilities Common stock &APIC Retained earnings Total stockholders' equity Total liabilities and stockholders' equity $12,000 29,143 6,857 48,000 93,000 107,000 200,000 $248,000 $ 10,000 40,429 8,571 59,000 93,000 91,000 184,000 $243,000 Income Statements Revenues Expenses Net income before taxes Income taxes Net income 180,000 171,143151,429 28,571 8,571 $ 20,000 $194,000 22,857 6,857 16,000 Statements of Retained Earnings Retained earnings, beginning 91,000 $71,000 Net income Retained earnings, ending 16,000 $ 107,000 20,000 $91,000