Answered step by step

Verified Expert Solution

Question

1 Approved Answer

nznd Illustration 46. M, J and P were partners sharing profits/losses in the ratio of M 40%, J 35% and P 25%. The draft Balance

nznd

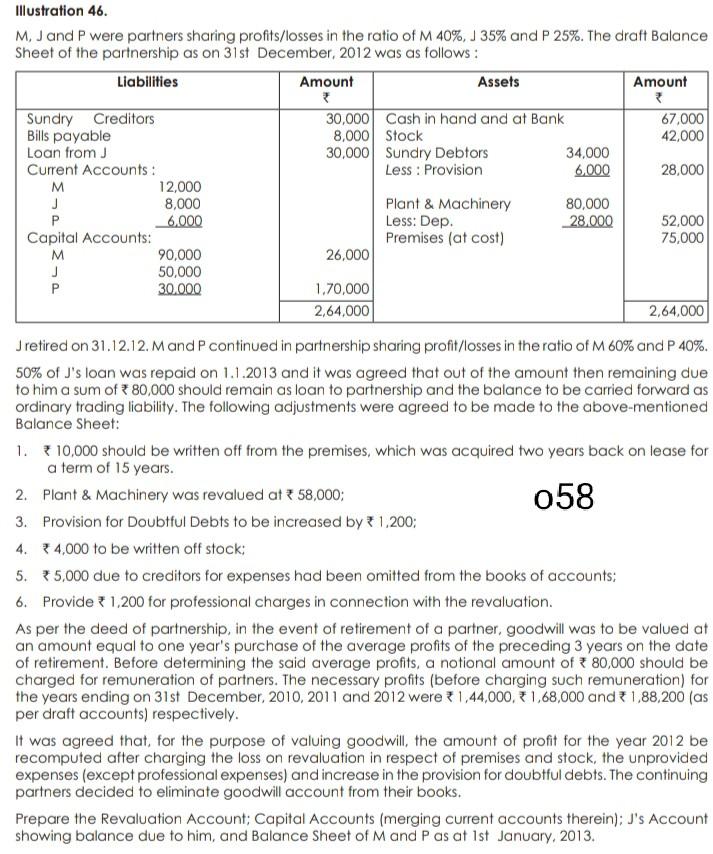

Illustration 46. M, J and P were partners sharing profits/losses in the ratio of M 40%, J 35% and P 25%. The draft Balance Sheet of the partnership as on 31st December, 2012 was as follows: Liabilities Amount Assets Amount Sundry Creditors 30,000 Cash in hand and at Bank 67,000 Bills payable 8,000 Stock 42,000 Loan from 30,000 Sundry Debtors 34,000 Current Accounts: Less : Provision 6,000 28,000 12,000 J 8,000 Plant & Machinery 80,000 6.000 Less: Dep. 28.000 52,000 Capital Accounts: Premises (at cost) 75,000 M 90,000 26,000 J 50,000 30.000 1.70,000 2,64.000 2,64,000 J retired on 31.12.12. M and P continued in partnership sharing profit/losses in the ratio of M 60% and P 40%. 50% of J's loan was repaid on 1.1.2013 and it was agreed that out of the amount then remaining due to him a sum of 80,000 should remain as loan to partnership and the balance to be carried forward as ordinary trading liability. The following adjustments were agreed to be made to the above-mentioned Balance Sheet: 1. 10,000 should be written off from the premises, which was acquired two years back on lease for a term of 15 years. 2. Plant & Machinery was revalued at 58,000; 058 3. Provision for Doubtful Debts to be increased by 1,200: 4. 34,000 to be written off stock: 5. 5,000 due to creditors for expenses had been omitted from the books of accounts: 6. Provide : 1,200 for professional charges in connection with the revaluation. As per the deed of partnership in the event of retirement of a partner, goodwill was to be valued at an amount equal to one year's purchase of the average profits of the preceding 3 years on the date of retirement. Before determining the said average profits, a notional amount of 80,000 should be charged for remuneration of partners. The necessary profits (before charging such remuneration) for the years ending on 31st December, 2010, 2011 and 2012 were : 1,44,000, 31,68,000 and 1,88,200 (as per draft accounts) respectively. It was agreed that, for the purpose of valuing goodwill, the amount of profit for the year 2012 be recomputed after charging the loss on revaluation in respect of premises and stock, the unprovided expenses (except professional expenses) and increase in the provision for doubtful debts. The continuing partners decided to eliminate goodwill account from their books. Prepare the Revaluation Account; Capital Accounts (merging current accounts therein); J's Account showing balance due to him, and Balance Sheet of Mand P as at 1st January, 2013Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started