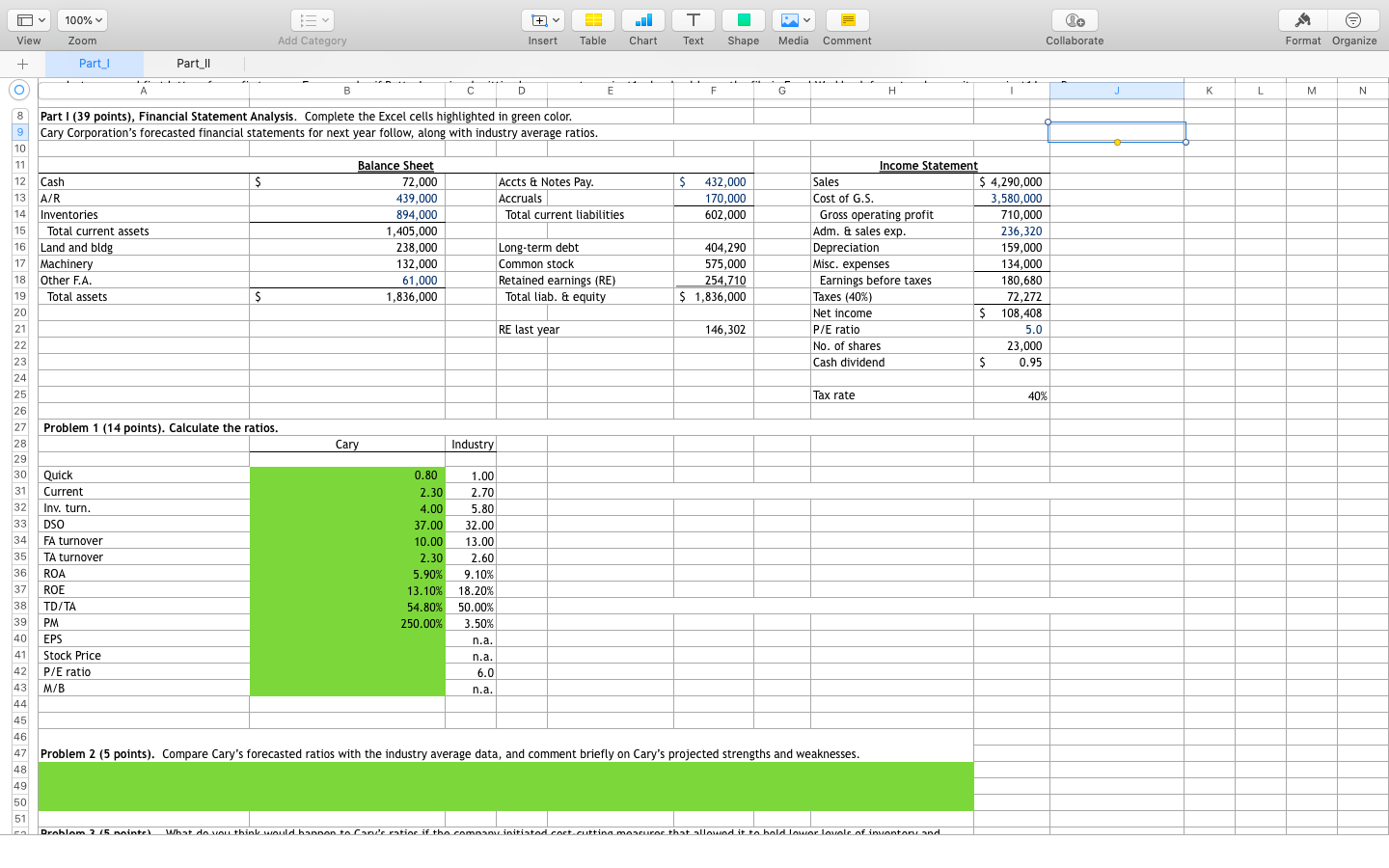

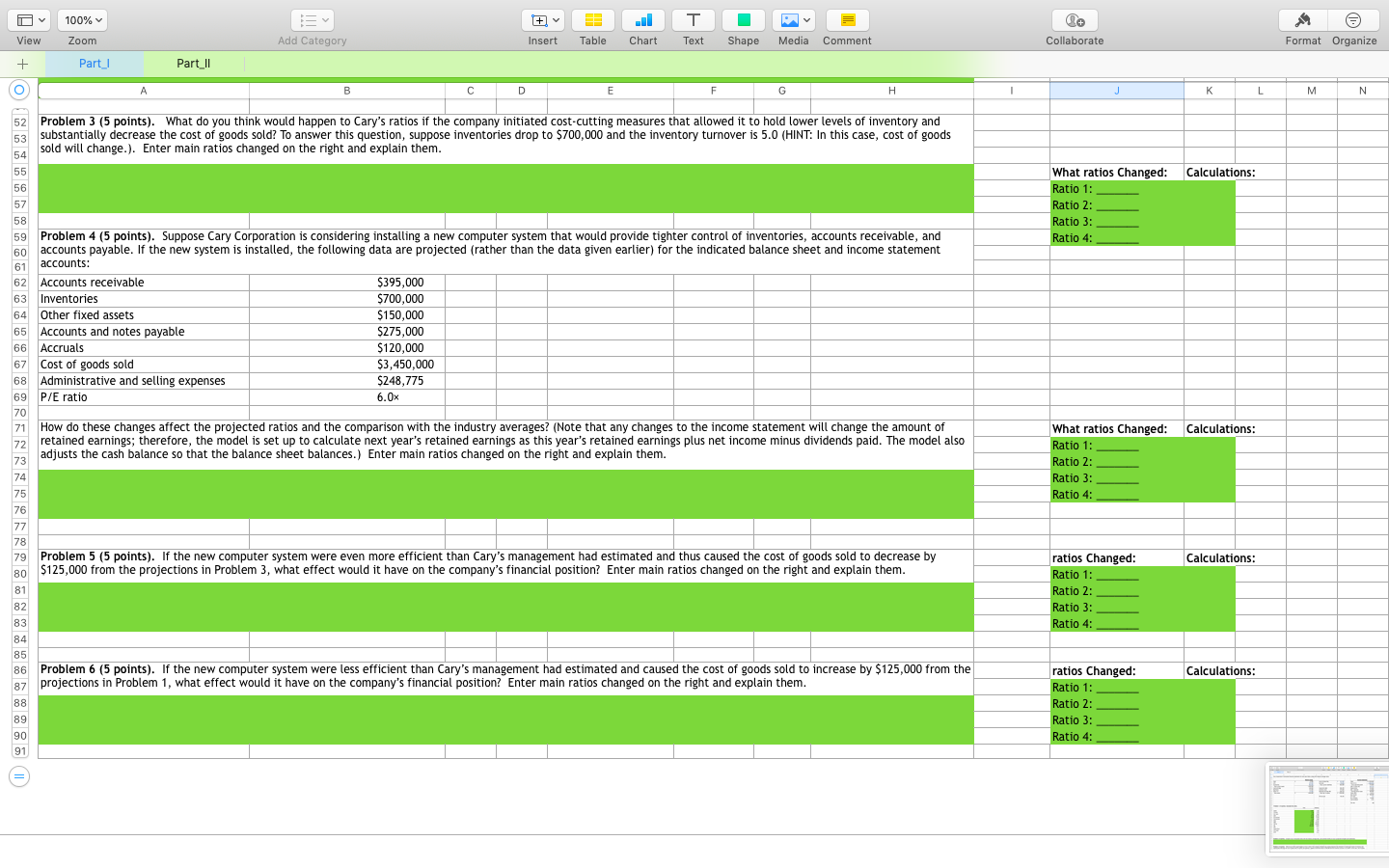

o 100% co View Zoom Add Category Insert Table Chart Text Shape Media Comment Collaborate Format Organize + Part Part_ll 0 A M N 000 Part I (39 points), Financial Statement Analysis. Complete the Excel cells highlighted in green color. Cary Corporation's forecasted financial statements for next year follow, along with industry average ratios. $ Accts & Notes Pay. Accruals Total current liabilities 432,000 170,000 602,000 Cash A/R Inventories Total current assets Land and bldg Machinery Other F.A. Total assets Balance Sheet 72,000 439,000 894,000 1,405,000 238,000 132,000 61,000 1,836,000 Long-term debt Common stock Retained earnings (RE) Total liab. & equity 404,290 575,000 254,710 1,836,000 Income Statement Sales $ 4,290,000 Cost of G.S. 3,580,000 Gross operating profit 710,000 Adm. & sales exp. 236,320 Depreciation 159,000 Misc. expenses 134,000 Earnings before taxes 180,680 Taxes (40%) 72.272 Net income $ 108,408 P/E ratio 5.0 No. of shares 23,000 Cash dividend $ 0.95 $ RE last year 146,302 Tax rate 40% Problem 1 (14 points). Calculate the ratios. Cary Industry Quick Current Inv. turn. DSO FA turnover TA turnover ROA ROE TD/TA PM EPS Stock Price P/E ratio M/B 0.80 2.30 4.00 37.00 10.00 2.30 5.90% 13.10% 54.80% 250.00% 1.00 2.70 5.80 32.00 13.00 2.60 9.10% 18.20% 50.00% 3.50% n.a. n.a. 6.0 n.a. Problem 2 (5 points). Compare Cary's forecasted ratios with the industry average data, and comment briefly on Cary's projected strengths and weaknesses. Drablam2 (5 pointe bat da NALL thinly would hannan to Carve ratior if the caman initiated.cact.cuttina mascuror that allowed it to bold lovar loval of invantars and co o View + 100% Zoom Part Add Category Insert Table Chart Text Shape Media Comment Collaborate Format Organize Part II A C D F G M N Problem 3 (5 points). What do you think would happen to Cary's ratios if the company initiated cost-cutting measures that allowed it to hold lower levels of inventory and substantially decrease the cost of goods sold? To answer this question, suppose inventories drop to $700,000 and the inventory turnover is 5.0 (HINT: In this case, cost of goods sold will change.). Enter main ratios changed on the right and explain them. Calculations: What ratios Changed: Ratio 1: Ratio 2: Ratio 3: Ratio 4: Problem 4 (5 points). Suppose Cary Corporation is considering installing a new computer system that would provide tighter control of inventories, accounts receivable, and accounts payable. If the new system is installed, the following data are projected (rather than the data given earlier) for the indicated balance sheet and income statement accounts: Accounts receivable $395,000 Inventories $700,000 Other fixed assets $150,000 Accounts and notes payable $275,000 Accruals $120,000 Cost of goods sold $3,450,000 Administrative and selling expenses $248,775 P/E ratio 6.0x Calculations: How do these changes affect the projected ratios and the comparison with the industry averages? (Note that any changes to the income statement will change the amount of retained earnings; therefore, the model is set up to calculate next year's retained earnings as this year's retained earnings plus net income minus dividends paid. The model also adjusts the cash balance so that the balance sheet balances.) Enter main ratios changed on the right and explain them. What ratios Changed: Ratio 1: Ratio 2: Ratio 3: Ratio 4: Problem 5 (5 points). If the new computer system were even more efficient than Cary's management had estimated and thus caused the cost of goods sold to decrease by $125,000 from the projections in Problem 3, what effect would it have on the company's financial position? Enter main ratios changed on the right and explain them. Calculations: ratios Changed: Ratio 1: Ratio 2: Ratio 3: Ratio 4: Problem 6 (5 points). If the new computer system were less efficient than Cary's management had estimated and caused the cost of goods sold to increase by $125,000 from the projections in Problem 1, what effect would it have on the company's financial position? Enter main ratios changed on the right and explain them. Calculations: ratios Changed: Ratio 1: Ratio 2: Ratio 3: Ratio 4