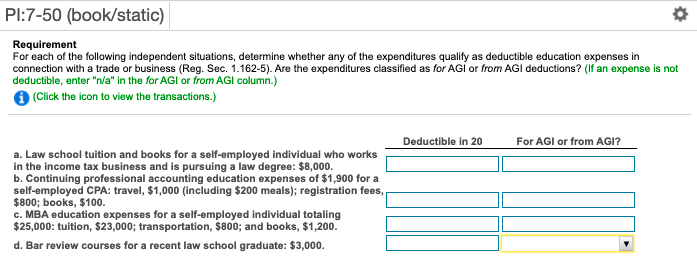

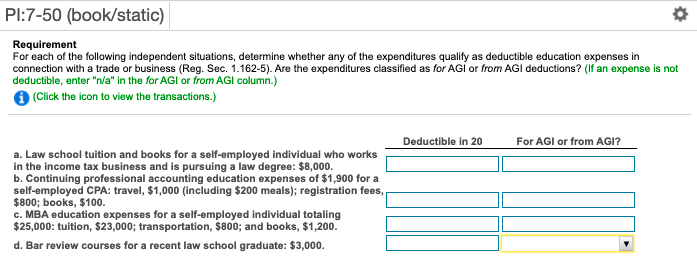

o PI:7-50 (book/static) Requirement For each of the following independent situations, determine whether any of the expenditures qualify as deductible education expenses in connection with a trade or business (Reg. Sec. 1.162-5). Are the expenditures classified as for AGI or from AGI deductions? (If an expense is not deductible, enter "n/a" in the for AGI or from AGI column.) (Click the icon to view the transactions.) Deductible in 20 For AGI or from AGI? a. Law school tuition and books for a self-employed individual who works in the income tax business and is pursuing a law degree: $8,000. b. Continuing professional accounting education expenses of $1,900 for a self-employed CPA: travel, $1,000 (including $200 meals); registration fees, $800; books, $100. c. MBA education expenses for a self-employed individual totaling $25,000: tuition, $23,000; transportation, $800; and books, $1,200. d. Bar review courses for a recent law school graduate: $3,000. a. Law school tuition and books for a self-employed individual who works in the income tax business and is pursuing a law degree: $8,000. b. Continuing professional accounting education expenses of $1,900 for a self-employed CPA: travel, $1,000 (including $200 meals); registration fees, $800; books, $100. C. MBA education expenses for a self-employed individual totaling $25,000: tuition, $23,000; transportation, $800; and books, $1,200. d. Bar review courses for a recent law school graduate: $3,000. o PI:7-50 (book/static) Requirement For each of the following independent situations, determine whether any of the expenditures qualify as deductible education expenses in connection with a trade or business (Reg. Sec. 1.162-5). Are the expenditures classified as for AGI or from AGI deductions? (If an expense is not deductible, enter "n/a" in the for AGI or from AGI column.) (Click the icon to view the transactions.) Deductible in 20 For AGI or from AGI? a. Law school tuition and books for a self-employed individual who works in the income tax business and is pursuing a law degree: $8,000. b. Continuing professional accounting education expenses of $1,900 for a self-employed CPA: travel, $1,000 (including $200 meals); registration fees, $800; books, $100. c. MBA education expenses for a self-employed individual totaling $25,000: tuition, $23,000; transportation, $800; and books, $1,200. d. Bar review courses for a recent law school graduate: $3,000. a. Law school tuition and books for a self-employed individual who works in the income tax business and is pursuing a law degree: $8,000. b. Continuing professional accounting education expenses of $1,900 for a self-employed CPA: travel, $1,000 (including $200 meals); registration fees, $800; books, $100. C. MBA education expenses for a self-employed individual totaling $25,000: tuition, $23,000; transportation, $800; and books, $1,200. d. Bar review courses for a recent law school graduate: $3,000