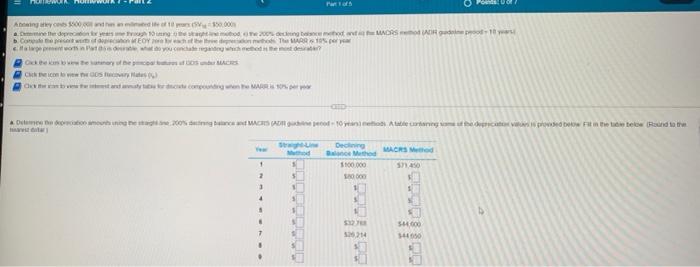

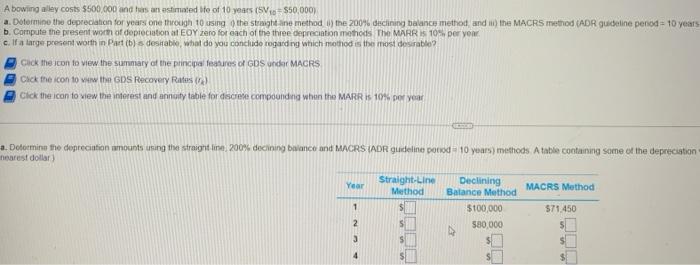

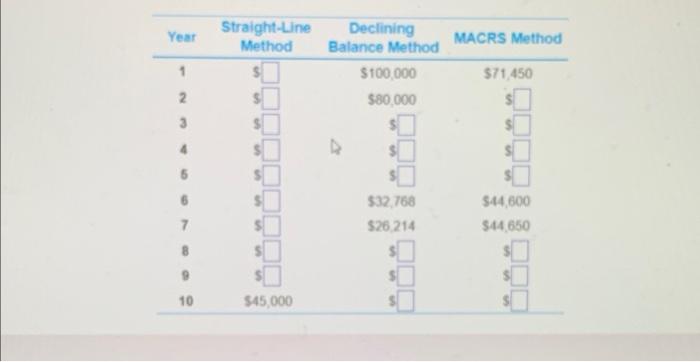

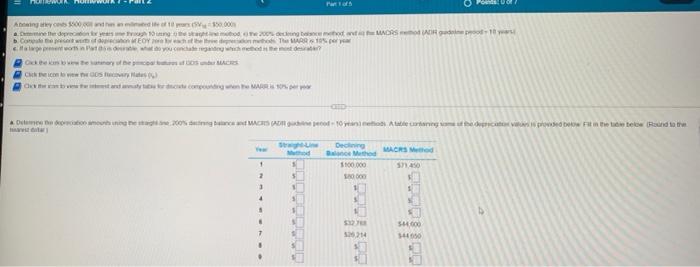

O PODE Aby 350.00 ...pentrs 10 e 20 MARS good Con EOYT MARR clientouched Gateway Deco ACS Chicon EOS) Obecoming wees, Omhoogste Alto Fatte Rand to the Deng MARS 1 571450 2 1100.000 1000 1 1 4 1 3 3 S 546 BE M A bowing alley costs $500.000 and has an estimated te of 10 years (Vio= $50,000) Dotermine the depreciation for years ore turetuigh 10 using the straight and method / the 200% declining balance method, and at the MACRS method ADR guideline pencd = 40 years b. Compute the present worth of depreciation at EDYzero for each of the three depreciation methods The MARR IS 10% per year c. If a large present worth in Part (b) destabie, what do you concludo togarding which mothod is the most desirable? Click the icon to view the summary of the principal features of GDS under MACRS Click the icon to Vw GDS Recovery Rates) Click the icon to view the interest and annaty table for discrete compounding when the MARR IS 10% per year GEGE 1. Deforming the depreciation wounts using the straight line 200% declining balance and MACRS (ADR guideline ponied = 10 years) methods Atable containing some of the depreciation nearest dollar Straight-Line Declining Year MACRS Method Method Balance Method 1 $100,000 $71.450 2 580,000 D Year Straight-Line Method MACRS Method 1 Declining Balance Method $100,000 $80,000 $71.450 2 $ S $32.768 $26 214 544.600 $44,650 7 10 $45,000 O PODE Aby 350.00 ...pentrs 10 e 20 MARS good Con EOYT MARR clientouched Gateway Deco ACS Chicon EOS) Obecoming wees, Omhoogste Alto Fatte Rand to the Deng MARS 1 571450 2 1100.000 1000 1 1 4 1 3 3 S 546 BE M A bowing alley costs $500.000 and has an estimated te of 10 years (Vio= $50,000) Dotermine the depreciation for years ore turetuigh 10 using the straight and method / the 200% declining balance method, and at the MACRS method ADR guideline pencd = 40 years b. Compute the present worth of depreciation at EDYzero for each of the three depreciation methods The MARR IS 10% per year c. If a large present worth in Part (b) destabie, what do you concludo togarding which mothod is the most desirable? Click the icon to view the summary of the principal features of GDS under MACRS Click the icon to Vw GDS Recovery Rates) Click the icon to view the interest and annaty table for discrete compounding when the MARR IS 10% per year GEGE 1. Deforming the depreciation wounts using the straight line 200% declining balance and MACRS (ADR guideline ponied = 10 years) methods Atable containing some of the depreciation nearest dollar Straight-Line Declining Year MACRS Method Method Balance Method 1 $100,000 $71.450 2 580,000 D Year Straight-Line Method MACRS Method 1 Declining Balance Method $100,000 $80,000 $71.450 2 $ S $32.768 $26 214 544.600 $44,650 7 10 $45,000