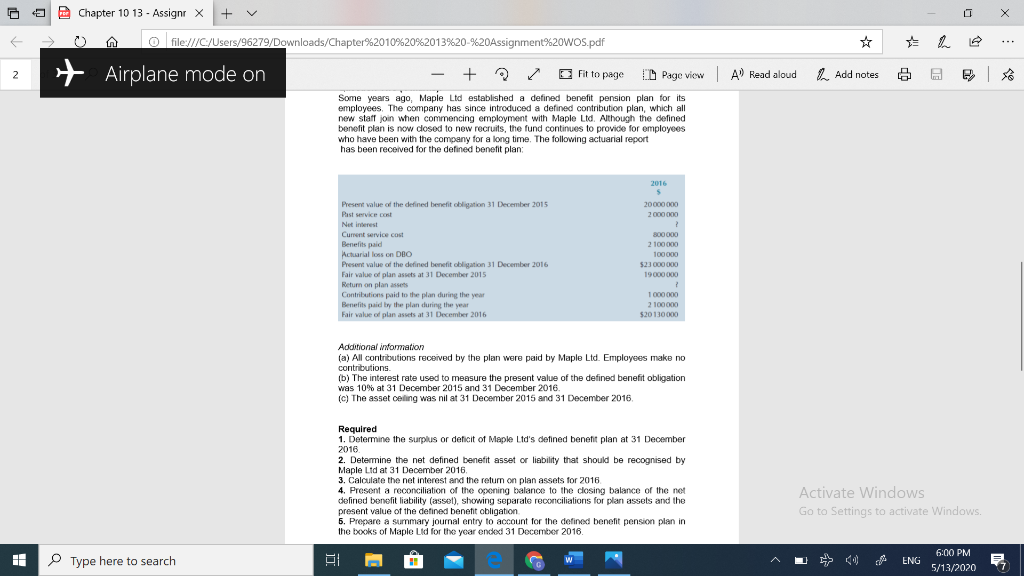

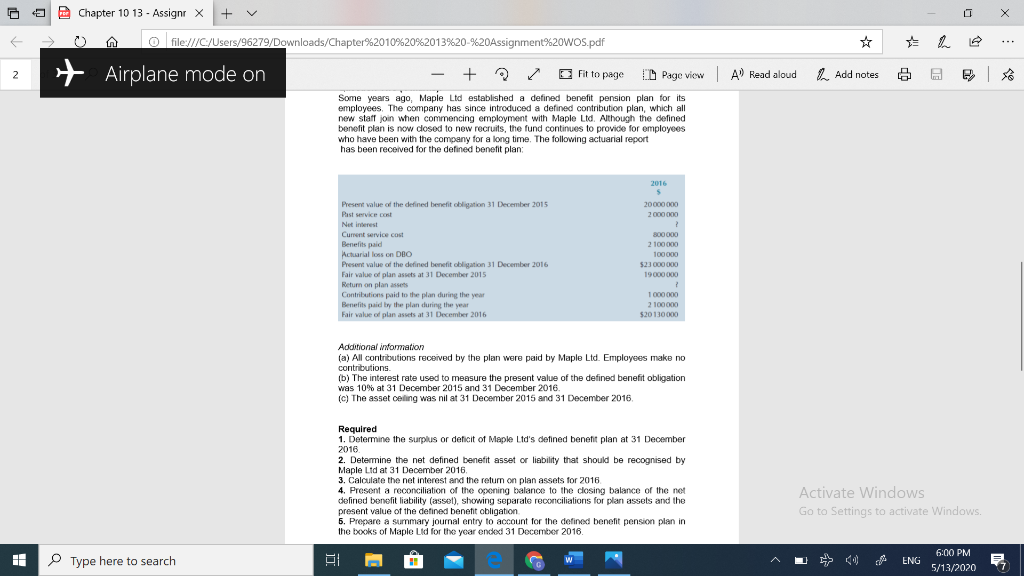

- o X a > Chapter 10 13 - Assignr X + v 0 file:///C:/Users/96279/Downloads/Chapter%2010%20%2013%20-%20Assignment%20WOS.pdf 2 + Airplane mode on - + Fit to page Page view A Read aloud Add notes 6 Some years ago, Maple Ltd established a defined benefit pension plan for its employees. The company has since introduced a defined contribution plan, which all new staff join when commencing employment with Maple Ltd. Although the defined benefit plan is now dosed to new recruits, the fund continues to provide for employees who have been with the company for a long time. The following actuarial report has been received for the defined benefit plan 20000 000 2 000 000 Present value of the defined benefit obligation 31 December 2015 Past service cost Net interest Current service cost Benefits paid Actuarial loss on DBO Present value of the defined benefit obligation 31 December 2016 Fair value of plan assets at 31 December 2015 Return on plan assets Contributions paid to the plan during the year Benefits paid by the plan during the year Fair value of plan assets at 31 December 2016 800000 2 100 000 100000 $23 000 000 19000000 1 000 000 2100000 $20 130000 Additional information (a) All contributions received by the plan were paid by Maple Ltd. Employees make no contributions (b) The interest rate used to measure the present value of the defined benefit obligation was 10% at 31 December 2015 and 31 December 2016. (c) The asset ceiling was nil at 31 December 2015 and 31 December 2016 Required 1. Determine the surplus or deficit of Maple Lid's defined benefit plan at 31 December 2016 2. Determine the net defined benefit asset or liability that should be recognised by Maple Lid at 31 December 2016 3. Calculate the net interest and the return on plan assets for 2016 4. Present a reconciliation of the opening balance to the closing balance of the net defined benefit liability asset), showing separate reconciliations for plan 35sels and the present value of the defined benefit obligation 6. Prepare a summary journal entry to account for the defined benefit pension plan in the books of Maple Lid for the year onckxi 31 December 2016 Activate Windows Go to Settings to activate Windows. 16 Type here to search w A u Chapter 10 13 - Assignr X + v 0 file:///C:/Users/96279/Downloads/Chapter%2010%20%2013%20-%20Assignment%20WOS.pdf 2 + Airplane mode on - + Fit to page Page view A Read aloud Add notes 6 Some years ago, Maple Ltd established a defined benefit pension plan for its employees. The company has since introduced a defined contribution plan, which all new staff join when commencing employment with Maple Ltd. Although the defined benefit plan is now dosed to new recruits, the fund continues to provide for employees who have been with the company for a long time. The following actuarial report has been received for the defined benefit plan 20000 000 2 000 000 Present value of the defined benefit obligation 31 December 2015 Past service cost Net interest Current service cost Benefits paid Actuarial loss on DBO Present value of the defined benefit obligation 31 December 2016 Fair value of plan assets at 31 December 2015 Return on plan assets Contributions paid to the plan during the year Benefits paid by the plan during the year Fair value of plan assets at 31 December 2016 800000 2 100 000 100000 $23 000 000 19000000 1 000 000 2100000 $20 130000 Additional information (a) All contributions received by the plan were paid by Maple Ltd. Employees make no contributions (b) The interest rate used to measure the present value of the defined benefit obligation was 10% at 31 December 2015 and 31 December 2016. (c) The asset ceiling was nil at 31 December 2015 and 31 December 2016 Required 1. Determine the surplus or deficit of Maple Lid's defined benefit plan at 31 December 2016 2. Determine the net defined benefit asset or liability that should be recognised by Maple Lid at 31 December 2016 3. Calculate the net interest and the return on plan assets for 2016 4. Present a reconciliation of the opening balance to the closing balance of the net defined benefit liability asset), showing separate reconciliations for plan 35sels and the present value of the defined benefit obligation 6. Prepare a summary journal entry to account for the defined benefit pension plan in the books of Maple Lid for the year onckxi 31 December 2016 Activate Windows Go to Settings to activate Windows. 16 Type here to search w A u