Answered step by step

Verified Expert Solution

Question

1 Approved Answer

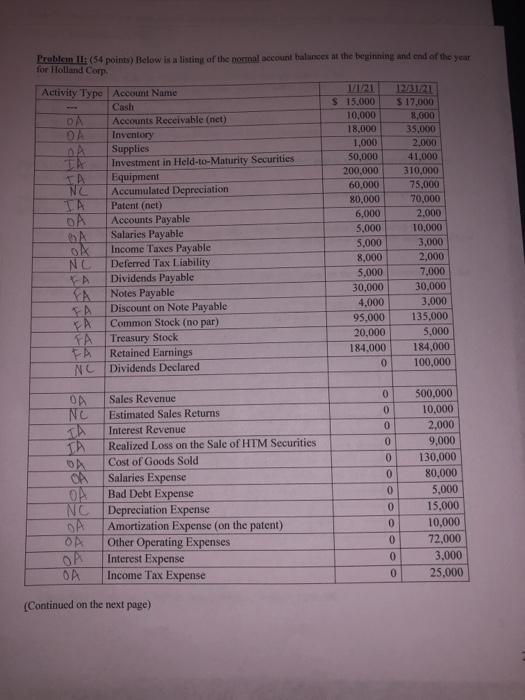

OA Problem II: (54 points) Relow is a listing of the normal secount balance at the beginning and end of the year for Holland Corp

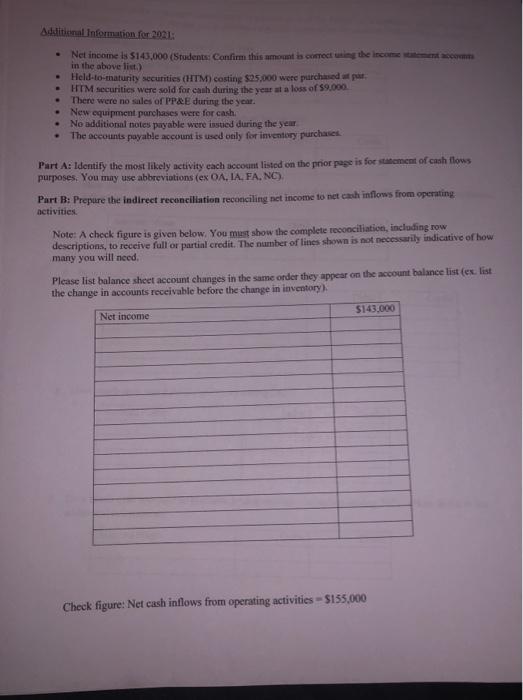

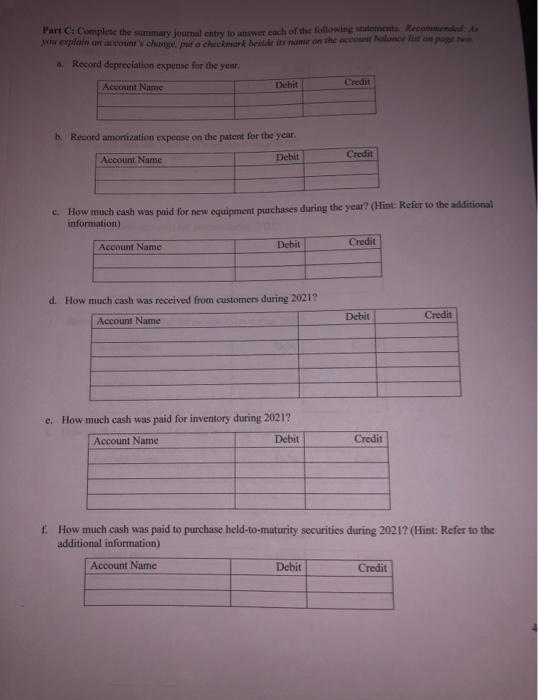

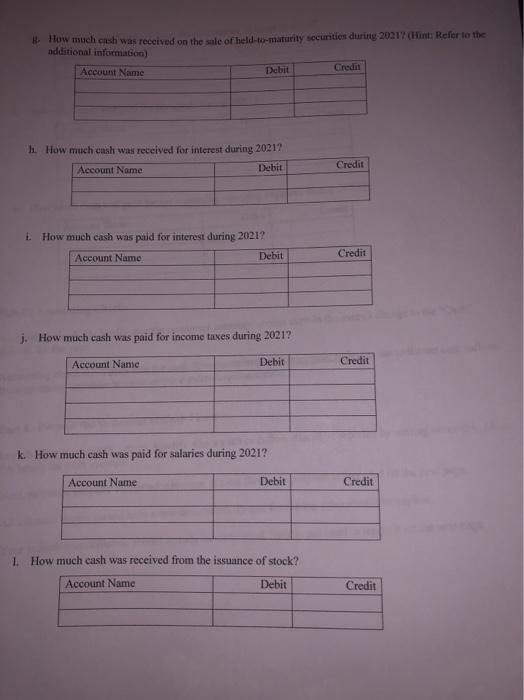

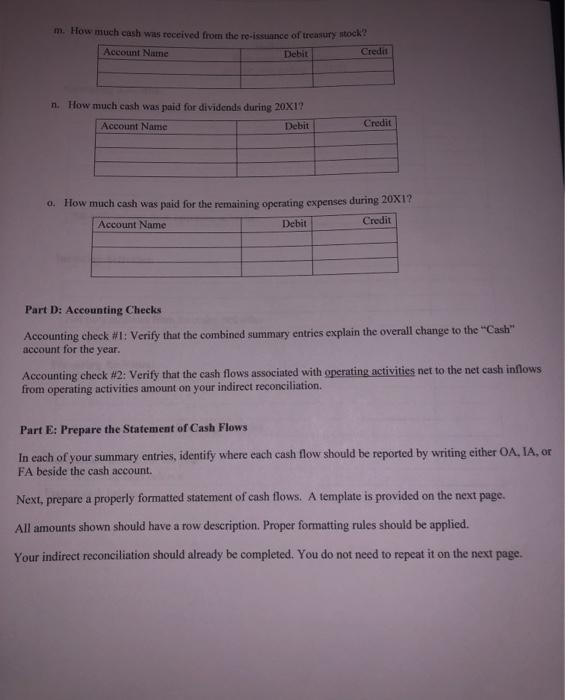

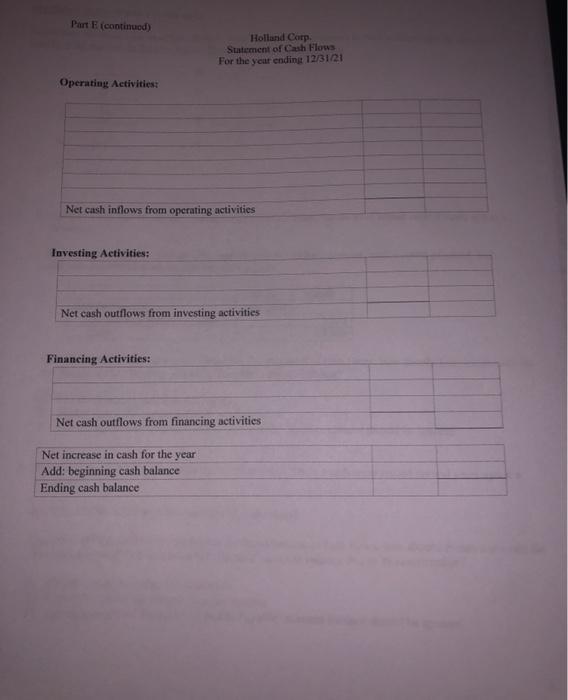

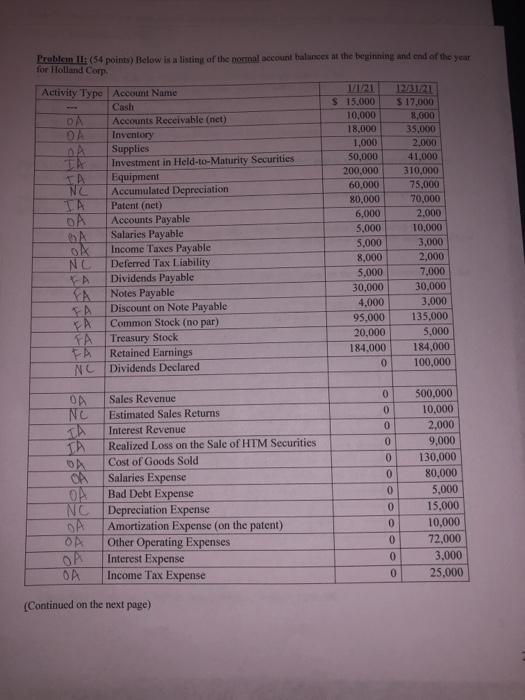

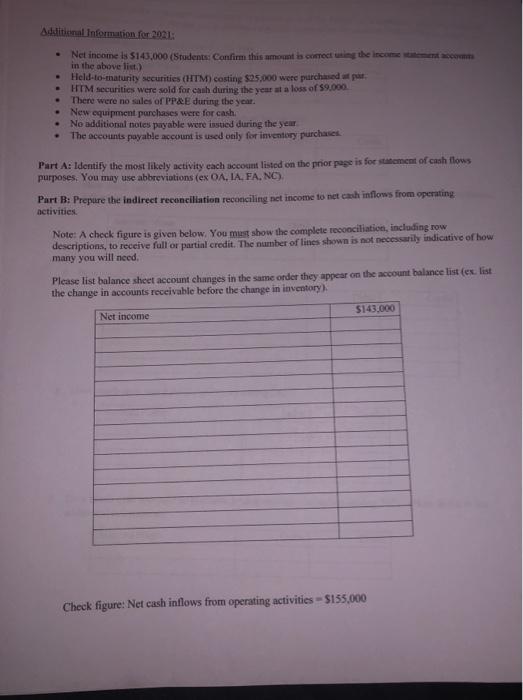

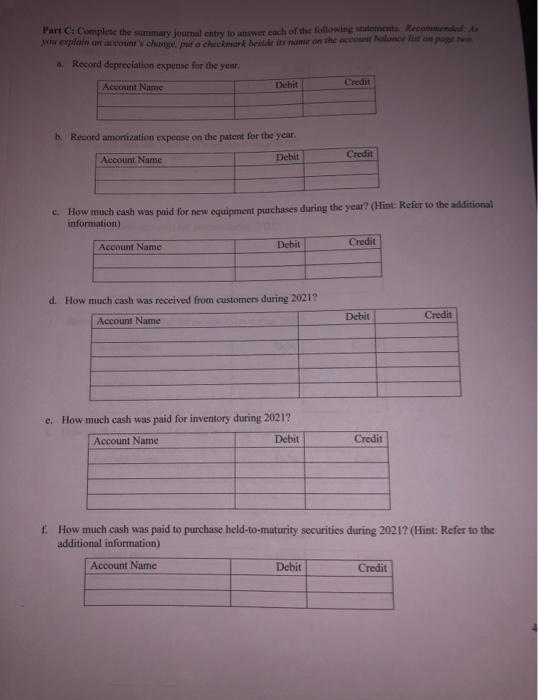

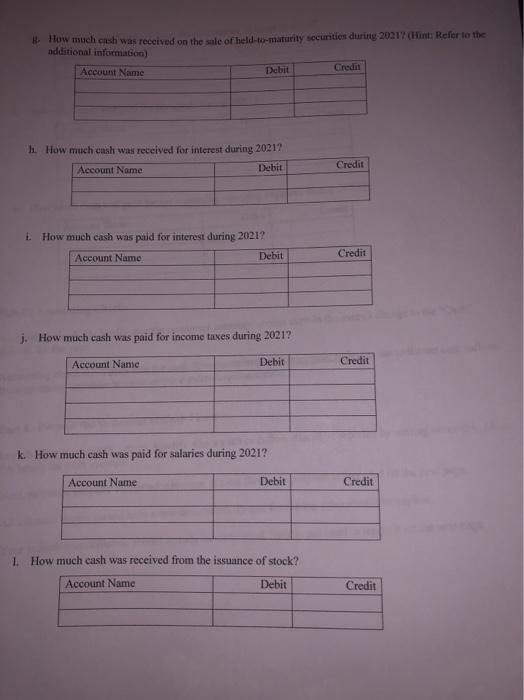

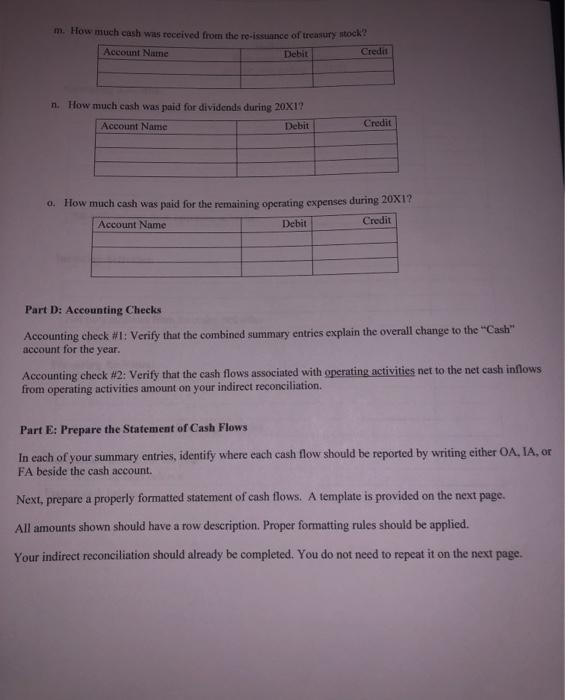

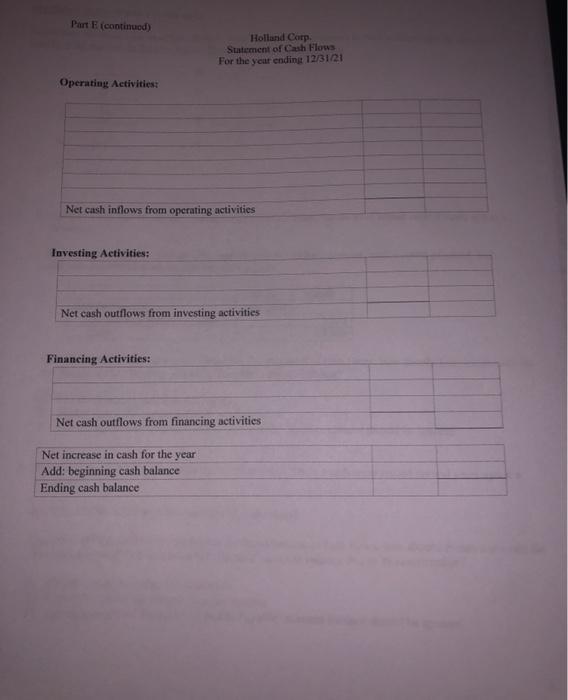

OA Problem II: (54 points) Relow is a listing of the normal secount balance at the beginning and end of the year for Holland Corp Activity Type Account Name 123121 Cash $ 15,000 $ 17.000 Accounts Receivable (net) 10,000 8.000 Inventory 18,000 35.000 1,000 DA Supplies 2,000 Investment in Held-to-Maturity Securities 50,000 41,000 200,000 . Equipment 310,000 NC Accumulated Depreciation 60.000 75,000 Patent (net) 80.000 70,000 Accounts Payable 6,000 2.000 Salaries Payable 5,000 10,000 Income Taxes Payable 5.000 3,000 NC Deferred Tax Liability 8,000 2,000 Dividends Payable 5,000 7.000 30.000 Notes Payable 30,000 YA Discount on Note Payable 4.000 3,000 Common Stock (no par) 95.000 135,000 FA Treasury Stock 20,000 5,000 Retained Earnings 184.000 184.000 0 NC Dividends Declared 100,000 OA FA 0 ON Nc 0 0 0 0 0 DA CA ON NC DA Sales Revenue Estimated Sales Returns Interest Revenue Realized Loss on the sale of HTM Securities Cost of Goods Sold Salaries Expense Bad Debt Expense Depreciation Expense Amortization Expense (on the patent) Other Operating Expenses Interest Expense Income Tax Expense 500.000 10,000 2,000 9,000 130,000 80,000 5,000 15,000 10,000 72,000 3,000 25,000 0 0 0 0 OA 0 0 (Continued on the next page) Aditional Information for 2013 Net income is 5143,000 (Students Confirm this amount becting the income in the above list) Held-to-maturity securities (HTM) costing $25,000 were purchased put HIM securities were sold for canh during the yent at a loss of 89.000 There were no sales of PP&E during the year New equipment parchases were for cash No additional notes payable were instied during the year The accounts payable account is used only for inventory purchase Part A: Identify the most likely activity each account listed on the prior page is for statement of cash flows purposes. You may use abbreviations (ex OA, IA. FA, NC), Part B: Prepare the indirect reconciliation reconciling net income to net cash inflows from operating activities Note: A check figure is given below. You must show the complete reconciliation, including row descriptions, to receive full or partial credit. The number of lines shown is not necessarily indicative of how many you will need, Please list balance sheet account changes in the same order they appear on the account balance list (ex. list the change in accounts receivable before the change in inventory) $143.000 Net income Check figure: Net cash inflows from operating activities - S155,000 Part C: Complete the summary journal entry mwer each of the following statement. Recome wowerplate an accounchig, put a checkmark bestille name on the account alone to a Record depreciation expense for the year Account Name Debit Credit b. Record amortization expense on the patent for the year. Debit Credit Account Name c. How much cash was paid for new equipment purchases during the year? (Hint: Refer to the additional information) Account Name Debit Credit d. How much cash was received from customers during 2021? Account Name Dehit Credit e. How much cash was paid for inventory during 2021? Account Name Debit Credit f. How much cash was paid to purchase held-to-maturity securities during 2021? (Hint: Refer to the additional information) Account Name Debit Credit # How much cash was received on the sale of held-to-maturity securities during 20217. (Hint: Refer to the additional information Account Name Debit Credit How much cash was received for interest during 2021? Account Name Debit Credit 1. How much eash was paid for interest during 2021? Account Name Debit Credit How much cash was paid for income taxes during 2021? Account Name Debit Credit k. How much cash was paid for salaries during 2021? Account Name Debit Credit 1. How much cash was received from the issuance of stock? Account Name Debit Credit m. How much cash was received from the re-issuance of treasury stock? Account Name Debit Credit n. How much cash was paid for dividends during 20X1? Account Name Debit Credit o. How much cash was paid for the remaining operating expenses during 20X1? Account Name Debit Credit Part D: Accounting Checks Accounting check #1: Verify that the combined summary entries explain the overall change to the "Cash" account for the year. Accounting check #2: Verify that the cash flows associated with operating activities net to the net cash inflows from operating activities amount on your indirect reconciliation. Part E: Prepare the Statement of Cash Flows In each of your summary entries, identify where each cash flow should be reported by writing either OA, IA, or FA beside the cash account. Next, prepare a properly formatted statement of cash flows. A template is provided on the next page. All amounts shown should have a row description Proper formatting rules should be applied. Your indirect reconciliation should already be completed. You do not need to repeat it on the next page. Part E (continued) Holland Carp Statement of Cash Flows For the year ending 12/31/21 Operating Activities: Net cash inflows from operating activities Investing Activities: Net cash outflows from investing activities Financing Activities: Net cash outflows from financing activities Net increase in cash for the year Add: beginning cash balance Ending cash balance OA Problem II: (54 points) Relow is a listing of the normal secount balance at the beginning and end of the year for Holland Corp Activity Type Account Name 123121 Cash $ 15,000 $ 17.000 Accounts Receivable (net) 10,000 8.000 Inventory 18,000 35.000 1,000 DA Supplies 2,000 Investment in Held-to-Maturity Securities 50,000 41,000 200,000 . Equipment 310,000 NC Accumulated Depreciation 60.000 75,000 Patent (net) 80.000 70,000 Accounts Payable 6,000 2.000 Salaries Payable 5,000 10,000 Income Taxes Payable 5.000 3,000 NC Deferred Tax Liability 8,000 2,000 Dividends Payable 5,000 7.000 30.000 Notes Payable 30,000 YA Discount on Note Payable 4.000 3,000 Common Stock (no par) 95.000 135,000 FA Treasury Stock 20,000 5,000 Retained Earnings 184.000 184.000 0 NC Dividends Declared 100,000 OA FA 0 ON Nc 0 0 0 0 0 DA CA ON NC DA Sales Revenue Estimated Sales Returns Interest Revenue Realized Loss on the sale of HTM Securities Cost of Goods Sold Salaries Expense Bad Debt Expense Depreciation Expense Amortization Expense (on the patent) Other Operating Expenses Interest Expense Income Tax Expense 500.000 10,000 2,000 9,000 130,000 80,000 5,000 15,000 10,000 72,000 3,000 25,000 0 0 0 0 OA 0 0 (Continued on the next page) Aditional Information for 2013 Net income is 5143,000 (Students Confirm this amount becting the income in the above list) Held-to-maturity securities (HTM) costing $25,000 were purchased put HIM securities were sold for canh during the yent at a loss of 89.000 There were no sales of PP&E during the year New equipment parchases were for cash No additional notes payable were instied during the year The accounts payable account is used only for inventory purchase Part A: Identify the most likely activity each account listed on the prior page is for statement of cash flows purposes. You may use abbreviations (ex OA, IA. FA, NC), Part B: Prepare the indirect reconciliation reconciling net income to net cash inflows from operating activities Note: A check figure is given below. You must show the complete reconciliation, including row descriptions, to receive full or partial credit. The number of lines shown is not necessarily indicative of how many you will need, Please list balance sheet account changes in the same order they appear on the account balance list (ex. list the change in accounts receivable before the change in inventory) $143.000 Net income Check figure: Net cash inflows from operating activities - S155,000 Part C: Complete the summary journal entry mwer each of the following statement. Recome wowerplate an accounchig, put a checkmark bestille name on the account alone to a Record depreciation expense for the year Account Name Debit Credit b. Record amortization expense on the patent for the year. Debit Credit Account Name c. How much cash was paid for new equipment purchases during the year? (Hint: Refer to the additional information) Account Name Debit Credit d. How much cash was received from customers during 2021? Account Name Dehit Credit e. How much cash was paid for inventory during 2021? Account Name Debit Credit f. How much cash was paid to purchase held-to-maturity securities during 2021? (Hint: Refer to the additional information) Account Name Debit Credit # How much cash was received on the sale of held-to-maturity securities during 20217. (Hint: Refer to the additional information Account Name Debit Credit How much cash was received for interest during 2021? Account Name Debit Credit 1. How much eash was paid for interest during 2021? Account Name Debit Credit How much cash was paid for income taxes during 2021? Account Name Debit Credit k. How much cash was paid for salaries during 2021? Account Name Debit Credit 1. How much cash was received from the issuance of stock? Account Name Debit Credit m. How much cash was received from the re-issuance of treasury stock? Account Name Debit Credit n. How much cash was paid for dividends during 20X1? Account Name Debit Credit o. How much cash was paid for the remaining operating expenses during 20X1? Account Name Debit Credit Part D: Accounting Checks Accounting check #1: Verify that the combined summary entries explain the overall change to the "Cash" account for the year. Accounting check #2: Verify that the cash flows associated with operating activities net to the net cash inflows from operating activities amount on your indirect reconciliation. Part E: Prepare the Statement of Cash Flows In each of your summary entries, identify where each cash flow should be reported by writing either OA, IA, or FA beside the cash account. Next, prepare a properly formatted statement of cash flows. A template is provided on the next page. All amounts shown should have a row description Proper formatting rules should be applied. Your indirect reconciliation should already be completed. You do not need to repeat it on the next page. Part E (continued) Holland Carp Statement of Cash Flows For the year ending 12/31/21 Operating Activities: Net cash inflows from operating activities Investing Activities: Net cash outflows from investing activities Financing Activities: Net cash outflows from financing activities Net increase in cash for the year Add: beginning cash balance Ending cash balance

OA Problem II: (54 points) Relow is a listing of the normal secount balance at the beginning and end of the year for Holland Corp Activity Type Account Name 123121 Cash $ 15,000 $ 17.000 Accounts Receivable (net) 10,000 8.000 Inventory 18,000 35.000 1,000 DA Supplies 2,000 Investment in Held-to-Maturity Securities 50,000 41,000 200,000 . Equipment 310,000 NC Accumulated Depreciation 60.000 75,000 Patent (net) 80.000 70,000 Accounts Payable 6,000 2.000 Salaries Payable 5,000 10,000 Income Taxes Payable 5.000 3,000 NC Deferred Tax Liability 8,000 2,000 Dividends Payable 5,000 7.000 30.000 Notes Payable 30,000 YA Discount on Note Payable 4.000 3,000 Common Stock (no par) 95.000 135,000 FA Treasury Stock 20,000 5,000 Retained Earnings 184.000 184.000 0 NC Dividends Declared 100,000 OA FA 0 ON Nc 0 0 0 0 0 DA CA ON NC DA Sales Revenue Estimated Sales Returns Interest Revenue Realized Loss on the sale of HTM Securities Cost of Goods Sold Salaries Expense Bad Debt Expense Depreciation Expense Amortization Expense (on the patent) Other Operating Expenses Interest Expense Income Tax Expense 500.000 10,000 2,000 9,000 130,000 80,000 5,000 15,000 10,000 72,000 3,000 25,000 0 0 0 0 OA 0 0 (Continued on the next page) Aditional Information for 2013 Net income is 5143,000 (Students Confirm this amount becting the income in the above list) Held-to-maturity securities (HTM) costing $25,000 were purchased put HIM securities were sold for canh during the yent at a loss of 89.000 There were no sales of PP&E during the year New equipment parchases were for cash No additional notes payable were instied during the year The accounts payable account is used only for inventory purchase Part A: Identify the most likely activity each account listed on the prior page is for statement of cash flows purposes. You may use abbreviations (ex OA, IA. FA, NC), Part B: Prepare the indirect reconciliation reconciling net income to net cash inflows from operating activities Note: A check figure is given below. You must show the complete reconciliation, including row descriptions, to receive full or partial credit. The number of lines shown is not necessarily indicative of how many you will need, Please list balance sheet account changes in the same order they appear on the account balance list (ex. list the change in accounts receivable before the change in inventory) $143.000 Net income Check figure: Net cash inflows from operating activities - S155,000 Part C: Complete the summary journal entry mwer each of the following statement. Recome wowerplate an accounchig, put a checkmark bestille name on the account alone to a Record depreciation expense for the year Account Name Debit Credit b. Record amortization expense on the patent for the year. Debit Credit Account Name c. How much cash was paid for new equipment purchases during the year? (Hint: Refer to the additional information) Account Name Debit Credit d. How much cash was received from customers during 2021? Account Name Dehit Credit e. How much cash was paid for inventory during 2021? Account Name Debit Credit f. How much cash was paid to purchase held-to-maturity securities during 2021? (Hint: Refer to the additional information) Account Name Debit Credit # How much cash was received on the sale of held-to-maturity securities during 20217. (Hint: Refer to the additional information Account Name Debit Credit How much cash was received for interest during 2021? Account Name Debit Credit 1. How much eash was paid for interest during 2021? Account Name Debit Credit How much cash was paid for income taxes during 2021? Account Name Debit Credit k. How much cash was paid for salaries during 2021? Account Name Debit Credit 1. How much cash was received from the issuance of stock? Account Name Debit Credit m. How much cash was received from the re-issuance of treasury stock? Account Name Debit Credit n. How much cash was paid for dividends during 20X1? Account Name Debit Credit o. How much cash was paid for the remaining operating expenses during 20X1? Account Name Debit Credit Part D: Accounting Checks Accounting check #1: Verify that the combined summary entries explain the overall change to the "Cash" account for the year. Accounting check #2: Verify that the cash flows associated with operating activities net to the net cash inflows from operating activities amount on your indirect reconciliation. Part E: Prepare the Statement of Cash Flows In each of your summary entries, identify where each cash flow should be reported by writing either OA, IA, or FA beside the cash account. Next, prepare a properly formatted statement of cash flows. A template is provided on the next page. All amounts shown should have a row description Proper formatting rules should be applied. Your indirect reconciliation should already be completed. You do not need to repeat it on the next page. Part E (continued) Holland Carp Statement of Cash Flows For the year ending 12/31/21 Operating Activities: Net cash inflows from operating activities Investing Activities: Net cash outflows from investing activities Financing Activities: Net cash outflows from financing activities Net increase in cash for the year Add: beginning cash balance Ending cash balance OA Problem II: (54 points) Relow is a listing of the normal secount balance at the beginning and end of the year for Holland Corp Activity Type Account Name 123121 Cash $ 15,000 $ 17.000 Accounts Receivable (net) 10,000 8.000 Inventory 18,000 35.000 1,000 DA Supplies 2,000 Investment in Held-to-Maturity Securities 50,000 41,000 200,000 . Equipment 310,000 NC Accumulated Depreciation 60.000 75,000 Patent (net) 80.000 70,000 Accounts Payable 6,000 2.000 Salaries Payable 5,000 10,000 Income Taxes Payable 5.000 3,000 NC Deferred Tax Liability 8,000 2,000 Dividends Payable 5,000 7.000 30.000 Notes Payable 30,000 YA Discount on Note Payable 4.000 3,000 Common Stock (no par) 95.000 135,000 FA Treasury Stock 20,000 5,000 Retained Earnings 184.000 184.000 0 NC Dividends Declared 100,000 OA FA 0 ON Nc 0 0 0 0 0 DA CA ON NC DA Sales Revenue Estimated Sales Returns Interest Revenue Realized Loss on the sale of HTM Securities Cost of Goods Sold Salaries Expense Bad Debt Expense Depreciation Expense Amortization Expense (on the patent) Other Operating Expenses Interest Expense Income Tax Expense 500.000 10,000 2,000 9,000 130,000 80,000 5,000 15,000 10,000 72,000 3,000 25,000 0 0 0 0 OA 0 0 (Continued on the next page) Aditional Information for 2013 Net income is 5143,000 (Students Confirm this amount becting the income in the above list) Held-to-maturity securities (HTM) costing $25,000 were purchased put HIM securities were sold for canh during the yent at a loss of 89.000 There were no sales of PP&E during the year New equipment parchases were for cash No additional notes payable were instied during the year The accounts payable account is used only for inventory purchase Part A: Identify the most likely activity each account listed on the prior page is for statement of cash flows purposes. You may use abbreviations (ex OA, IA. FA, NC), Part B: Prepare the indirect reconciliation reconciling net income to net cash inflows from operating activities Note: A check figure is given below. You must show the complete reconciliation, including row descriptions, to receive full or partial credit. The number of lines shown is not necessarily indicative of how many you will need, Please list balance sheet account changes in the same order they appear on the account balance list (ex. list the change in accounts receivable before the change in inventory) $143.000 Net income Check figure: Net cash inflows from operating activities - S155,000 Part C: Complete the summary journal entry mwer each of the following statement. Recome wowerplate an accounchig, put a checkmark bestille name on the account alone to a Record depreciation expense for the year Account Name Debit Credit b. Record amortization expense on the patent for the year. Debit Credit Account Name c. How much cash was paid for new equipment purchases during the year? (Hint: Refer to the additional information) Account Name Debit Credit d. How much cash was received from customers during 2021? Account Name Dehit Credit e. How much cash was paid for inventory during 2021? Account Name Debit Credit f. How much cash was paid to purchase held-to-maturity securities during 2021? (Hint: Refer to the additional information) Account Name Debit Credit # How much cash was received on the sale of held-to-maturity securities during 20217. (Hint: Refer to the additional information Account Name Debit Credit How much cash was received for interest during 2021? Account Name Debit Credit 1. How much eash was paid for interest during 2021? Account Name Debit Credit How much cash was paid for income taxes during 2021? Account Name Debit Credit k. How much cash was paid for salaries during 2021? Account Name Debit Credit 1. How much cash was received from the issuance of stock? Account Name Debit Credit m. How much cash was received from the re-issuance of treasury stock? Account Name Debit Credit n. How much cash was paid for dividends during 20X1? Account Name Debit Credit o. How much cash was paid for the remaining operating expenses during 20X1? Account Name Debit Credit Part D: Accounting Checks Accounting check #1: Verify that the combined summary entries explain the overall change to the "Cash" account for the year. Accounting check #2: Verify that the cash flows associated with operating activities net to the net cash inflows from operating activities amount on your indirect reconciliation. Part E: Prepare the Statement of Cash Flows In each of your summary entries, identify where each cash flow should be reported by writing either OA, IA, or FA beside the cash account. Next, prepare a properly formatted statement of cash flows. A template is provided on the next page. All amounts shown should have a row description Proper formatting rules should be applied. Your indirect reconciliation should already be completed. You do not need to repeat it on the next page. Part E (continued) Holland Carp Statement of Cash Flows For the year ending 12/31/21 Operating Activities: Net cash inflows from operating activities Investing Activities: Net cash outflows from investing activities Financing Activities: Net cash outflows from financing activities Net increase in cash for the year Add: beginning cash balance Ending cash balance

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started