Question

Oak Enterprises accepts projects earning more than the firm's 14% cost of capital. Oak is currently considering a 10-year project that provides annual cash inflows

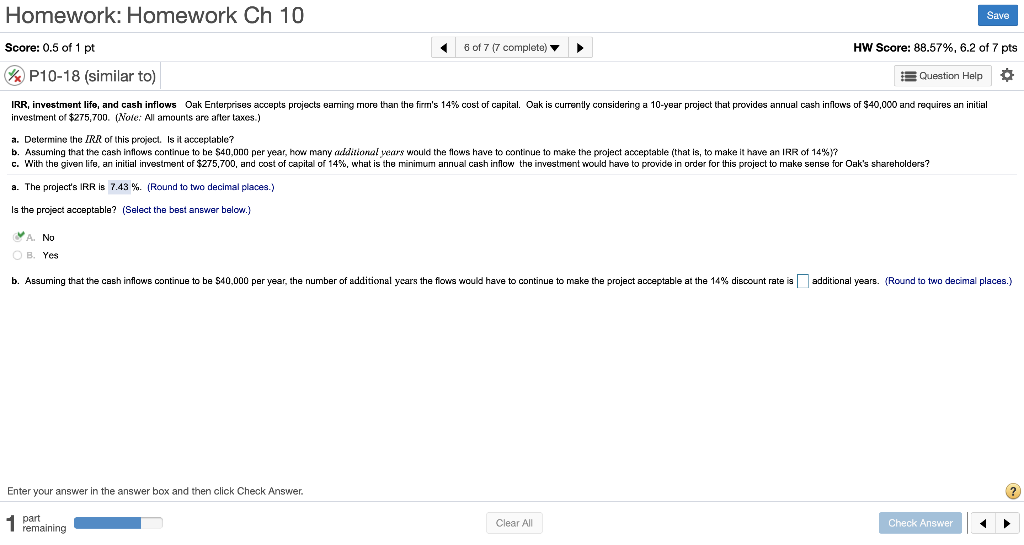

Oak Enterprises accepts projects earning more than the firm's 14% cost of capital. Oak is currently considering a 10-year project that provides annual cash inflows of $40 comma 000 and requires an initial investment of $275 comma 700. (Note: All amounts are after taxes.) a.Determine the IRR of this project. Is it acceptable? b.Assuming that the cash inflows continue to be $40 comma 000 per year, how many additional years would the flows have to continue to make the project acceptable (that is, to make it have an IRR of 14%)? c.With the given life, an initial investment of $275 comma 700, and cost of capital of 14%, what is the minimum annual cash inflow the investment would have to provide in order for this project to make sense for Oak's shareholders? a.The project's IRR is 7.43%. (Round to two decimal places.) Is the project acceptable?(Select the best answer below.) A. No Your answer is correct.B. Yes b.Assuming that the cash inflows continue to be $40 comma 000 per year, the number of additional years the flows would have to continue to make the project acceptable at the 14% discount rate is nothing additional years.(Round to two decimal place

Oak Enterprises accepts projects earning more than the firm's 14% cost of capital. Oak is currently considering a 10-year project that provides annual cash inflows of $40 comma 000 and requires an initial investment of $275 comma 700. (Note: All amounts are after taxes.) a.Determine the IRR of this project. Is it acceptable? b.Assuming that the cash inflows continue to be $40 comma 000 per year, how many additional years would the flows have to continue to make the project acceptable (that is, to make it have an IRR of 14%)? c.With the given life, an initial investment of $275 comma 700, and cost of capital of 14%, what is the minimum annual cash inflow the investment would have to provide in order for this project to make sense for Oak's shareholders? a.The project's IRR is 7.43%. (Round to two decimal places.) Is the project acceptable?(Select the best answer below.) A. No Your answer is correct.B. Yes b.Assuming that the cash inflows continue to be $40 comma 000 per year, the number of additional years the flows would have to continue to make the project acceptable at the 14% discount rate is nothing additional years.(Round to two decimal place

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started