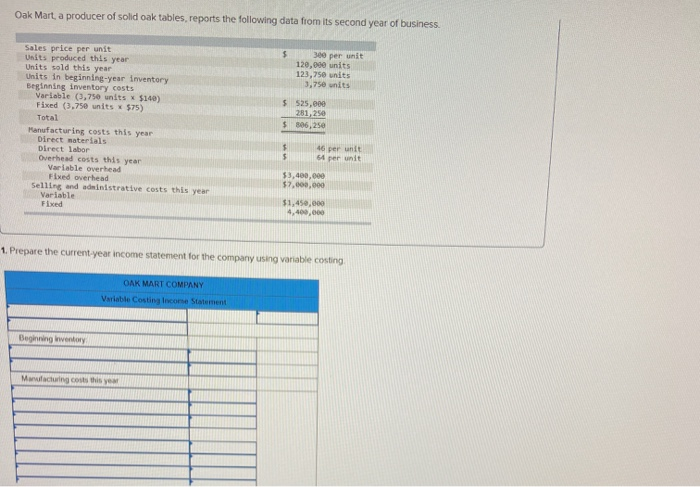

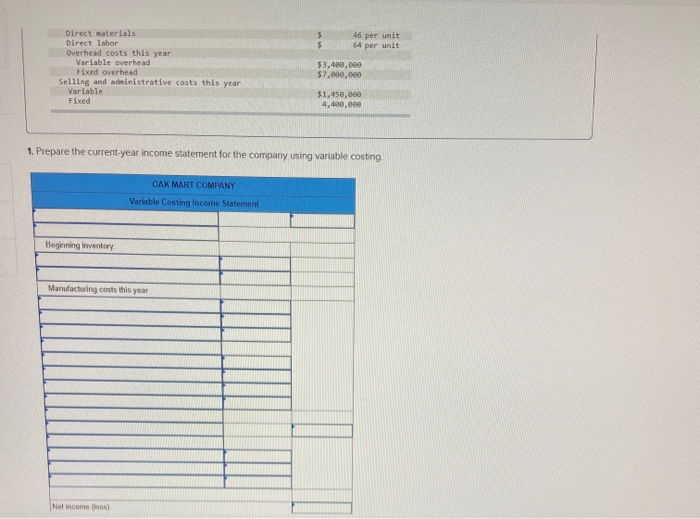

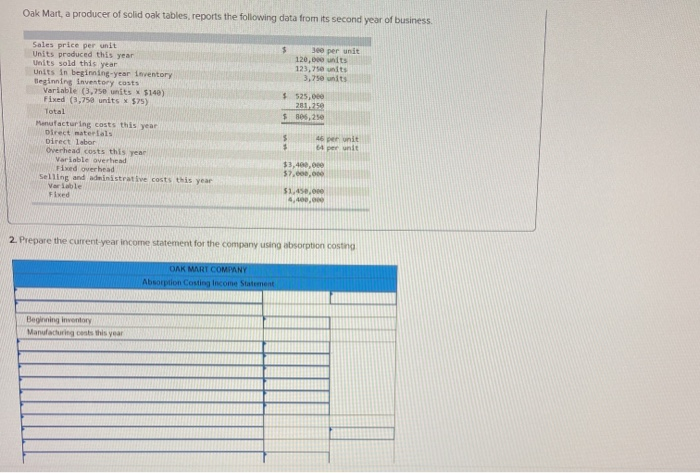

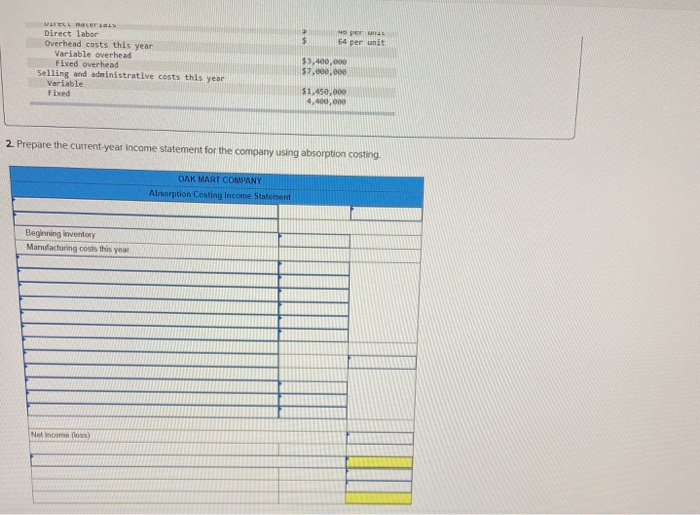

Oak Mart, a producer of solid oak tables, reports the following data from its second year of business. $ 300 per unit 120,000 units 123,750 units 3,750 units Sales price per unit Units produced this year Units sold this year Units in beginning-year Inventory Beginning inventory costs Variable (3,750 units 5140) Fixed (3.750 units 575) Total Manufacturing costs this year Direct materials Direct labor Overhead costs this year Variable overhead Fixed overhead Selling and administrative costs this year Variable Fixed $ 525,000 281,250 $ 306,250 $ $ 46 per unit 54 per unit $3,400,000 $7,000,000 $1,450,000 4,400,000 1. Prepare the current year income statement for the company using variable costing OAK MART COMPANY Variable Costing Income Statement Beginning inventory Manufacturing costs this year $ 46 per unit 64 per unit Direct materials Direct labor Overhead costs this year Variable overhead Fixed overhead Selling and administrative costs this year Variable Fixed $3,400,000 $7,000,000 $1,450,000 4,490,000 1. Prepare the current-year income statement for the company using variable costing OAK MART COMPANY Variable Costing Income Statement Beginning inventory Manufacturing costs this year Nel income (0) Oak Mart, a producer of solid oak tables, reports the following data from its second year of business. Sales price per unit Units produced this year Units sold this year Units in beginning-year inventory Beginning inventory costs Variable (3.750 units $140) Fixed (3,758 units x 575) Total Manufacturing costs this year Direct materials Direct labor Overhead costs this year Variable overhead Find overhead Selling and administrative costs this year Variable 300 per unit 120,000 units 123,70 units 3,750 units $ 525.000 20125 $ 305,250 $ $ 46 per unit 64 per unit $3,400,000 57,000.00 Fixed $1,450.000 4,400,000 2. Prepare the current-year income statement for the company using absorption costing OAK MART COMPANY Absorption Costing Income Statement Beginning inventory Manufacturing costs this year NO PS 64 per unit VRELL LLLS Direct labor Overhead costs this year Variable overhead Fixed overhead Selling and administrative costs this year Variable Fixed $3,400,000 57,000,000 $1,450,000 4,400,000 2. Prepare the current year income statement for the company using absorption costing OAK MART COMPANY Absorption Costing Income Statement Beginning inventory Manufacturing costs this year Net Income foss)