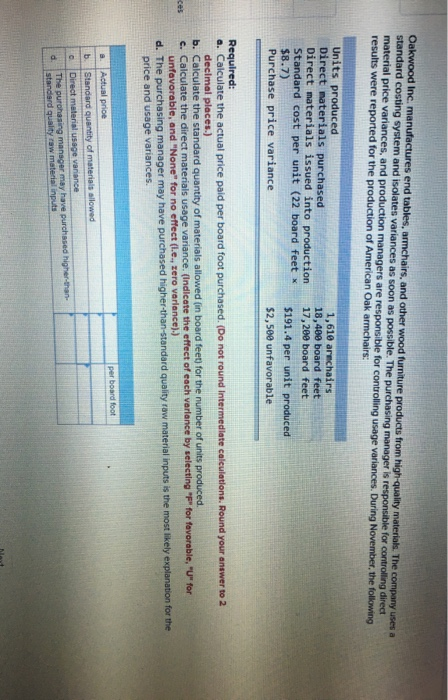

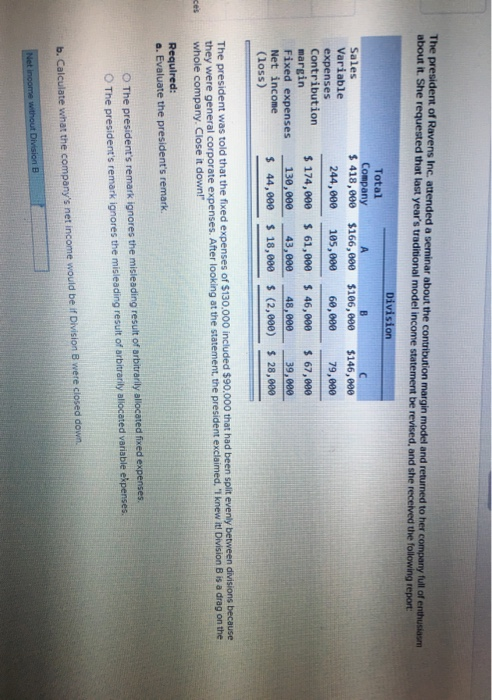

Oakwood Inc. manufactures end tables, armchairs, and other wood furniture products from high-quality materials. The company uses a standard costing system and isolates variances as soon as possible. The purchasing manager is responsible for controlling direct material price variances, and production managers are responsible for controlling usage variances. During November, the following results were reported for the production of American Oak armchairs: Units produced Direct materials purchased Direct materials issued into production Standard cost per unit (22 board feet x $8.7) Purchase price variance 1,610 arechairs 18,400 board feet 17,200 board feet $191.4 per unit produced $2,500 unfavorable Required: a. Calculate the actual price paid per board foot purchased. (Do not round Intermediate calculations. Round your answer to 2 decimal places.) b. Calculate the standard quantity of materials allowed (in board feet) for the number of units produced. c. Calculate the direct materials usage variance. (Indicate the effect of each varlance by selecting "F" for favorable, "U" for unfavorable, and "None" for no effect (L.e, zero varlance).) d. The purchasing manager may have purchased higher-than-standard quality raw material inputs is the most likely explanation for the price and usage variances ces per board foot Actual prioe b. Standard queantity of materials allowed Direct material usage variance The purahasing manager may have purchased higher-than standsrd qualty raw material inputs The president of Ravens Inc. attended a seminar about the contribution margin model and returned to her company full of enthusiasm about it. She requested that last year's traditional model income statement be revised, and she recelved the following report Division Total Company $ 418,000 $166,000 $106,e8e A C $146,ee0 Sales Variable expenses Contribution margin Fixed expenses Net income 244,000 105,080 60,000 79,000 $ 174,e00 $ 61,000 $ 46,000 $ 67,000 130,000 43,000 48,000 39,000 $ 44,000 18,000 (2,e00) $28,000 (loss) The president was told that the fixed expenses of $130,000 included $90,000 that had been split evenly between divisions because they were general corporate expenses. After looking at the statement, the president exclaimed, 1 knew it! Division B is a drag on the whole company. Close it down!" ces Required: a. Evaluate the president's remark. O The president's remark ignores the misleading result of arbitrarily allocated fixed expenses. O The president's remark ignores the misleading result of arbitrarily aliocated variable ekpenses. b. Calculate what the company's net income would be if Division 8 were closed down Net inoome without Division B