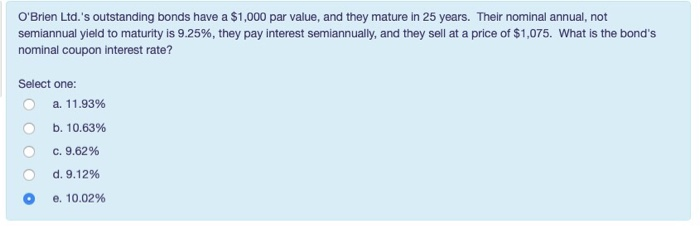

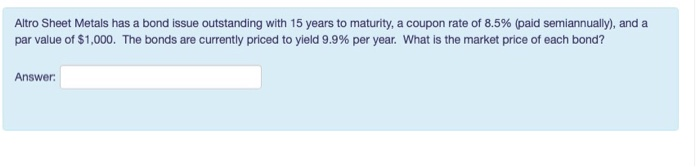

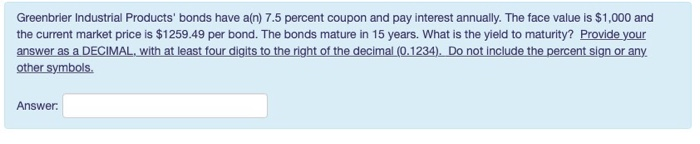

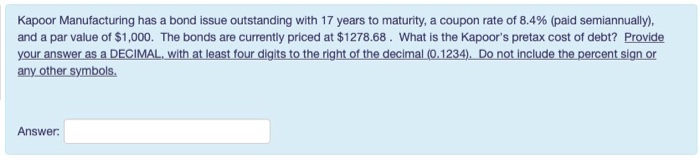

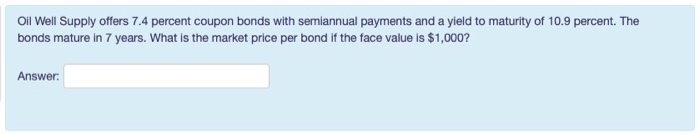

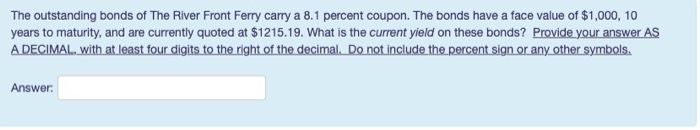

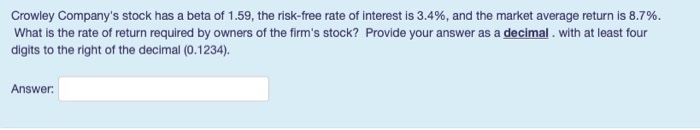

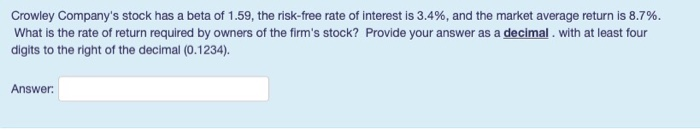

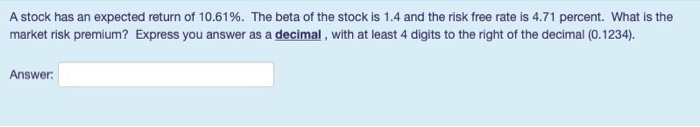

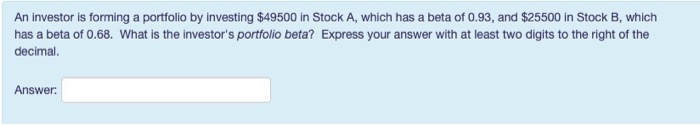

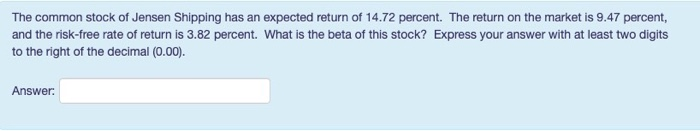

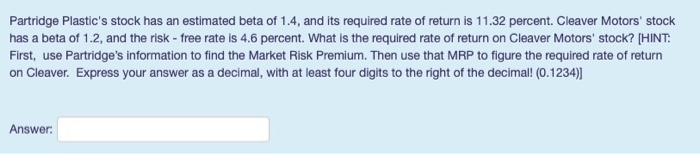

O'Brien Ltd.'s outstanding bonds have a $1,000 par value, and they mature in 25 years. Their nominal annual, not semiannual yield to maturity is 9.25%, they pay interest semiannually, and they sell at a price of $1,075, what is the bond's nominal coupon interest rate? Select one: a. 11.93% b. 10.63% . 9.62% d, 9.12% e. 10.02% O Altro Sheet Metals has a bond issue outstanding with 15 years to maturity, a coupon rate of 8.5% (paid semiannually), and a par value of $1,000. The bonds are currently priced to yield 9.9% per year. What is the market price of each bond? Answer: Greenbrier Industrial Products' bonds have a(n) 7.5 percent coupon and pay interest annually. The face value is $1,000 and the current market price is $1259.49 per bond. The bonds mature in 15 years. What is the yield to maturity? Provide your Answer Kapoor Manufacturing has a bond issue ou standing with 17 years to maturity, a coupon rate of 8.4% (paid semiannually. and a par value of $1,000. The bonds are currently priced at $1278.68. What is the Kapoor's pretax cost of debt? Provide ). Do not include the percent sign or Answer Oil Well Supply offers 7.4 percent coupon bonds with semiannual payments and a yield to maturity of 10.9 percent. The bonds mature in 7 years. What is the market price per bond if the face value is $1,000? Answer The outstanding bonds of The River Front Ferry carry a 8.1 percent coupon. The bonds have a face value of $1,000, 10 years to maturity, and are currently quoted at $1215.19. What is the current yield on these bonds? Provide your answer AS Answer Crowley Company's stock has a beta of 1.59, the risk-free rate of interest is 3.4%, and the market average return is 8.7%. What is the rate of return required by owners of the firm's stock? Provide your answer as a decimal. with at least four digits to the right of the decimal (0.1234). Answer: Crowley Company's stock has a beta of 1.59, the risk-free rate of interest is 3.4%, and the market average return is 8.7%. What is the rate of return required by owners of the firm's stock? Provide your answer as a decimal. with at least four digits to the right of the decimal (0.1234). Answer: A stock has an expected return of 10.61%. The beta of the stock is 1.4 and the risk free rate is 4.71 percent. What is the market risk premium? Express you answer as a decimal, with at least 4 digits to the right of the decimal (0.1234). Answer. An investor is forming a portfolio by investing $49500 in Stock A, which has a beta of 0.93, and $25500 in Stock B, which has a beta of 0.68. What is the investor's portfolio beta? Express your answer with at least two digits to the right of the decimal. Answer The common stock of Jensen Shipping has an expected return of 14.72 percent. The return on the market is 9.47 percent, and the risk-free rate of return is 3.82 percent. What is the beta of this stock? Express your answer with at least two digits to the right of the decimal (0.00) Answer Partridge Plastic's stock has an estimated beta of 1.4, and its required rate of return is 11.32 percent. Cleaver Motors' stock has a beta of 1.2, and the risk - free rate is 4.6 percent. What is the required rate of return on Cleaver Motors' stock? [HINT: First, use Partridge's information to find the Market Risk Premium. Then use that MRP to figure the required rate of return on Cleaver. Express your answer as a decimal, with at least four digits to the right of the decimal! (0.1234)]