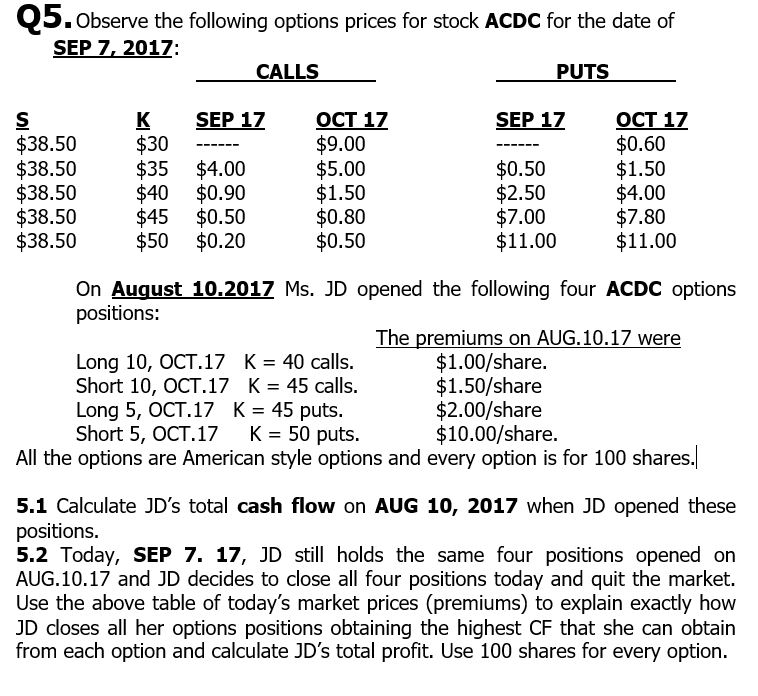

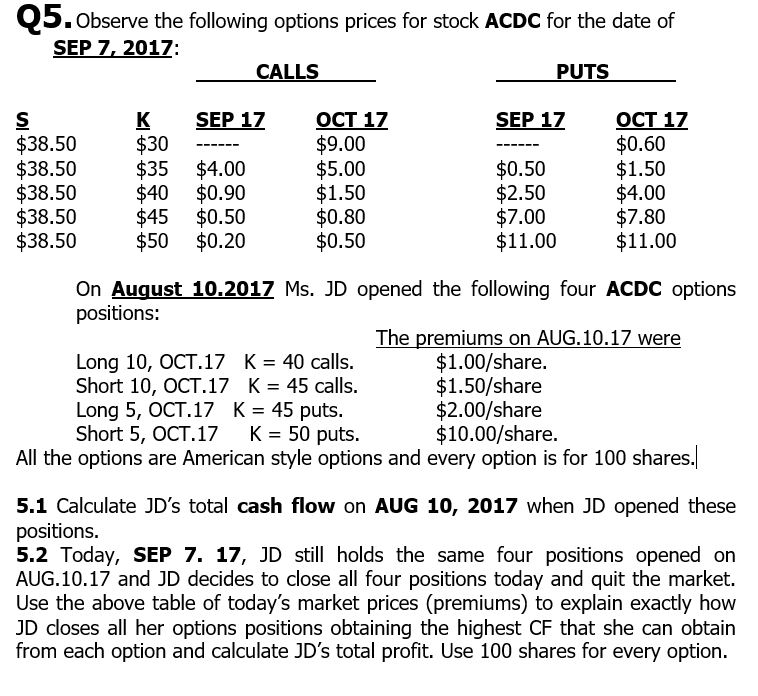

. Observe the following options prices for stock ACDC for the date of SEP 7, 2017: CALLS PUTS K SEP 17 SEP 17 $38.50 $38.50 $38.50 $38.50 $38.50 $30 $35 $40 $45 $50 $4.00 $0.90 $0.50 $0.20 OCT 17 $9.00 $5.00 $1.50 $0.80 $0.50 $0.50 $2.50 $7.00 $11.00 OCT 17 $0.60 $1.50 $4.00 $7.80 $11.00 On August 10.2017 Ms. JD opened the following four ACDC options positions: The premiums on AUG.10.17 were Long 10, OCT.17 K = 40 calls. $1.00/share. Short 10, OCT.17 K= 45 calls. $1.50/share Long 5, OCT.17 K = 45 puts. $2.00/share Short 5, OCT.17 K = 50 puts. $10.00/share. All the options are American style options and every option is for 100 shares. 5.1 Calculate JD's total cash flow on AUG 10, 2017 when JD opened these positions. 5.2 Today, SEP 7. 17, JD still holds the same four positions opened on AUG.10.17 and JD decides to close all four positions today and quit the market. Use the above table of today's market prices (premiums) to explain exactly how JD closes all her options positions obtaining the highest CF that she can obtain from each option and calculate JD's total profit. Use 100 shares for every option. . Observe the following options prices for stock ACDC for the date of SEP 7, 2017: CALLS PUTS K SEP 17 SEP 17 $38.50 $38.50 $38.50 $38.50 $38.50 $30 $35 $40 $45 $50 $4.00 $0.90 $0.50 $0.20 OCT 17 $9.00 $5.00 $1.50 $0.80 $0.50 $0.50 $2.50 $7.00 $11.00 OCT 17 $0.60 $1.50 $4.00 $7.80 $11.00 On August 10.2017 Ms. JD opened the following four ACDC options positions: The premiums on AUG.10.17 were Long 10, OCT.17 K = 40 calls. $1.00/share. Short 10, OCT.17 K= 45 calls. $1.50/share Long 5, OCT.17 K = 45 puts. $2.00/share Short 5, OCT.17 K = 50 puts. $10.00/share. All the options are American style options and every option is for 100 shares. 5.1 Calculate JD's total cash flow on AUG 10, 2017 when JD opened these positions. 5.2 Today, SEP 7. 17, JD still holds the same four positions opened on AUG.10.17 and JD decides to close all four positions today and quit the market. Use the above table of today's market prices (premiums) to explain exactly how JD closes all her options positions obtaining the highest CF that she can obtain from each option and calculate JD's total profit. Use 100 shares for every option