Answered step by step

Verified Expert Solution

Question

1 Approved Answer

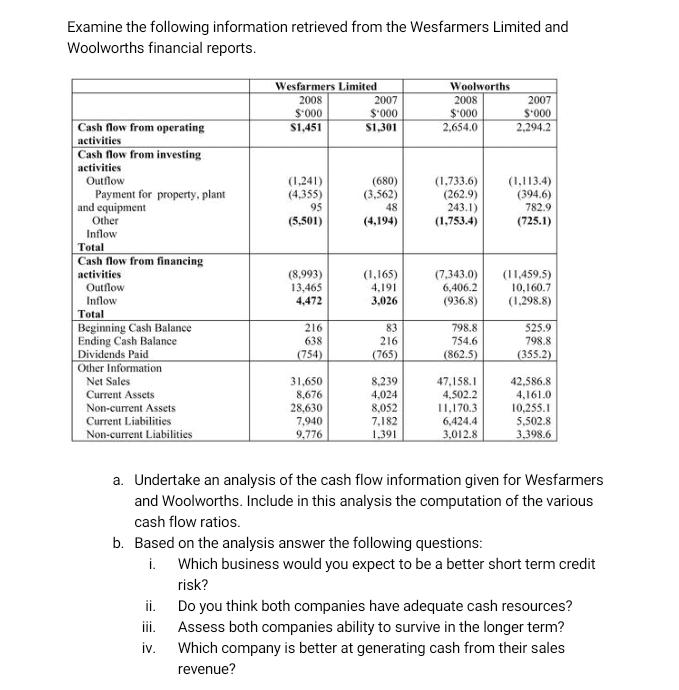

Examine the following information retrieved from the Wesfarmers Limited and Woolworths financial reports. Cash flow from operating activities Cash flow from investing activities Outflow

Examine the following information retrieved from the Wesfarmers Limited and Woolworths financial reports. Cash flow from operating activities Cash flow from investing activities Outflow Payment for property, plant and equipment Other Inflow Total Cash flow from financing activities Outflow Inflow Total Beginning Cash Balance Ending Cash Balance Dividends Paid Other Information Net Sales Current Assets Non-current Assets Current Liabilities Non-current Liabilities Wesfarmers Limited 2008 $.000 $1,451 (1,241) (4,355) 95 (5,501) ii. iii. iv. (8,993) 13,465 4,472 216 638 (754) 31,650 8,676 28,630 7,940 9.776 2007 $'000 $1,301 (680) (3,562) 48 (4,194) (1,165) 4,191 3,026 83 216 (765) 8,239 4,024 8,052 7,182 1.391 Woolworths 2008 $'000 2,654.0 (1,733.6) (262.9) 243.1) (1,753.4) (7,343.0) 6,406.2 (936.8) 798.8 754.6 (862.5) 47,158.1 4,502.2 11,170.3 6,424.4 3,012.8 2007 $'000 2,294.2 (1,113.4) (394.6) 782.9 (725.1) (11,459.5) 10,160.7 (1,298.8) 525.9 798.8 (355.2) 42,586.8 4,161.0 10,255.1 5,502.8 3,398.6 a. Undertake an analysis of the cash flow information given for Wesfarmers and Woolworths. Include in this analysis the computation of the various cash flow ratios. b. Based on the analysis answer the following questions: i. Which business would you expect to be a better short term credit risk? Do you think both companies have adequate cash resources? Assess both companies ability to survive in the longer term? Which company is better at generating cash from their sales revenue?

Step by Step Solution

★★★★★

3.38 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

Wesfarmers Limited Woolworths 2008 2007 2008 2007 a Cash flow margin ratio Cashflow from operation S...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

635d612b3151a_175056.pdf

180 KBs PDF File

635d612b3151a_175056.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started