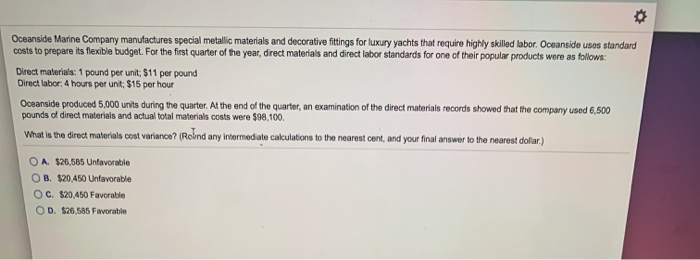

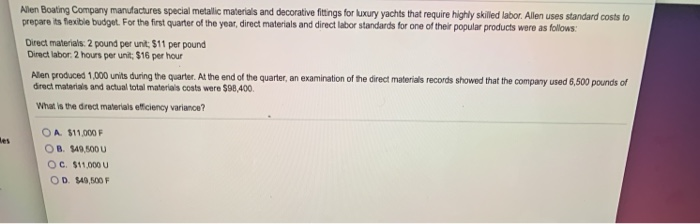

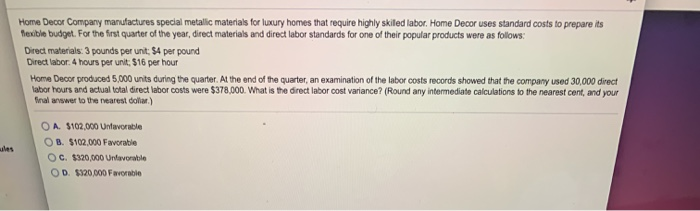

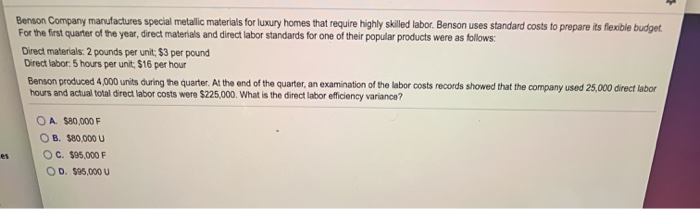

Oceanside Marine Company manufactures special metallic materials and decorative fittings for luxury yachts that require highly skilled labor. Oceanside usos standard costs to prepare its flexible budget. For the first quarter of the year, direct materials and direct labor standards for one of their popular products were as follows: Direct materials: 1 pound per unit, $11 per pound Direct labor 4 hours per unt;$15 per hour Oceanside produced 5,000 units during the quarter. At the end of the quarter, an examination of the direct materials records showed that the company used 6,500 pounds of direct materials and actual total materials costs were $98, 100. What is the direct materials cost variance? Round any intermediate calculations to the nearest cent, and your final answer to the nearest dollar) O A $26,585 Unfavorable OB. $20,450 Unfavorable O C. $20,450 Favorable OD. $26,585 Favorable Allen Boating Company manufactures special metalic materials and decorative fittings for luxury yachts that require highly skilled labor. Allen uses standard costs to prepare its flexible budget. For the first quarter of the year, direct materials and direct labor standards for one of their popular products were as follows: Direct materials: 2 pound per unit: $11 per pound Direct labor: 2 hours per unit; $16 per hour Alen produced 1,000 units during the quarter. At the end of the quarter, an examination of the direct materials records showed that the company used 6,500 pounds of direct materials and actual total materials costs were $98,400 What is the direct materials effciency variance? OA. $11.000 F OB. 349,500U OC $11,000 U OD $49,500 F Home Decor Company manufactures special metallic materials for luxury homes that require highly skilled labor. Home Decor uses standard costs to prepare its Texible budget. For the first quarter of the year, direct materials and direct labor standards for one of their popular products were as follows: Direct materials: 3 pounds per unit: $4 per pound Direct labor. 4 hours per unit: $16 per hour Home Decor produced 5,000 unts during the quarter. At the end of the quarter, an examination of the labor costs records showed that the company used 30,000 direct labor hours and actual total direct labor costs were $378,000. What is the direct labor cost variance? (Round any intermediate calculations to the nearest cont, and your final answer to the rearest dollar) O A $102,000 Untavorable OB. $102,000 Favorable O C. $320,000 Unfavorable OD. $320,000 Favorable Benson Company manufactures special metallic materials for luxury homes that require highly skilled labor. Benson uses standard costs to prepare its flexible budget. For the first quarter of the year, direct materials and direct labor standards for one of their popular products were as follows: Direct materials: 2 pounds per unit: $3 per pound Direct labor: 5 hours per unit: $16 per hour Benson produced 4,000 units during the quarter. At the end of the quarter, an examination of the labor costs records showed that the company used 25,000 direct labor hours and actual total direct labor costs were $225,000. What is the direct labor efficiency variance? A $80,000 F B. $80,000 U OC. $95.000 F OD. $95.000 U es