Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Ocsic Motors Limited is considering purchasing a bumper manufacturing machine. The machine will result in before tax cost savings of $100,000 per year for

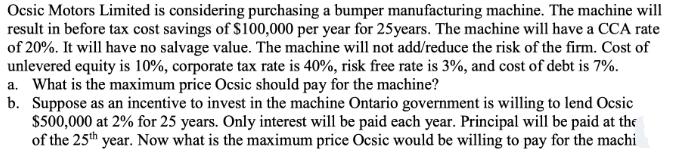

Ocsic Motors Limited is considering purchasing a bumper manufacturing machine. The machine will result in before tax cost savings of $100,000 per year for 25 years. The machine will have a CCA rate of 20%. It will have no salvage value. The machine will not add/reduce the risk of the firm. Cost of unlevered equity is 10%, corporate tax rate is 40%, risk free rate is 3%, and cost of debt is 7%. a. What is the maximum price Ocsic should pay for the machine? b. Suppose as an incentive to invest in the machine Ontario government is willing to lend Ocsic $500,000 at 2% for 25 years. Only interest will be paid each year. Principal will be paid at the of the 25th year. Now what is the maximum price Ocsic would be willing to pay for the machi

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To calculate the maximum price that Ocsic should be willing to pay for the machine we can use the Net Present Value NPV method The NPV is the present ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started