Answered step by step

Verified Expert Solution

Question

1 Approved Answer

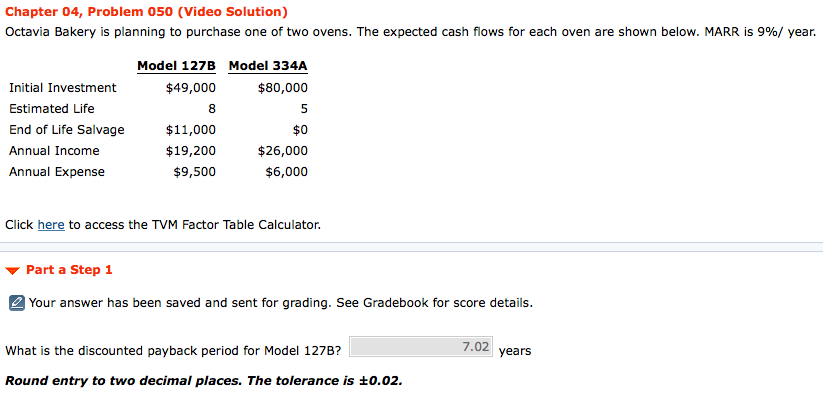

Octavia Bakery is planning to purchase one of two ovens. The expected cash flows for each oven are shown below. MARR is 9%/ year. What

Octavia Bakery is planning to purchase one of two ovens. The expected cash flows for each oven are shown below. MARR is 9%/ year. What is the discounted payback period for Model 334A??? (years)

Chapter 04, Problem 050 (Video Solution) Octavia Bakery is planning to purchase one of two ovens. The expected cash flows for each oven are shown below. MARR is 9%/ year. Initial Investment Estimated Life End of Life Salvage$11,000 Annual Income Annual Expense Model 127B Model 334A $80,000 5 $0 $26,000 $6,000 $49,000 8 $19,200 $9,500 Click here to access the TVM Factor Table Calculator. Part a Step 1 Your answer has been saved and sent for grading. See Gradebook for score details. What is the discounted payback period for Model 127B? 7.02 years Round entry to two decimal places. The tolerance is 0.02

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started