Answered step by step

Verified Expert Solution

Question

1 Approved Answer

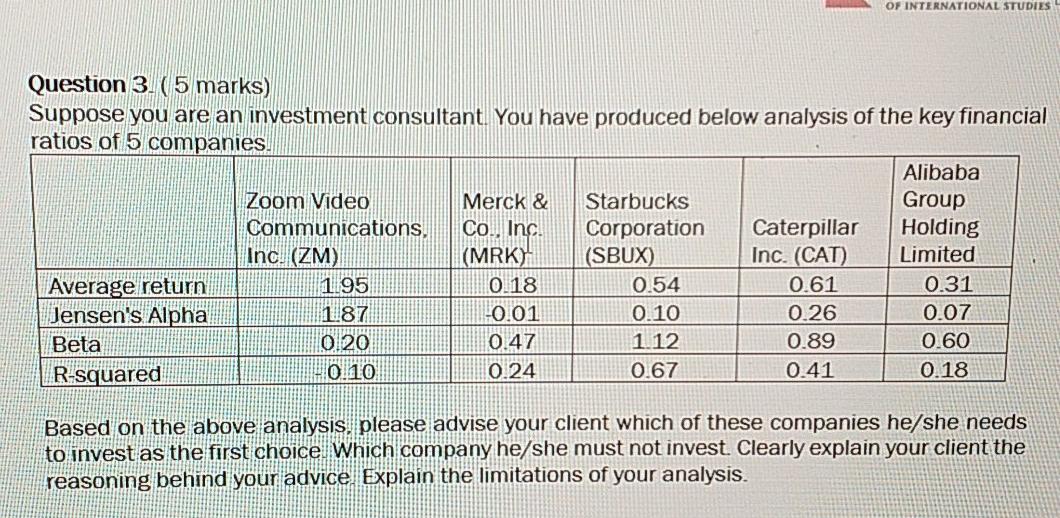

OF INTERNATIONAL STUDIES Question 3. (5 marks) Suppose you are an investment consultant. You have produced below analysis of the key financial ratios of 5

OF INTERNATIONAL STUDIES Question 3. (5 marks) Suppose you are an investment consultant. You have produced below analysis of the key financial ratios of 5 companies. Alibaba Zoom Video Merck & Starbucks Group Communications, Co., Inc. Corporation Caterpillar Holding Inc. (ZM) (MRK) (SBUX) Inc. (CAT) Limited Average return 1.95 0.18 0.54 0.61 0.31 Jensen's Alpha 1187 0.01 0.10 0.26 0.07 Beta 0.20 0.47 1.12 0.89 0.60 R-squared 010 0.24 0.67 0.41 0.18 Based on the above analysis, please advise your client which of these companies he/she needs to invest as the first choice. Which company he/she must not invest Clearly explain your client the reasoning behind your advice. Explain the limitations of your analysis

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started