Answered step by step

Verified Expert Solution

Question

1 Approved Answer

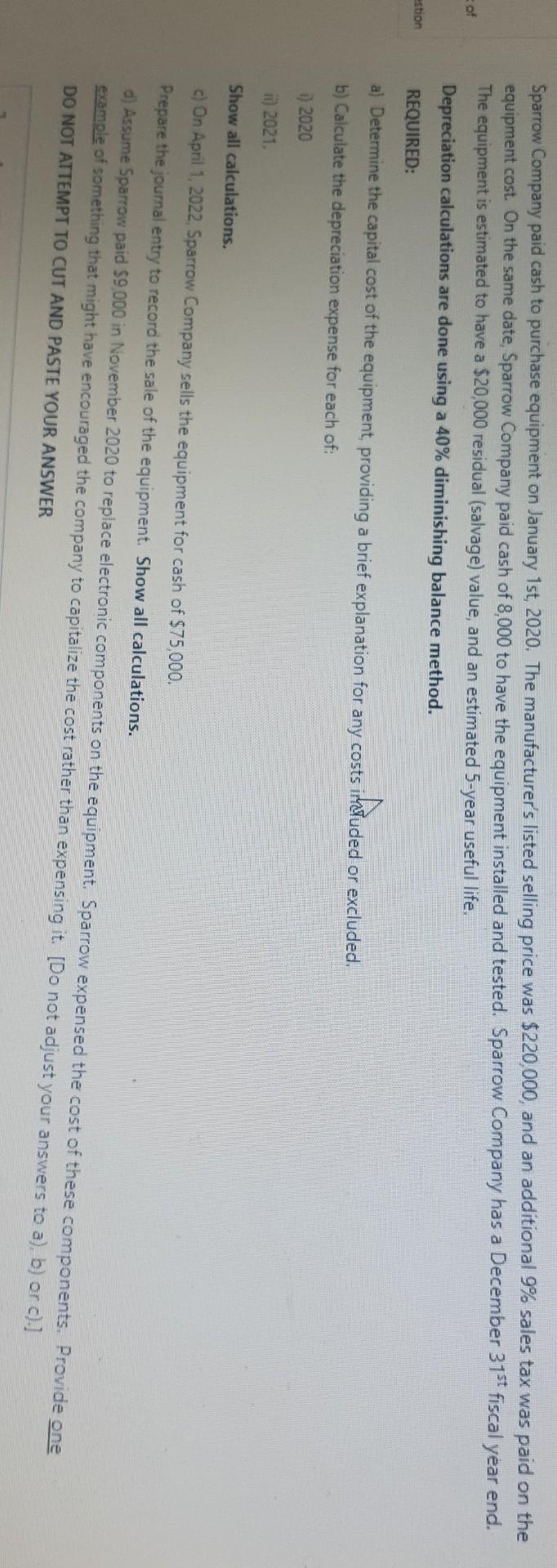

=of Sparrow Company paid cash to purchase equipment on January 1st, 2020. The manufacturer's listed selling price was $220,000, and an additional 9% sales tax

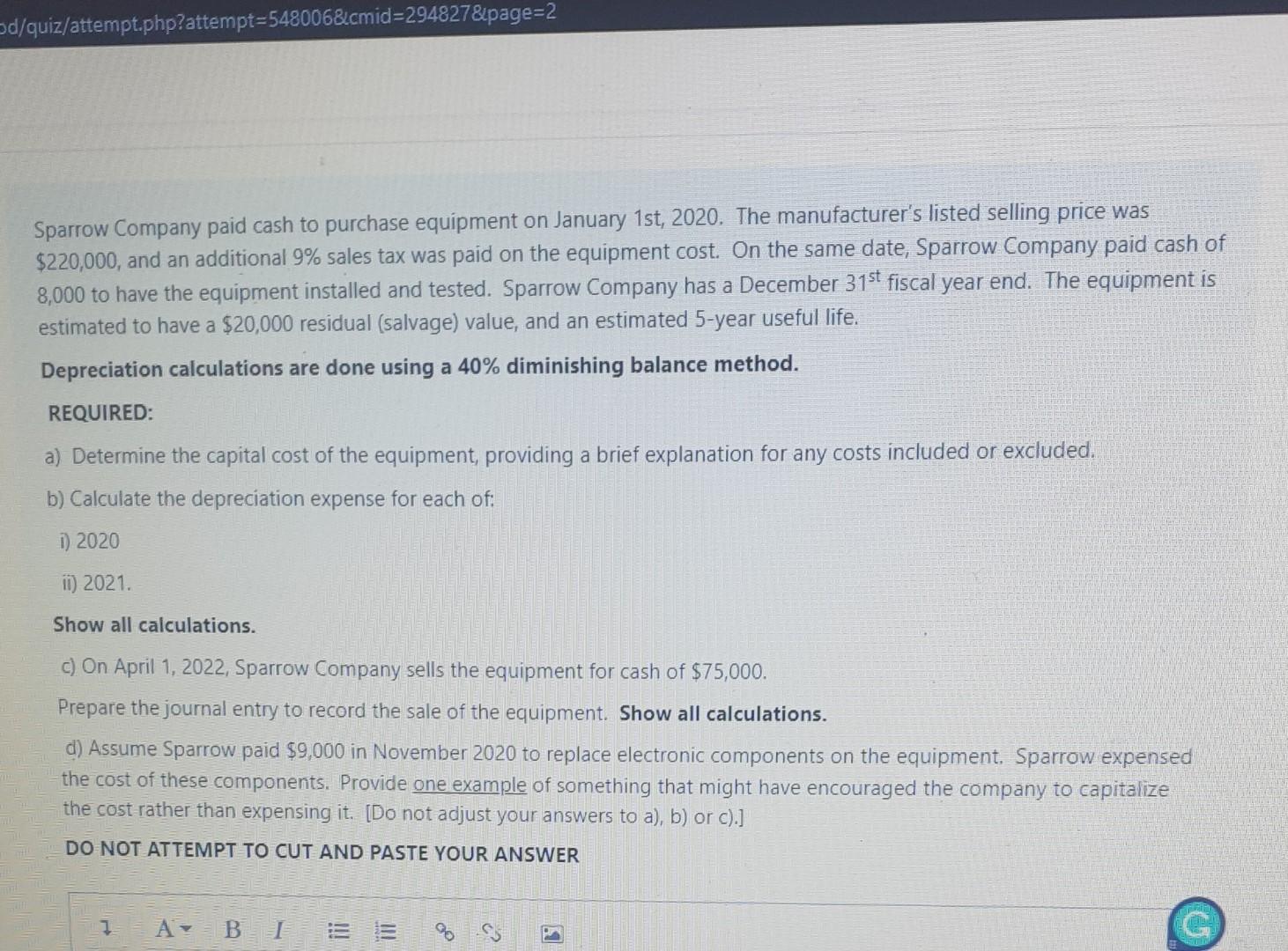

=of Sparrow Company paid cash to purchase equipment on January 1st, 2020. The manufacturer's listed selling price was $220,000, and an additional 9% sales tax was paid on the equipment cost. On the same date, Sparrow Company paid cash of 8,000 to have the equipment installed and tested. Sparrow Company has a December 31st fiscal year end. The equipment is estimated to have a $20,000 residual (salvage) value, and an estimated 5-year useful life. Depreciation calculations are done using a 40% diminishing balance method. REQUIRED: a) Determine the capital cost of the equipment, providing a brief explanation for any costs included or excluded. included b) Calculate the depreciation expense for each of: 1) 2020 estion ii) 2021 Show all calculations. c) On April 1, 2022, Sparrow Company sells the equipment for cash of $75,000. Prepare the journal entry to record the sale of the equipment Show all calculations. d) Assume Sparrow paid $9.000 in November 2020 to replace electronic components on the equipment. Sparrow expensed the cost of these components. Provide one example of something that might have encouraged the company to capitalize the cost rather than expensing it. [Do not adjust your answers to a), b) or c).] DO NOT ATTEMPT TO CUT AND PASTE YOUR ANSWER od/quiz/attempt.php?attempt=548006&_cmid=294827&page=2 Sparrow Company paid cash to purchase equipment on January 1st, 2020. The manufacturer's listed selling price was $220,000, and an additional 9% sales tax was paid on the equipment cost. On the same date, Sparrow Company paid cash of 8,000 to have the equipment installed and tested. Sparrow Company has a December 31st fiscal year end. The equipment is estimated to have a $20,000 residual (salvage) value, and an estimated 5-year useful life. Depreciation calculations are done using a 40% diminishing balance method. REQUIRED: a) Determine the capital cost of the equipment, providing a brief explanation for any costs included or excluded. b) Calculate the depreciation expense for each of: i) 2020 ii) 2021. Show all calculations. c) On April 1, 2022, Sparrow Company sells the equipment for cash of $75,000. Prepare the journal entry to record the sale of the equipment. Show all calculations. d) Assume Sparrow paid $9,000 in November 2020 to replace electronic components on the equipment. Sparrow expensed the cost of these components. Provide one example of something that might have encouraged the company to capitalize the cost rather than expensing it. (Do not adjust your answers to a), b) or c).] DO NOT ATTEMPT TO CUT AND PASTE YOUR ANSWER I AB I % c

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started