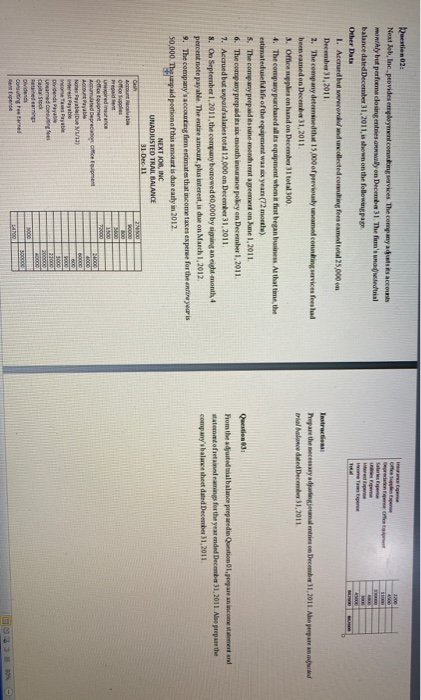

of the ulares To Prepare the cardinalis December 31, 2011 Aho perpare need trial dated December 31, 2011 Puestiena Next Job, Inc.provides employment conting sevices. The companys com monthly but performa closingentes away on Dec 31 The's nodrial balance dated December 31, 2011, is shown on the following page Other Data 1. Acened but recorded and wedected conting for camel total 25.000 on December 31, 2011 2. The company determined the 15,000 of previously melconning vies felad beneamed on December 31, 2011 3. Once upplies on hand on December total 300 4. The company purchased all its equipment when it first began busines. Al that time, the estimateduse life of the equipment was six yean (72 months) 5. The company prepaid nine-menthet areement on June 1, 2011 6. The company prepaid monthiance policy on December 1, 2011 7. Accrued but paidalaries total 12,000 on December 31, 2011 S. On September 1, 2011, the company bonowed 60,000 by signing an eight month, 4 percent note payable. The entire amount, plus interest is due on March 1, 2012 9. The company's accountang fimm estimates that income taxes expense for the entire years 50,000. The paid portion of this amount is due eatly in 2012. NEXT OR INC UNADJUSTED TRAIL BALANCE 31 Dec 11 Gash ACER Office Supplies Prepaid 1600 Unionen offertiment Add Diet 200 Acne W/12) eestyle Test Dividends Payable neamed om Stock ering Dividende contingered 3000 end Question 31 From the adjusted balance preparedin Question 01, prepare an income testare statoma frenang for the year ended December 31, 2011. Also prepare the company's balance sheet dated December 31, 2011 00 1300 600 3000 21000 00 of the ulares To Prepare the cardinalis December 31, 2011 Aho perpare need trial dated December 31, 2011 Puestiena Next Job, Inc.provides employment conting sevices. The companys com monthly but performa closingentes away on Dec 31 The's nodrial balance dated December 31, 2011, is shown on the following page Other Data 1. Acened but recorded and wedected conting for camel total 25.000 on December 31, 2011 2. The company determined the 15,000 of previously melconning vies felad beneamed on December 31, 2011 3. Once upplies on hand on December total 300 4. The company purchased all its equipment when it first began busines. Al that time, the estimateduse life of the equipment was six yean (72 months) 5. The company prepaid nine-menthet areement on June 1, 2011 6. The company prepaid monthiance policy on December 1, 2011 7. Accrued but paidalaries total 12,000 on December 31, 2011 S. On September 1, 2011, the company bonowed 60,000 by signing an eight month, 4 percent note payable. The entire amount, plus interest is due on March 1, 2012 9. The company's accountang fimm estimates that income taxes expense for the entire years 50,000. The paid portion of this amount is due eatly in 2012. NEXT OR INC UNADJUSTED TRAIL BALANCE 31 Dec 11 Gash ACER Office Supplies Prepaid 1600 Unionen offertiment Add Diet 200 Acne W/12) eestyle Test Dividends Payable neamed om Stock ering Dividende contingered 3000 end Question 31 From the adjusted balance preparedin Question 01, prepare an income testare statoma frenang for the year ended December 31, 2011. Also prepare the company's balance sheet dated December 31, 2011 00 1300 600 3000 21000 00