Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Off-balance-sheet financing is an attempt to borrow monies in such a way to prevent recording the obligations. Two common forms of off-balance sheet financing are

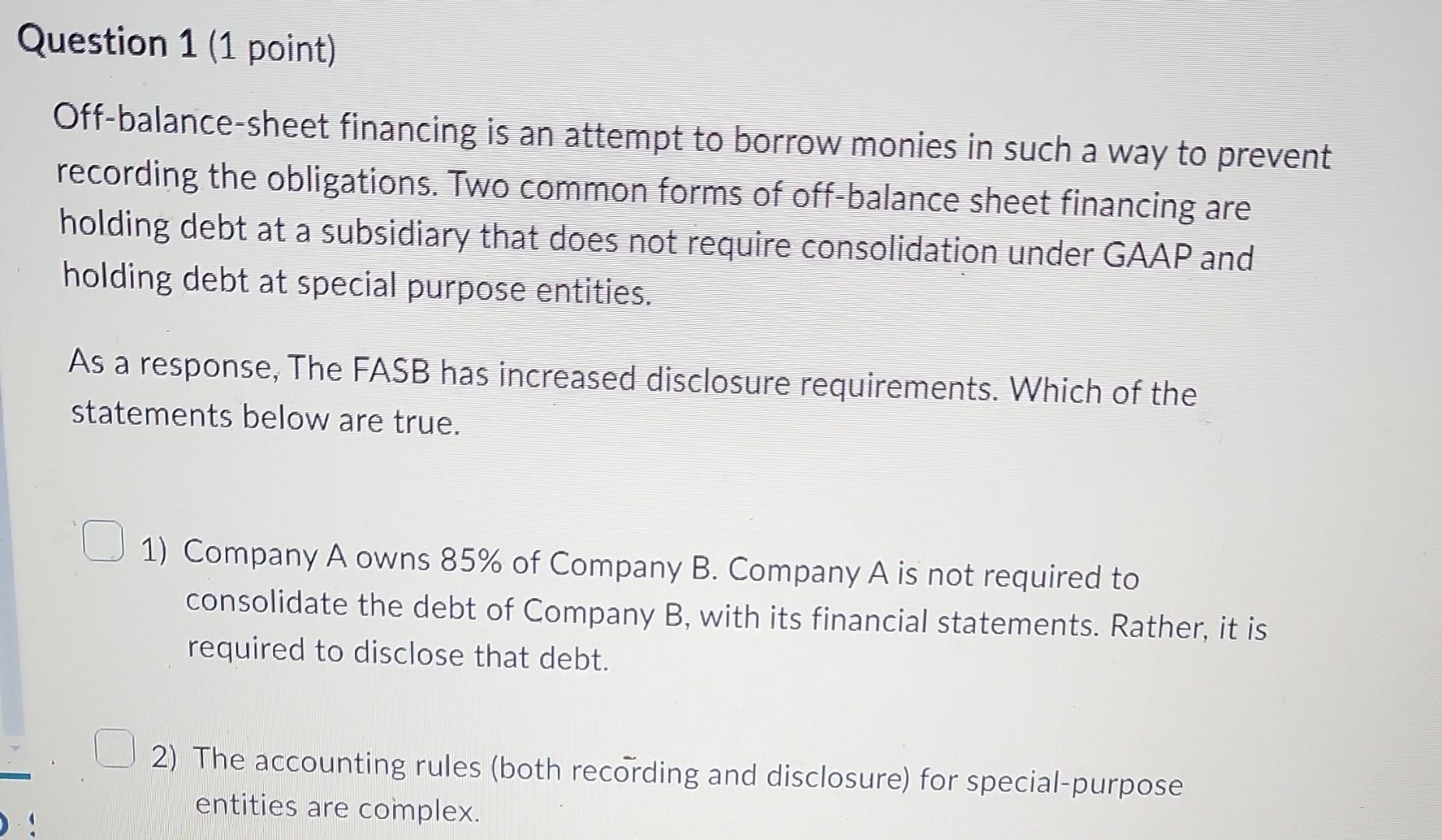

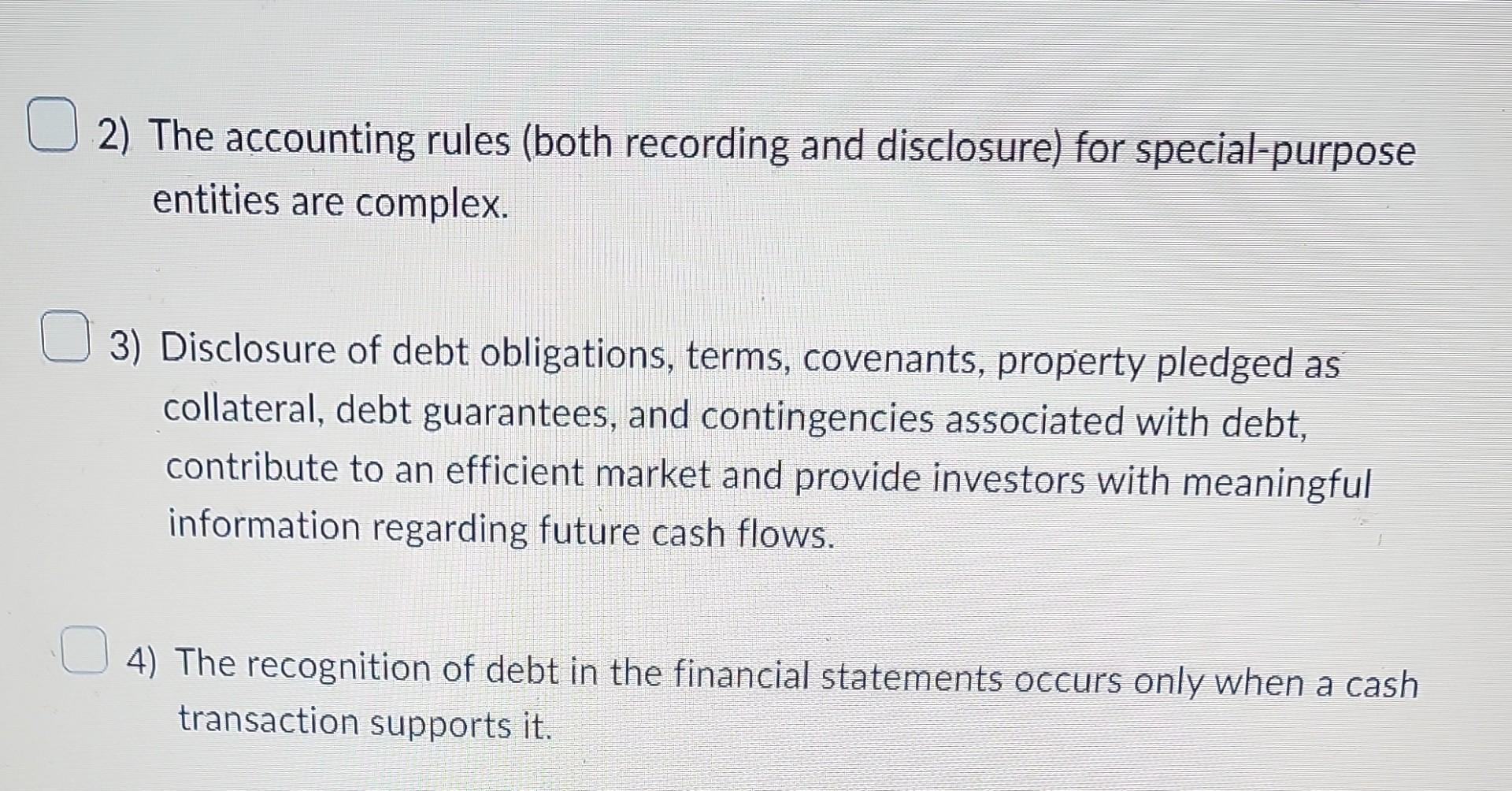

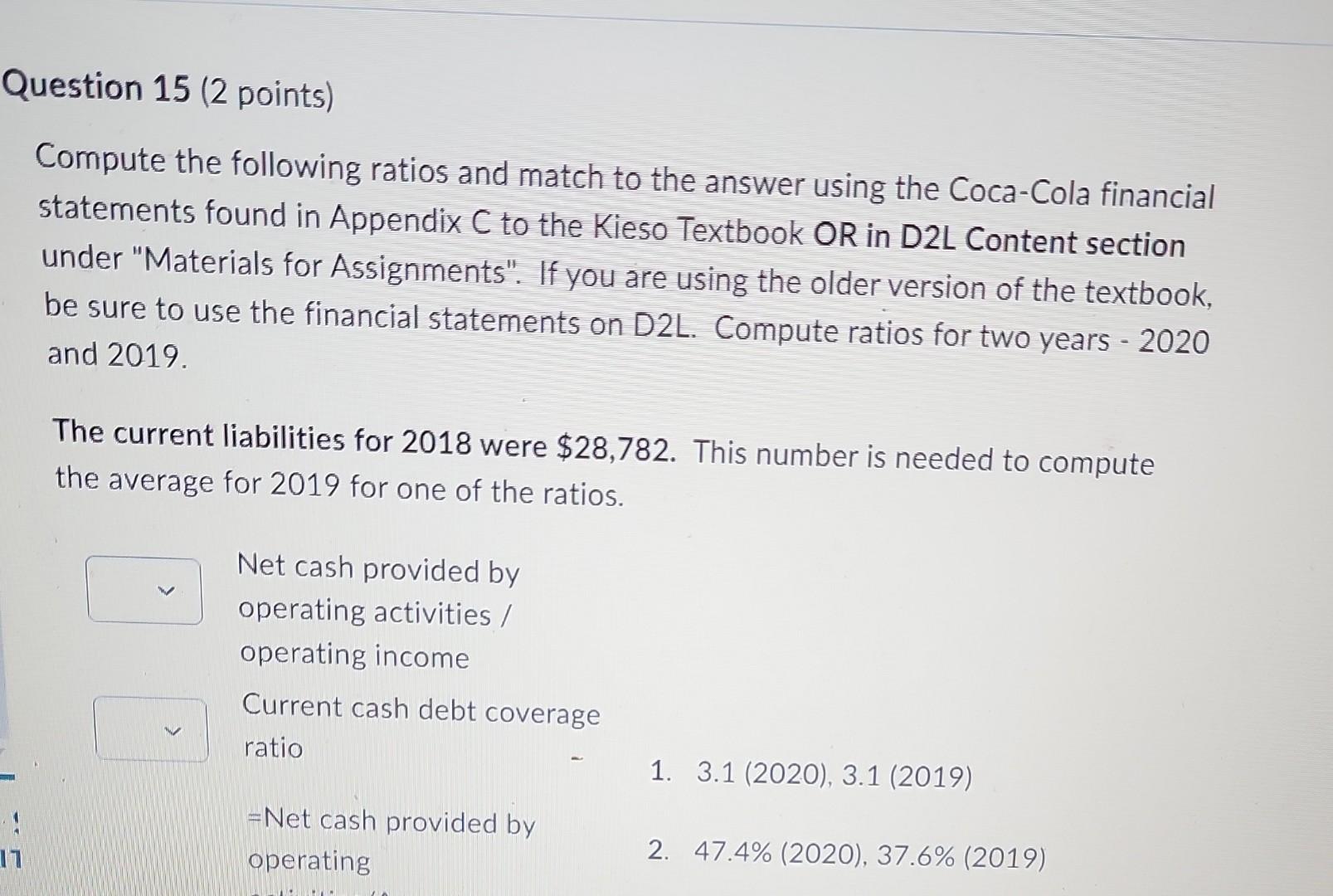

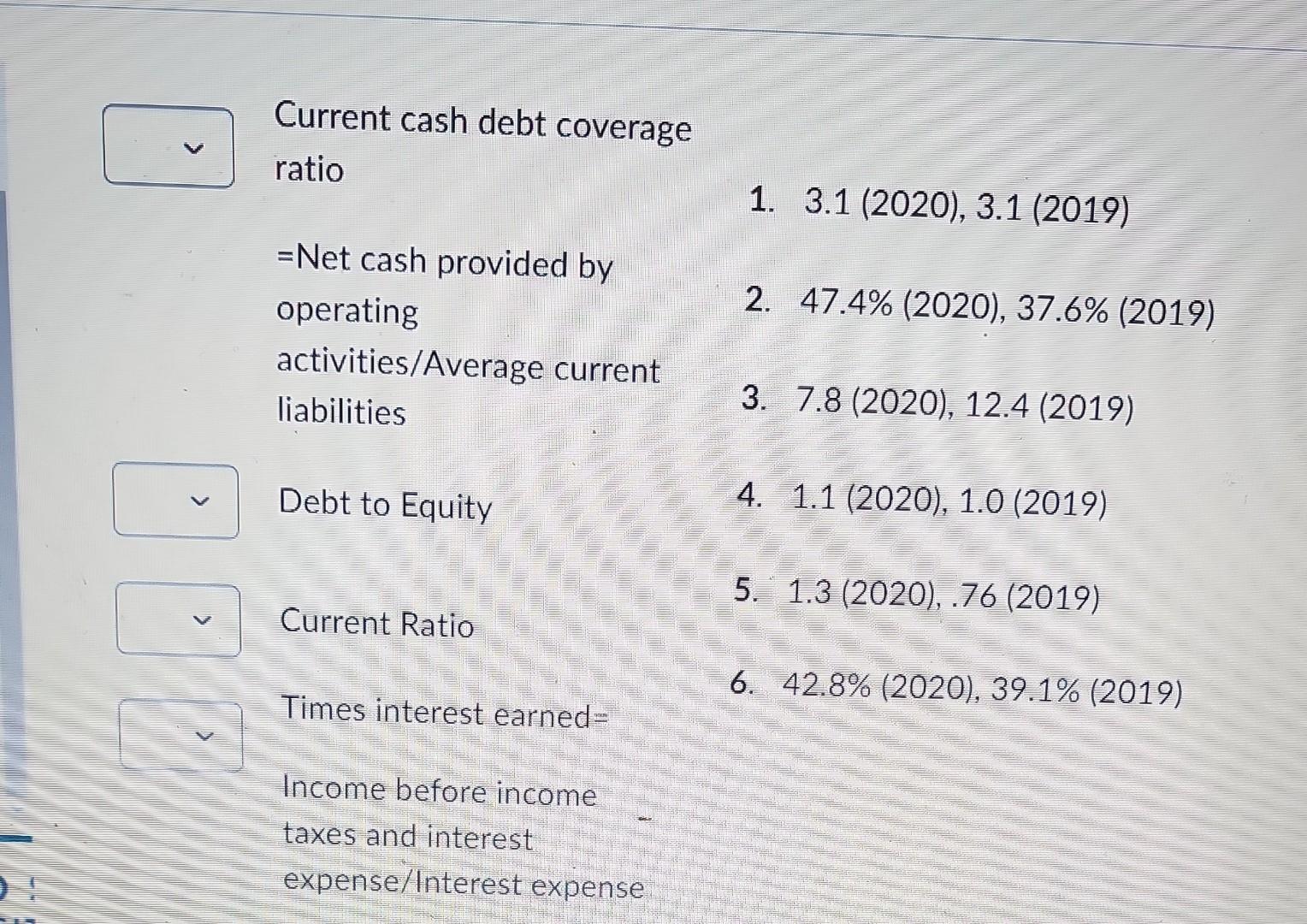

Off-balance-sheet financing is an attempt to borrow monies in such a way to prevent recording the obligations. Two common forms of off-balance sheet financing are holding debt at a subsidiary that does not require consolidation under GAAP and holding debt at special purpose entities. As a response, The FASB has increased disclosure requirements. Which of the statements below are true. 1) Company A owns 85% of Company B. Company A is not required to consolidate the debt of Company B, with its financial statements. Rather, it is required to disclose that debt. 2) The accounting rules (both recorrding and disclosure) for special-purpose entities are complex. 2) The accounting rules (both recording and disclosure) for special-purpose entities are complex. 3) Disclosure of debt obligations, terms, covenants, property pledged as collateral, debt guarantees, and contingencies associated with debt, contribute to an efficient market and provide investors with meaningful information regarding future cash flows. 4) The recognition of debt in the financial statements occurs only when a cash transaction supports it. Compute the following ratios and match to the answer using the Coca-Cola financial statements found in Appendix C to the Kieso Textbook OR in D2L Content section under "Materials for Assignments". If you are using the older version of the textbook, be sure to use the financial statements on D2L. Compute ratios for two years - 2020 and 2019. The current liabilities for 2018 were $28,782. This number is needed to compute the average for 2019 for one of the ratios. Net cash provided by operating activities / operating income Current cash debt coverage ratio 1. 3.1 (2020), 3.1 (2019) = Net cash provided by operating 2. 47.4% (2020), 37.6% (2019) Current cash debt coverage ratio 1. 3.1 (2020), 3.1 (2019) =Net cash provided by operating 2. 47.4% (2020), 37.6% (2019) activities/Average current liabilities 3. 7.8(2020),12.4 (2019) Debt to Equity 4. 1.1 (2020), 1.0 (2019) 5. 1.3(2020),.76(2019) Current Ratio 6. 42.8%(2020),39.1% (2019) Times interest earned= Income before income taxes and interest expense/Interest expense

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started