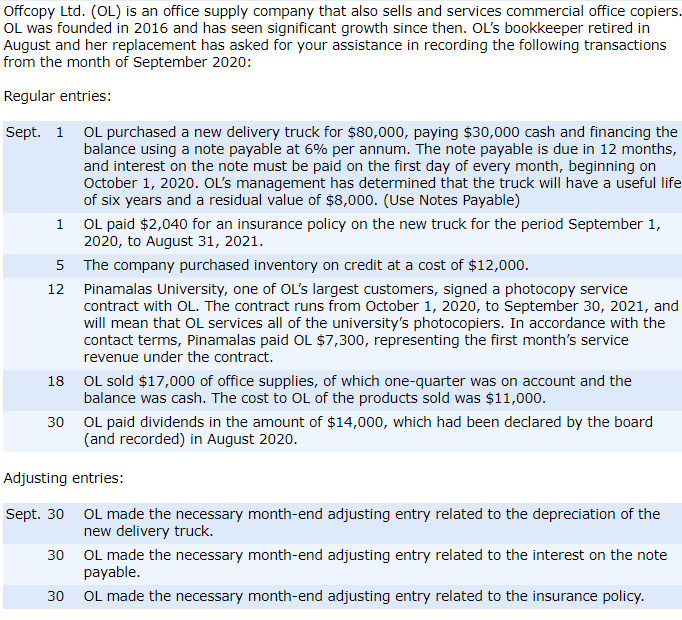

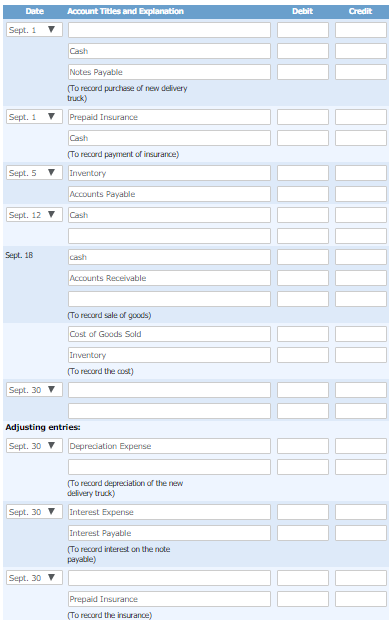

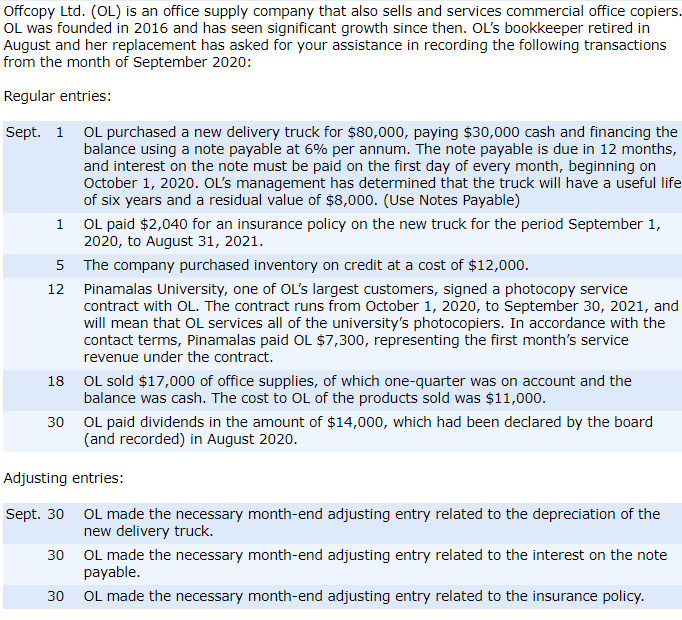

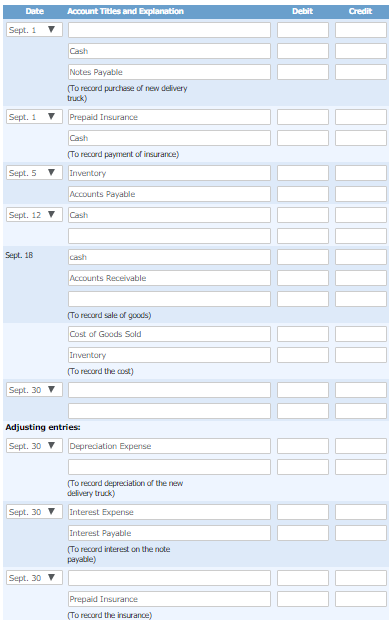

Offcopy Ltd. (OL) is an office supply company that also sells and services commercial office copiers. OL was founded in 2016 and has seen significant growth since then. OL's bookkeeper retired in August and her replacement has asked for your assistance in recording the following transactions from the month of September 2020 Regular entries: OL purchased a new delivery truck for $80,000, paying $30,000 cash and financing the balance using a note payable at 6% per annum. The note payable is due in 12 months, and interest on the note must be paid on the first day of every month, beginning on October 1, 2020. OL's management has determined that the truck will have a useful life of six years and a residual value of $8,000. (Use Notes Payable) Sept. 1 OL paid $2,040 for an insurance policy on the new truck for the period September 1, 2020, to August 31, 2021 1 The company purchased inventory on credit at a cost of $12,000. 5 Pinamalas University, one of OL's largest customers, signed a photocopy service contract with OL. The contract runs from October 1, 2020, to September 30, 2021, and will mean that OL services all of the university's photocopiers. In accordance with the contact terms, Pinamalas paid OL $7,300, representing the first month's service revenue under the contract. 12 OL sold $17,000 of office supplies, of which one-quarter was on account and the balance was cash. The cost to OL of the products sold was $11,000. 18 OL paid dividends in the amount of $14,000, which had been declared by the board (and recorded) in August 2020. 30 Adjusting entries: Sept. 30 OL made the necessary month-end adjusting entry related to the depreciation of the new delivery truck OL made the necessary month-end adjusting entry related to the interest on the note payable. 30 OL made the necessary month-end adjusting entry related to the insurance policy. 30 Date Account Titles and Explanation Debit Credit Sept. 1 Cash Notes Payable (To record purchese of new delivery truck) Sept. 1 Prepaid Insurance Cash (To record payment of insurance) Inventory Sept. 5 Accounts Payable Sept. 12 Cash Sept. 18 cash Accounts Receivable (To record sale of goods) Cost of Goods Sold Inventory (To record the ost) Sept. 30 Adjusting entries Sept. 30 Deprediation Expense (To record depreciation of the new delivery truck) Sept. 30 Interest Expense Interest Payable To recard interest on the note payable) Sept. 30 Prepaid Insurance (To record the insurance)